A member of the Central Bank of Nigeria Monetary Policy Committee, Adenikinju Festus, has advised the apex bank to devalue the naira in a way that will have minimum effect on the economy.

Festus made the position in his personal statement during the Monetary Policy Committee meeting held January in Abuja.

Advertisement

The call follows foreign investors’ apathy driven by the different exchange rates operated in the country. Manufacturers have also faulted the rates which they say is not investor friendly.

Nigeria has an official exchange rate which is N379 per dollar, the Investors’ and Exporter Window and the parallel market rate.

Nigeria’s largest lender has been faced with the dilemma of putting the right foreign exchange policy in place to ensure stability in the foreign exchange market.

Festus who is a professor of economics said, “The exchange rate management will continue to be challenging as the deficits in trade account and current account during slowdown in remittances and Foreign Portfolio Investment persist. Hence, the bank must creatively adjust the exchange rate at minimum costs to the economy.

Advertisement

The Naira was first devalued on March 20th to N360 from N307 and further adjusted to N380 per dollar in August last year.

Festus said, “For most countries in 2020, real Gross Domestic Product was negative, local currencies depreciated relative to the US dollar, inflation though muted in advanced economies, rose in most emerging and developing economies.”

The MPC member also pointed out that there was a need for continuous dialogue between CBN and key stakeholders in the economy like non-oil exporters.

Festus said, this will, “ensure synergy between CBN policies and programmes and the incidence of their implementation.”

According to him, the apex bank monetary policy stance was accommodating, but expressed worry over rising public debts.

Advertisement

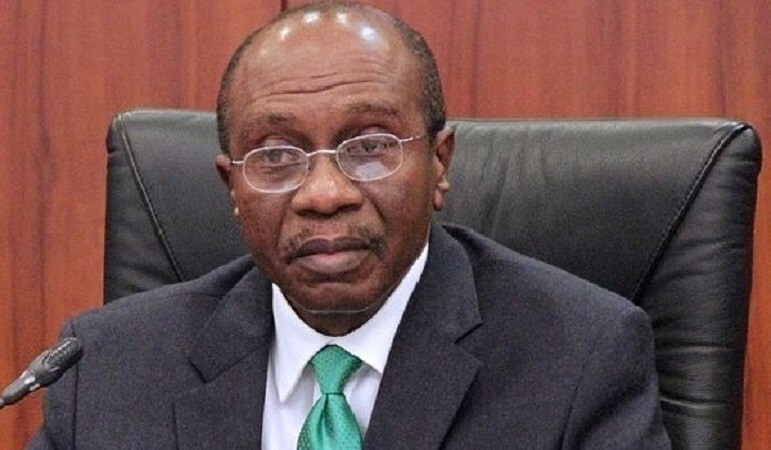

The apex bank in 2020 set aside N3.5trn as stimulus, but only N2trn was disbursed as at December 2020, according to the apex bank governor, Godwin Emefiele.

Festus said the CBN stimulus package was lower compared to the size of most emerging economies.

The MPC member said, “Nigeria’s share of stimuli funding to rescue the economy and restore growth was in general lower than its comparator countries.

“Nigeria’s share of four per cent of 2019 GDP is extremely low compared to 12 per cent in South Africa, 10 per cent in India and 10 per cent in Brazil.

“In more advanced countries like Japan, it is over 68 per cent, 45.04 per cent in the UK and 28.4 per cent in the USA.

“However, there are few issues that need to be addressed under the current dispensation of providing support for the economy.”

Advertisement

He also pointed out that there was a need for robust oversight on the country’s financial sector.

“The bank (CBN) must use all tools necessary to ensure that current forbearance granted to bank customers are not withdrawn prematurely,” Festus said.