The various fiscal and monetary challenges facing the Nigerian economy has made it to become so inefficient and currently performing sub-optimally, according to finance and economic experts.

Specifically, the depreciation of the naira, the huge debt burden, the revenue underperformance and the country’s over reliance on import is seriously having negative impact on the economy.

Advertisement

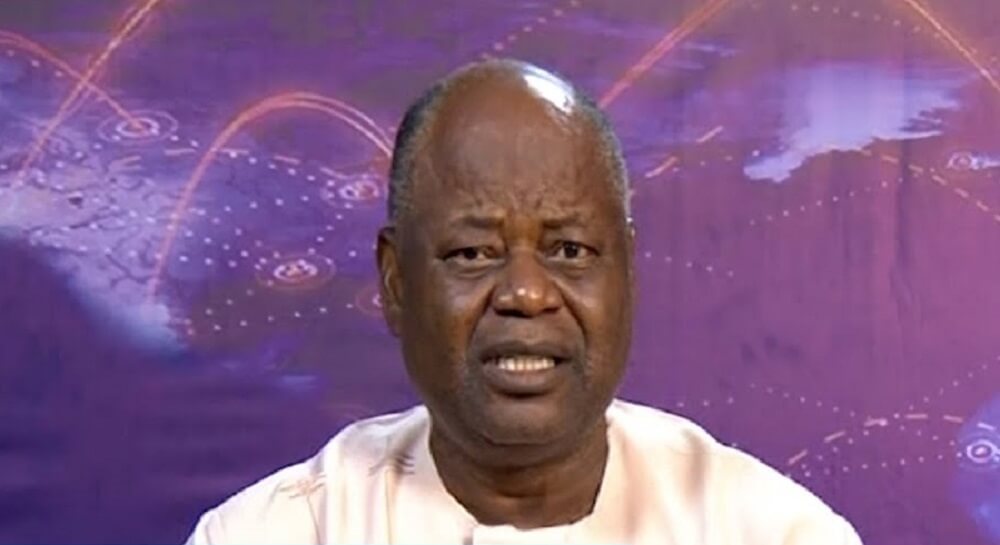

A Professor of Economics and International Finance expert, Ken Ife said these on Tuesday during an interview on TVC which was monitored by THE WHISTLER.

Nigeria’s fiscal position worsened in the first four months of the year as the cost of repaying debt surpassed the government’s revenue in the first quarter of 2022.

According to details of the 2022 fiscal performance report for January through April, Nigeria’s total revenue stood at N1.63trn while debt servicing stood at N1.94trn, showing a variance of over N300bn.

Nigeria’s Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed had last Thursday warned that urgent action is needed to address the nation’s revenue challenge and expenditure efficiency at both the national and sub-national levels.

The Medium Term Expenditure Framework Report for 2023-2025 showed that gross oil and gas federation revenue for the first four months of the year was projected at N3.12trn but as of April 30, only N1.23trn was realised, representing a mere 39 per cent performance.

Advertisement

Despite higher oil prices, the report showed that oil revenue underperformed due to significant oil production shortfalls such as shut-ins resulting from pipeline vandalism and crude oil theft as well as high petrol subsidy cost due to higher landing costs of imported products.

In the last few years, the nation has relied heavily on the Central Bank of Nigeria’s deficit financing, with the amount peaking at N19trn as of June 2022.

In the midst of the revenue challenges, the country is contending with the massive depreciation of the naira as the nation’s currency dropped to an all-time low of N670 to a dollar at the parallel market.

But speaking on the development, Ife who is also a Macroeconomic and Public Policy Analyst, called on the government to come up with fiscal policy measures that would enable it generate the much-needed revenue to finance its operation.

He said, “The major issue of the government is revenue, it is not about the debt we are owing but the revenue to service the debt we are owing.

Advertisement

“The government revenue is only seven per cent of our Gross Domestic Product and it is the lowest in Africa. The average is about 18 per cent and ECOWAS economic budget criteria put it at 20 per cent minimum. We are three times under powered in terms of revenue, it means that if Nigeria is a trailer, the engine driving that trailer is that of a Volkswagen. This is what it looks like, and we need to ramp up revenue by reducing the cost.”

Speaking on the foreign exchange crisis, he blamed the development on the country’s inability to generate foreign exchange like it did in the past.

For instance, Ife said that foreign direct investment inflows had dropped from about $10bn to less than $1bn, while portfolio investments have also dropped significantly.

He added, “Foreign direct investment has crashed which is about $8bn to $10bn, but we are talking about less than $800m last year and even now $200m portfolio investment.

“So, we are in a very tight corner, and then you look at expenditure, we heard the announcement that was made few days ago that the revenue of the government is not even enough to service the debt.”

He called on the federal government to come up with fiscal measures that would shore up revenue and reduce the cost of governance.