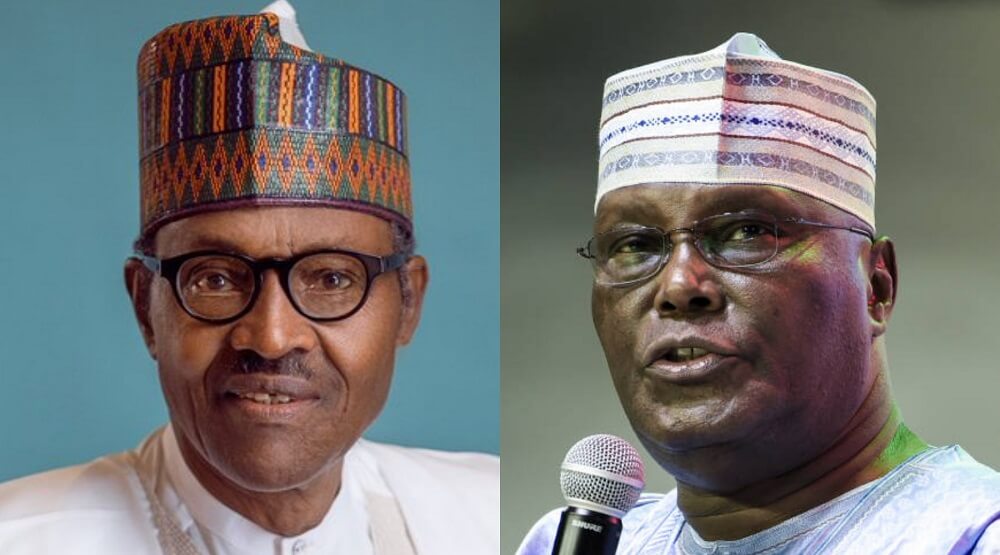

Nigeria’s Debt Profile: We’re Now Beggars Under Buhari – Atiku

The Peoples Democratic Party (PDP) presidential candidate in the 2019 general election, Atiku Abubakar, has reacted to the recent debt profile of Nigeria released by the Debt management office (DMO).

Data from the debt office on Wednesday showed the national debt profile in the first quarter of 2019 has increased by N560 billion.

Advertisement

Reacting to the debt report in a statement by his Media Aide, Paul Ibe, on Wednesday, the former Vice President noted that the debt situation under president Muhammadu Buhari-led administration was now at the stage where all genuine lovers of Nigeria ought to raise an alarm.

“As someone who headed the National Economic Council that paid off Nigeria’s entire debt under the visionary leadership of President Olusegun Obasanjo, Atiku Abubakar has the moral authority to call those who are turning Nigeria into a beggar nation to halt the drift into unsustainable borrowing.”

According to the Waziri Adamawa, since 2015 when Buhari came into power, the national debt profile has continuously increased from N12 trillion where the PDP-led administrations left it.

“As alarming as this is, what is more troubling is that between December 2018 and March 2019, the administration of General Buhari added an additional and unprecedented ₦560 billion debt to our national debt profile,” he said.

Advertisement

“What could this junta have needed that amount for? If you take those dates into account, they fell on the period of electioneering, when monies were freely distributed by officials of this government in the name of Tradermoni and other election gimmicks that were discontinued after the election.

“We find it inconceivable that Nigeria could have had such unprecedented borrowings in the midst of almost unimaginable sorrowing, which resulted in our nation becoming the world headquarters for extreme poverty and the global capital of out of school children, even as we slipped in the Corruption Perception Index of Transparency International.

“We cannot continue to borrow to pay salaries and support luxuries. Already, over 50% of our revenue is going towards debt servicing, not even debt repayments,” he said.