How CBN Injected Over N5.51trn To Save Agric, Health, Others Sectors From Imminent Collapse

The agricultural sector is one of the critical non-oil sectors which has made significant contributions to the Gross Domestic Product accounting for a 22.35 per cent and 23.78 per cent contribution to the overall GDP in the first and second quarters of 2021 respectively.

It was also instrumental in supporting the emergence of the economy from the recession in the 2nd half of 2020, following the COVID-19 pandemic.

Advertisement

The sector remains the largest sector contributing an average of 24 per cent to the country’s GDP between 2013 – 2019, and employs over 36 per cent of the labour force. In addition, the sector holds the key to solving the country’s unemployment crisis.

The National Bureau of Statistics (NBS) estimates that about 23.18 million Nigerians unemployment with the unemployment rate put at 33.3 per cent in the fourth quarter of 2020 (Q4 2020) compared to 27.1 per cent in Q2.

A key focus of the administration of President Muhammadu Buhari has been the deployment of mechanisms to ensure that agriculture thrives in Nigeria.

In fact, one of the key elements of the Economic Recovery and Growth Plan (ERGP) is to significantly grow the economy and achieve maximum welfare for the citizens by ensuring food and energy security.

Advertisement

Guaranteeing food security means ensuring availability and access across all demographics in the country. The current administration has leveraged innovation and mechanization in the agricultural sector by supporting the production of numerous commodities in which the country has comparative advantage, thereby guaranteeing the availability of these commodities to the masses.

Experts have said that food security cannot be attained if farmers are not encouraged and adequately equipped with access to the best inputs and opportunities to learn effective agronomic practices for improved yield. It is in line with this that the Federal Government has embarked on several initiatives to provide farmers with resources, input, and materials to cultivate.

It is for this reason that the Central Bank of Nigeria is supporting the efforts of the Federal Government by providing affordable and accessible financing options to drive domestic food production.

To support key sectors of the Nigerian economy, over N5.51trn has been disbursed by the Central Bank of Nigeria based on analysis of data from the apex bank’s various interventions.

The apex bank had in line with its developmental objective mandate to boost economic growth and create wealth for Nigerians intervened in various sectors of the economy.

Advertisement

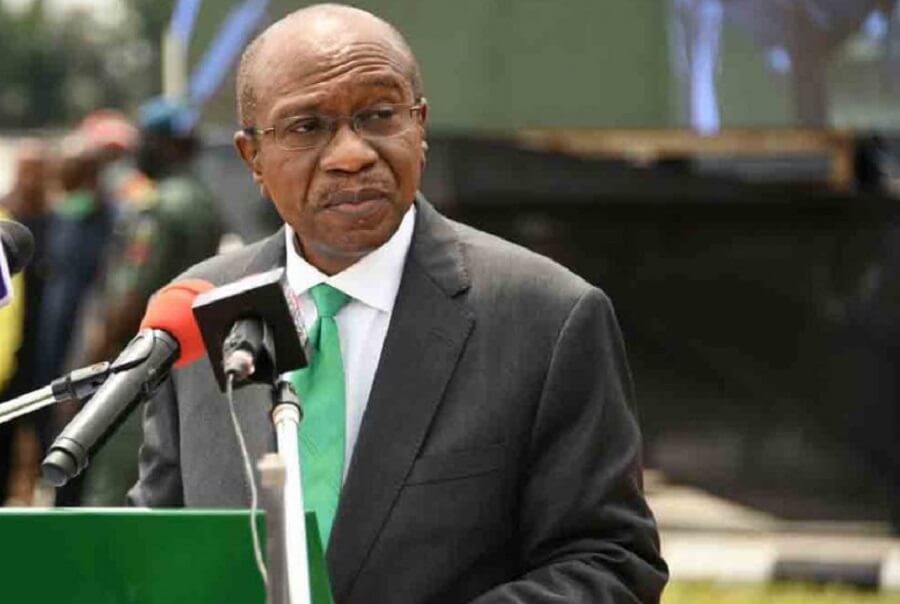

Some of these intervention programmes, being spearheaded by the CBN Governor, Mr Godwin Emefiele are the Anchor Borrowers Programme aimed at boosting agricultural production, create jobs, and reduce food import bill; Commercial Agriculture Credit Scheme which is to provide finance for the country’s agricultural value chain; Real Sector Facility to support large enterprises for startups and expansion financing needs; and the 100 for 100 on Production and Productivity Policy which was designed to create the flow of finance and investments to enterprises.

There is also the Health Sector Intervention Facility to stimulate economic activities locally within the healthcare sector; Targeted Credit Facility as a stimulus package to support households and firms to mitigate the negative impact of Covid-19; Nigeria Bulk Electricity Trading Partner Assurance Facility and the Nigerian Electricity Market Stabilization Fund aimed at supporting the power sector.

Based on data from the CBN, the Bank disbursed N29.67bn under the Anchor Borrowers’ Programme for the procurement of inputs and cultivation of maize, rice, and wheat. These three crops have had significant impact on foreign exchange demand.

This disbursement brings the total amount to N975.61bn to over 4.52 million smallholder farmers, cultivating 21 commodities across the country.

The Bank also released N19.15bn to finance five large-scale agricultural projects under the Commercial Agriculture Credit Scheme (CACS), bringing the total disbursements under the Scheme to N735.17bn for 671 projects in agro-production and agro-processing.

In addition, the CBN disbursed the sum of N428.31bn under the N1trn Real Sector Facility to 37 additional projects in the manufacturing, agriculture, and services sectors.

Advertisement

The fund, sourced from the Real Sector Support Facility – Differentiated Cash Reserve Requirement (RSSF-DCRR), were utilized for both greenfield and brownfield (expansion) projects under the COVID-19 intervention for the Manufacturing Sector.

Cumulative disbursements under the Real Sector Facility currently stand at N1.75trn, disbursed to 368 projects across the country.

Under the 100 for 100 Policy on Production and Productivity, the Bank has disbursed the sum of N29.51bn to 31 projects, comprising 16 in manufacturing, 13 in agriculture, and two in healthcare.

As part of its effort to support the resilience of the healthcare sector, the Bank also disbursed N8.50bn to six healthcare projects under the Healthcare Sector Intervention Facility, bringing the cumulative disbursements to N116.72bn for 124 projects, comprising of 31 pharmaceuticals, 56 hospitals, and 37 other services.

An additional tranche of N14.7m was disbursed to five researchers under the Healthcare Sector Research and Development Grant.

To support households and businesses affected by the COVID-19 Pandemic, the Bank disbursed N21.66bn to 19,685 beneficiaries, comprising 12,044 households and 7,641 small businesses under the Targeted Credit Facility within the period.

The cumulative disbursements under the TCF stood at N390.45bn to 797,351 9 Classified as Confidential beneficiaries, comprising 660,096 households and 137,255 small businesses.

The Bank also disbursed N11.11bn to power sector players, under the Nigeria Bulk Electricity Trading Payment Assurance Facility, bringing the cumulative disbursements under this facility to N1.28trn.

The sum of N12.64bn was also released to Distribution Companies (DisCos) under the Nigeria Electricity Market Stabilisation Facility – Phase 2.

The cumulative disbursement under the NEMSF-2 thus stood at N232.93bn.

Both interventions were designed to improve access to capital and ease the development of enabling infrastructure in the Nigeria Electricity Supply Industry.

Speaking on some of the CBN initiatives, the Chief Executive, Globa Analytics Company Limited, Dr. Tope Fashua, said agriculture remained a veritable tool for strengthening the local currency.

He said the sector has the potentials to generate the much-needed funds to make the country’s reserves much stronger.

According to him, one of the ways to boost the local currency was to stimulate investments in agricultural value chains both for self-sufficiency and exports to earn foreign exchange.

Fashua, however, commended the central bank for its numerous interventions in the sector, particularly the Anchor Borrowers Programme (ABP) which had helped reduce the undue pressure on food import bills and the external reserves.

Also, the Chief Executive Officer, Cowry Assets Management Limited, Mr. Johnson Chukwu, said that the CBN’s efforts should be complemented by the fiscal authorities in order to achieve the desired impact.

“What we have seen is that the intervention has largely come from the monetary authorities. We need to see a lot of activities from the fiscal side.

“There are a couple of things that the fiscal authorities can do. Therefore, there is need for the fiscal authorities to urgently roll out measures to support the development finance efforts of the central bank so as to stimulate economic activities.”

Emefiele had said that food security and job creation are fundamental building blocks in ensuring macro-economic stability, which is a cardinal mandate for the CBN.

He said that the apex bank and the financial system have critical roles to play in powering solutions to the issues of food security and job creation.

With an annual population growth rate of close to 2.8 percent, the CBN Governor said it was important that all efforts are concentrated at ensuring that employment opportunities were available for Nigerians particularly in sectors that has the ability to absorb key segments of the growing population.

Some of these sectors, according to him, are agriculture and manufacturing, which represented 10 and 27 per cent of Gross Domestic Product respectively.

He said, “Given our population size of over 200 million people along with favourable youth demographics, we were aware that if the necessary support was provided to households and business such as improved access to finance, and better infrastructure these measures would boost productivity, and help in enabling greater direct investment flows into our economy.

“As a result, there was a growing recognition on the need to refine our monetary policy tools and regulatory framework in order to ensure that it was more responsive to the needs of the Nigerian populace.

“It was important that this new framework enabled the flow of credit by financial institutions to critical sectors in order to aid our efforts at driving productive activities and creating job opportunities for our growing population.

“More importantly, the design to curb this was excessive penchant for imports particularly in areas where we possessed the manpower and resources to produce such goods in Nigeria.”

The CBN Governor explained that the creation of the appropriate policy initiatives to address the identified challenges is a charge the apex bank had championed with some results.

He said the bank had also deployed some development initiatives aimed at increasing food production, creating job opportunities and diversifying the economy.

In addition, he said credit to the manufacturing sector has risen from 10 per cent in 2014 to 16 percent in 2021 and in the agriculture sector, credit has grown from 3 per cent in 2013 to 6 per cent in 2022.

“We recently revamped the management of the Nigerian Commodities Exchange, as a reposition NCX will help enable farmers enter long term contracts with agro processors and exporters.

“This measure would ultimately increase the flow of funds to support expansion of agriculture and agro processing activities in the country, which will create jobs and wealth for our people.

“We are hopeful that over the next two years credit to the agricultural sector would rise to over 10 percent,” he added.