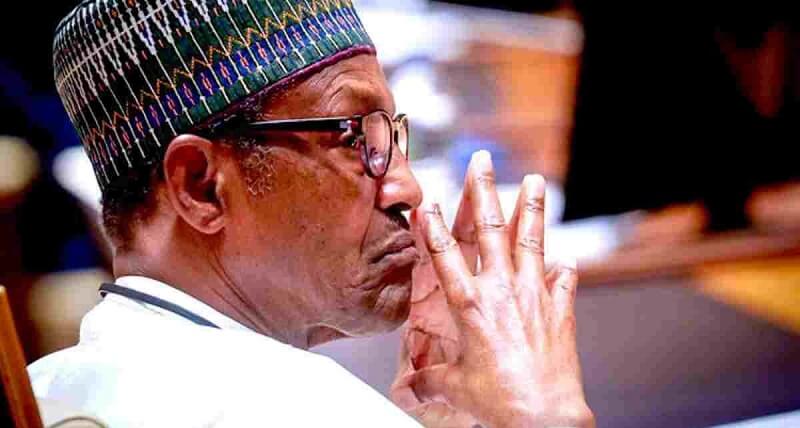

The Ministry of Finance Budget and National Planning on Thursday said that without the current borrowings by the administration of President Muhammadu Buhari, the country will experience bigger problems in the future.

It also defended the recent rise in Nigeria’s debt profile saying that the failure of the past administration has given the Buhari-led government no option than to borrow.

Advertisement

When Buhari came into power in 2015, Nigeria’s debt was at about N10trn but had risen to N38trn as of September 2021.

The most challenging part of Nigeria’s borrowing is the debt service to revenue ratio, which stands at 73 per cent.

When former President Olusegun Obasanjo was in office, Nigeria’s debt reduced from reduced the debt burden from almost $36bn to $3.65bn between 1999 to 2007.

A huge chunk of the debt reduction came from the debt forgiveness from the Paris Club.

Advertisement

Nigeria’s debt under late President Umaru Yar’ Adua was N6.17trn as of 2011. But since 2015, Nigeria’s debt had risen by N28trn.

Last Tuesday, the Debt Management Office said in the first nine months of 2021 that debt rose by N4.89trn, from N33.1trn in the first quarter of 2021 to N38trn in Q3.

But Nigeria’s Minister for State Budget and National Planning Clem Agba said the country’s debt was as a result of the failure of past leaders to utilise Nigeria’s wealth to build infrastructure projects.

Agba while defending the rising debt profile said in an interview monitored by THE WHISTLER on Arise TV that most of the loans were used to fund new and abandoned projects by previous administrations.

He said, “Why are we having those debts? It is because when we were rich, things that needed to be done were not done.

Advertisement

“Like the President would say, take a stock of our crude oil production over the years and look at the price of crude, take an average price of crude and look at what the country earned, why do we have so much infrastructure deficit?

“And if those are not taken care of today, then we will have a bigger problem in the future. What we should look at is these debts that you speak about, what are the conditions for them? Are they concessionary loans or are they commercial loans?

“In the first place, they are concessionary loans. The interest rate ranges from about 1.8 to about 2.5 per cent as against when you go to commercial banks and get a loan of 15 to over 20 per cent.”

He said Nigeria has a moratorium of ten years to begin to pay the loans which he described as a ‘gift.’

“I think that what is important is what is the money being used for. The Ajaokuta-Alaja rail line started about 35 years ago. No train ever passed it. Trees started growing on it.

“This government resuscitated it, revamped it, changed it from being a cargo rail and it is beginning to run after 35 years and it is carrying passengers,” he added.