Experts Blame Rising Inflation On CBN’s N19trn Loan To FG

Some finance and economic experts have said they are not surprised with the country’s 20.52 per cent inflation figures for August, adding that the N19trn loan which the Central Bank of Nigeria borrowed the federal government was responsible for the price increase in the economy.

Official inflation report released by the National Bureau of Statistics showed that despite monetary policy interventions, households and businesses were faced with the highest inflation rate in the last 17 years.

Advertisement

Food prices soared to 23.12 per cent, as the headline inflation rose to 20.52 per cent.

Although the CBN has struggled to moderate the rates with various policy measures including increasing the monetary policy rate to 14 per cent in July, inflation has not abated.

Apart from Nigeria, other economies are facing similar inflationary pressure. For instance, inflation rate in Argentina has risen to 78.50 per cent.

Bismarck Rewane, a member of the presidential economic advisory council holds the position that if Nigeria’s inflation method is reconstituted, the inflation figures may hit over 80 per cent in Nigeria.

Advertisement

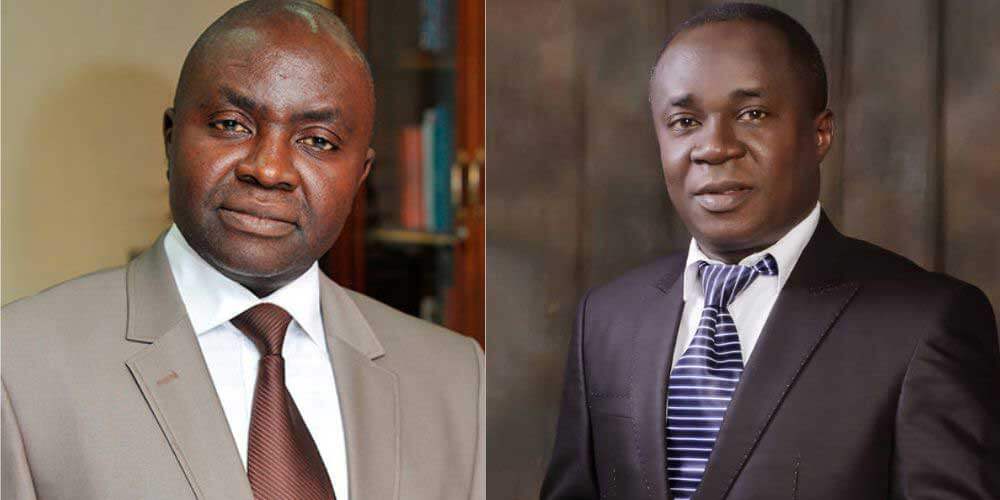

In a response sent to THE WHISTLER, Dr Muda Yusuf, Chief Executive Officer of the Centre for the Promotion of Private Enterprise and former DG Lagos Chamber of Commerce and Industry said the “heightened inflationary pressures in the Nigerian economy remains very troubling with Headline inflation surging to 20.52 per cent in August.”

Yusuf said more worrisome is the spike in food inflation which had risen to 23.12 per cent.

The Former LCCI boss said, “The reality is that the major inflation drivers have not abated. If anything, some have become even more intense. These factors include high transportation costs, increasing logistics challenges, worsening exchange rate depreciation, forex liquidity issues, hike in energy prices, climate change issues, insecurity in many farming communities and structural bottlenecks to production. These are basically supply-side issues.

“The accelerated fiscal deficit financing by the CBN is also a significant inflation driver. The financing of the fiscal deficit has been elevated to disturbing levels at almost N20trn. This has huge implications for money supply and knock-on effect on inflation. CBN financing of deficit is high powered money and very inflationary. It is an inflation tax.”

Nigeria has been battling foreign exchange setbacks which is affecting manufactures and businesses.

Advertisement

The Federal Government’s total borrowing from the CBN through Ways and Means Advances rose to N19.01trn in April 2022, a move that has been largely criticised.

Yusuf said these have compounded the mounting inflationary pressures and it “weakens purchasing power of citizens as real incomes are eroded.”

He added, “It aggravates pressure on production costs, negatively impacts profitability, erodes shareholders value and undermines investors’ confidence.

“In most cases, increases in production costs cannot be transferred to consumers by industrialists. The implication is that producers are also taking a major hit. This is more pronounced where the demand for the product is elastic. These are products that consumers can readily do without.

“Tackling inflation requires urgent government intervention to address the challenges bedevilling the supply side of the economy and the moderation of fiscal deficit monetization.”

The President of the Association of Capital Market Academics, Uche Uwaleke, told THE WHISTLER that the increase in headline inflation “above the psychological threshold of 20 per cent did not come as a surprise.”

Advertisement

Uwaleke said the high prices were partly triggered by the rising inflation trend in many economies partly caused by the Russian Ukrainian conflict.

According to him, the recent monetary policy rate has curbed the rising prices in Africa’s biggest economy.

He said, “It’s interesting to note that the NBS, in its latest CPI report, provided a clue as to the major factors driving the inflationary pressure in Nigeria namely supply disruptions and rising cost of production.

“In the light of this revelation, what becomes clear is that the recent monetary policy tightening stance of the CBN alone may not address the challenge.

“The government needs to formulate and implement complementary fiscal policies aimed at boosting food supply as well as reducing firm’s cost of production.”