The Securities and Exchange Commission has said it will collaborate with the Central Bank of Nigeria and other critical stakeholders to create a regulatory framework for Crypto-Currencies and other digital assets.

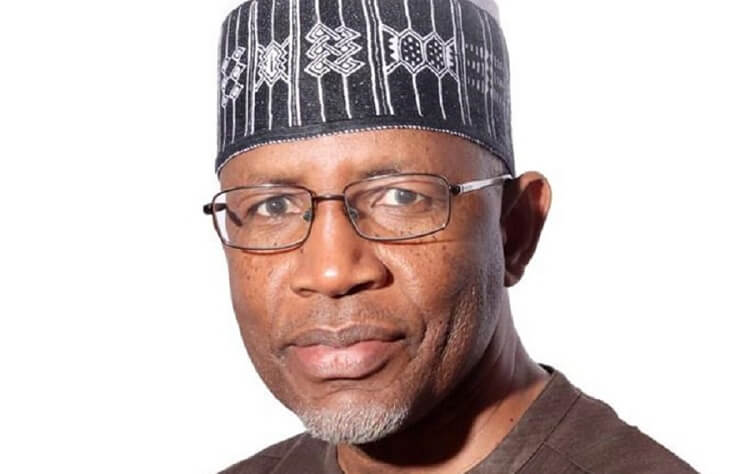

The Director-General, SEC, Mr Lamido Yuguda, said this at the joint session of the Senate Committee on Banking, Insurance and other Financial Institutions, Capital Market and ICT and Cyber Crime in Abuja, on Tuesday.

Advertisement

The Central Bank of Nigeria had earlier this month ordered banks and other financial institutions in the country to close all crypto-currency accounts.

The apex bank had stated that it carried out the order because Cryptos were being used as tools for money laundering and sponsoring illicit activities.

Yuguda, according to a statement from the Commission said the SEC recognizes the disruption of FinTech in the financial industry and aims to create an enabling regulatory environment that would ensure a balance between investor protection and technological advancement.

He said, “We believe that FinTech would not only bring about efficiency to the capital market but would also serve as a veritable tool for advancing Nigeria’s Financial Inclusion agenda.

Advertisement

“However, there is a need to develop an appropriate regulatory framework to ensure the safety of innovation to investors and preserve market integrity.

He said the SEC will advance efforts towards developing a comprehensive regulatory framework that ensures that operators in the crypto asset space conduct their activities in a manner that protects investors and maintains financial system stability.

“The SEC will continue to monitor developments in the digital asset space and further engage/collaborate with all critical stakeholders, including the CBN, to create a regulatory structure that enhances economic development while promoting a safe, innovative and transparent capital market” he added.

According to Yuguda, the SEC’s approach is consistent with the approaches of several securities regulators around the world.

He added, “In the United Kingdom, the Financial Conduct Authority requires firms that carry on specified activities, by way of business, involving a crypto asset, to be authorized. Crypto assets are viewed as financial products in South Africa and the Financial Sector Conduct Authority requires persons carrying out associated activities to be regulated.

Advertisement

“In Malaysia, operators of digital asset platforms are required to be approved by the Securities Commission as recognized market operators. Several other securities regulators have taken similar positions.”

Speaking earlier, the Chairman of the Joint Committee, Senator Uba Sani said the Committee is on a fact finding mission in the interest of Nigerians and the nation’s economy.

Sani said the Committee would look at enabling laws in line with global best practices.

He said, “We shall look at the position of the CBN who have said Crypto-Currencies are very volatile and supports insurgency. The Senate will always support innovation and the effective use of ICT for economic empowerment.

“We are aware of the damage it has done and are poised to protect our economy and ensure that our people benefit where necessary.”