The Greeks have to choose between the bad and the truly ugly in Sunday’s referendum. If I was Greek – and I’m not, although I speak the language and had a Greek great-grandmother – I would plump for the bad option, voting “Yes”.

Officially, this is a vote in favour of an offer made by Greece’s creditors on June 25, which would have involved Athens committing to more reforms and austerity in return for cash to stop it going bust. But this offer is no longer on the table. So what might happen after a “Yes” vote?

Officially, this is a vote in favour of an offer made by Greece’s creditors on June 25, which would have involved Athens committing to more reforms and austerity in return for cash to stop it going bust. But this offer is no longer on the table. So what might happen after a “Yes” vote?

The most likely scenario is that Alexis Tsipras, the radical left prime minister who is advocating a “No” vote, would resign. Then there would be new elections. The opposition would probably form a united front, win the elections and cut a new deal with the creditors.

Advertisement

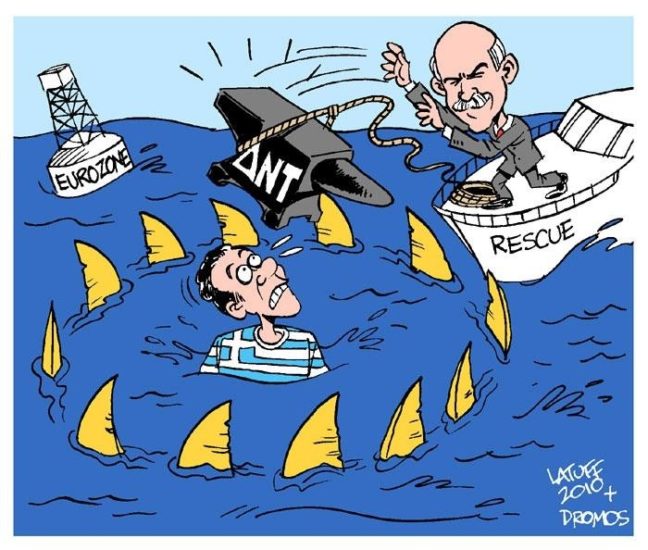

In one important respect, the new government would be in a position to cut a better deal than Tsipras. The euro zone countries and the International Monetary Fund would trust it more because it had campaigned for an agreement and had secured a strong mandate both from the referendum and the election to implement it.

The new government might be able to secure a deal that was heavy on reforms to deal with the country’s deep-seated problems, but light on fiscal austerity. It would probably even get a promise to reschedule Athens’ massive debts, provided it implemented the deal properly.

The problem is that Greece would be starting in a much worse place than it was before Tsipras was elected. Not only have the past five months destroyed confidence in an economy which was just beginning to grow; this week’s closure of the banks has accelerated the downturn.

Given that capital controls would only be lifted gradually, the best-case scenario is probably what Cyprus suffered after it closed its banks in 2013. Its economy shrank 5.4 percent that year followed by another 2.3 percent in 2014 before starting to grow.

Advertisement

Now look at the truly ugly option, voting “No”. Tsipras says this would give him a mandate to secure a better deal from the creditors. But it’s hard to see why this would be so. There is not a shred of trust left. The creditors would probably conclude that “No” means “No” and that there was therefore no point in talking about a deal.

The immediate consequence is that the banks would stay closed. At the moment, depositors are allowed to take out 60 euros a day. But after perhaps another week, they would run out of cash totally.

The government would default on its debt to the European Central Bank, which would conclude the banks were insolvent. There would then be only two ways of reopening them: either bringing back the drachma, or confiscating a portion of depositors’ money and converting it into new bank capital. In practice, the government would probably choose the drachma route – something that would be shambolic and lead to years of litigation.

Many people would stop paying their taxes. So in order to pay salaries and pensions, the government would resort to printing IOUs – which would be the precursor of the new currency. This would trade at a big discount to the euro, maybe half its value.

There would be precious little money to pay for imports either, even essential commodities such as oil and drugs. Greece has virtually no foreign exchange reserves and, since it has just defaulted on its loan from the IMF, Athens could hardly appeal to it for help.

Advertisement

The economy would go into meltdown. Shortages would appear in shops. Everybody would want to be paid in cash and then hoard it. Consumption would plummet. Companies would go bust because they couldn’t pay their suppliers. Tourism, Greece’s most important industry, would suffer a blow as foreigners cancelled holidays.

All this is already happening to some extent. But after a “No” vote, the current dire situation would seem like halcyon days. The European Union would probably step in with humanitarian aid.

In theory, after such mayhem, Greece might be able to grow again from a new, much lower base. After all, it would have regained its competitiveness in one fell swoop. Tourists would lap up cheap holidays and consumers would turn to cheaper products at home rather than expensive imports.

But there’s another risk. Once Tsipras had started printing drachmas to compensate for the fact that taxes were low, he would find it hard to kick the habit. This could lead to hyperinflation.

So voting “Yes” in Sunday’s referendum would mean at best two years of recession. Meanwhile, voting “No” would probably mean economic havoc in the short run probably followed by inflation and yet more chaos. It is a terrible choice for the Greeks. But the right answer is a positive one.

Source: Reuters