Greece has defaulted on €1.6bn IMF payment after Eurozone ministers failed to reach an agreement to extend it’s bailout. Greece is officially in arrears, becoming the first advanced country to default on it’s payment to IMF in it’s 188 member nations.

With the expiration of Eurozone bailout, Greece’s bankruptcy has worsened as it can no longer enjoy access to Eurozone resources and any of it’s financial benefits.

Although Greece made a request for a new €29.1bn two-year bailout from Eurozone, its third request in six years, is set to be conaidered later this week by the Eurozone ministers.

Advertisement

According to IMF spokesman Gerry, “We have informed our Executive Board that Greece is now in arrears and can only receive IMF financing once the arrears are cleared,”

The chairman of Eurogroup and Dutch Finance Minister Jeroen Dijsselbloem before the bailout expiration, said “it would be “crazy” to extend the Greek bailout beyond its Tuesday midnight expiration as Athens was refusing to accept the European proposals on the table.”

Some of Greece’s creditors like The European Commission, IMF and the eurozone’s European Central Bank; wants Greece’s government to raise taxes and cut welfare spending to meet its debt obligations.

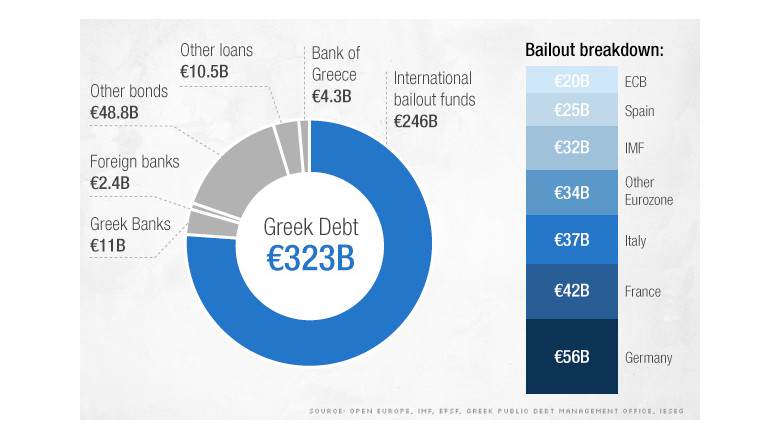

GREECE BAILOUT BREAKDOWN

Advertisement

The creaditors proposal are outlined below;

- VAT: A new system to come in from 1 July, with three rates, aimed at boosting annual revenue by 1% of total output (GDP)

- Most goods to be taxed at top rate of 23%, including restaurants and catering and processed foods

- Reduced rate of 13% for basic food, electricity, hotels and water

- 6% rate reduction for medicines, books and theatre

- End tax exemptions and eliminate VAT discounts for Greek islands

- Disincentivize early retirement

- Move retirement age up to 67 by 2022

- End Ekas “solidarity” top-up grant that some 200,000 poorer pensioners get – immediate Ekas cut for wealthiest 20% of recipients, and scrapped completely by 2020

- Pensioners’ healthcare insurance contributions to be raised from 4% to 6%

Amid fears that it’s Government will likely default on its huge public debt of €323bn, people have queued at ATM machines even as daily withdrawals are capped at €60.

Greek banks was shut this week after negotiations between Greece and its lenders broke down. However, many bank branches will re-open from Wednesday to allow pensioners – many of whom do not use bank cards – to withdraw up to €120.