Experts Divided On CBN’s Extension Of Deadline For Old Naira Notes Withdrawal

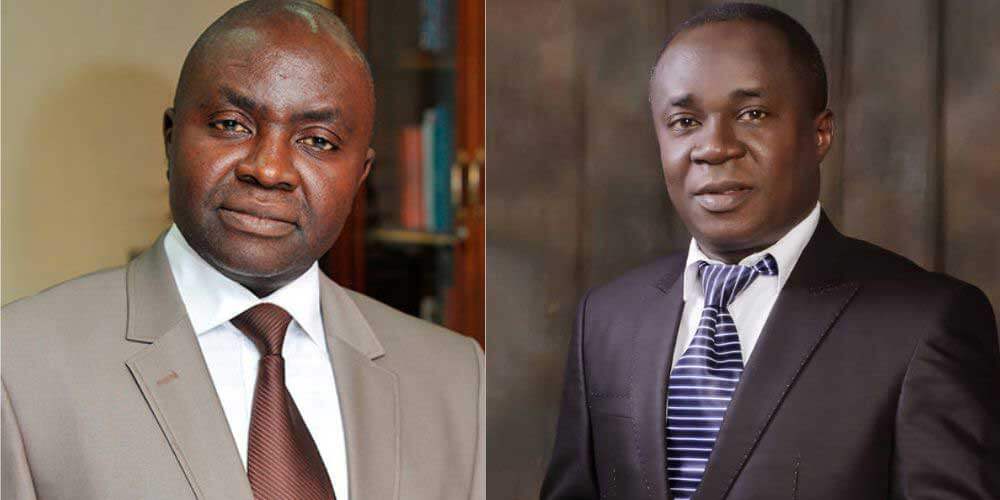

A Nigerian think-tank, the Center for the Promotion of Public Enterprises and Professor of Capital Market Studies at the Nasarawa State University, Uche Uwaleke, have expressed divergent views on the new deadline set by the Central Bank of Nigeria to withdraw the old Naira Notes from circulation.

Amid mounting pressure, CBN finally agreed to extend the deadline for the withdrawal of the old N1000, N500 and N200 from January 31, 2023 to February 10 with an additional seven days grace period to enable those who still have the old notes to swap them.

Advertisement

But during the grace period, people in possession of the old notes can only deposit them at CBN branches across the country.

The news brought calm to Nigerians who were already rushing to deposit their old notes, even on Sunday morning.

However, citizens are still facing scarcity of the new notes with some businesses and individuals who have urgent needs for cash said to be buying them from POS operators.

Also, some ATMs have been shut down because of the scarcity of the new notes.

Advertisement

Speaking to THE WHISTLER on extension of the deadline, Muda Yusuf, the Managing Director and Chief Executive Officer of the CPPE, said the grace period is still not enough for withdrawal of the old notes.

He noted that if poorly managed, the currency swap could put the N100trn component of the GDP at risk.

He told THE WHISTLER that, “The CPPE believes that 10 days is grossly inadequate to make up for the glaring shortcomings of the apex bank in this process.”

Yusuf also argued that the vote buying argument is not compelling enough to justify the “pain, agony, trauma and economic disruption foisted on Nigerians.”

But Uwaleke, on his part, believes that the extension was adequate to allow Nigerians to swap their old notes with new ones.

Advertisement

According to Uwaleke, the extension shows that the apex bank is a responsible organisation which listens to public outcry.

“The extension of the deadline for notes swap by the CBN till February 10 2023 with additional 7 days grace period is a welcome development and portrays the CBN as a responsive organisation that is sensitive to the yearnings of Nigerians.

“One recalls that when the CBN first placed a cash withdrawal limit of N20,000 per individual per day, it saw the need to revise it upward to N100,000 following reports that the limit was too low and causing a lot of hardship to the people.

“This deadline extension will reduce the queues at the ATM, reduce panic and uncertainty among small business owners in particular and more importantly allow more time for the new naira notes to circulate and more of the old ones returned to the CBN given that about N900 billion is still outside the banks as revealed by the CBN Governor.”

According to the Varsity Don, the extension by 10 days and a grace period clarifies the allegation that the CBN and the Buhari led government initiated the policy to inflict hardship on Nigerians.

He said, “I commend the CBN for this move as well as the President for giving approval for an extension. It goes to demonstrate that the currency redesign was not designed to foist hardship on Nigerians.

Advertisement

“The fact that the new deadline is before the February 25 election is laudable as the measure will help reduce vote buying.

“Having extended the deadline by 10 days, the CBN should ensure that the banks are strictly complying with its distribution guidelines for new notes. It should equally, through sensitization efforts, discourage the current practice of rejection of old notes while they are still considered legal tender.”