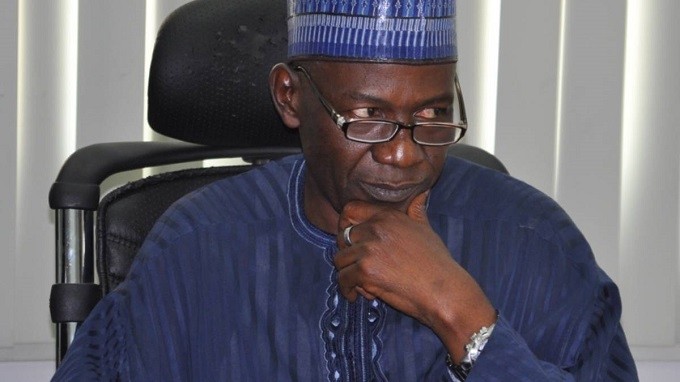

Alhaji Aminu Gwadabe (President, Association of Bureau De Change Operators of Nigeria, ABCON)[/caption]

Alhaji Aminu Gwadabe (President, Association of Bureau De Change Operators of Nigeria, ABCON)[/caption]

There are indications that no fewer than 30,000 out of the 200,000 bureaux de change (BDC) workers, will lose their jobs within the first quarter of this year.

The President, Association of Bureau De Change Operators of Nigeria (ABCON), Alhaji Aminu Gwadabe, who said this on Tuesday, added that the planned downsizing followed the continued loss of business by operators after the Central Bank of Nigeria’s (CBN’s) stoppage of weekly dollar sales to its members.

According to the ABCON boss, those to be affected might include directors, auditors, operations managers and compliance officers, as well as chief executives.

Advertisement

Speaking with newsmen on Tuesday, Gwadabe said, He regretted that the BDCs were being blamed whenever there was naira decline.

He explained that it was the involvement of the BDCs through the direct sale of dollars that led to the historic convergence of exchange rates in 2006.

His words, “As law- abiding citizens and partners in progress with the CBN, we respect the decision of the apex bank as the regulator of the banking industry and foreign exchange market where we operate. While we are not totally surprised by the decision, we, however, believe there are better ways of addressing the challenges in the foreign exchange market.”

“Suffice to mention that before the CBN started selling dollars to BDCs in 2006, there were about 270 BDCs in the country. Despite the harsh operating environment, these operators were able to survive by servicing their clients. Secondly, the BDC industry was created by the CBN to fill a critical gap in the retail segment of the foreign exchange market. Furthermore, the decision to sell dollars to BDCs was in recognition of the role of BDCs to counter the effect of the illegal currency traffickers and the continued depreciation of the naira in the parallel market.

Advertisement

“Thus, contrary to the impression created by the CBN, BDCs are not the problem of the foreign exchange market, rather they are solutions to deep rooted problems in the market namely activities of illegal foreign exchange operators and the wide gap between the official and the parallel market exchange rates. And they have performed creditably well in these regards.

“In the last one month, the CBN has been rationing dollar sales to BDCs, with less than half accessing the dollar windows. The Governor should have stated how much dollars the CBN actually sold to BDCs on an annual basis rather than estimating how much is been sold. For example, in 2014, according to the quarterly economic reports of the CBN, the CBN sold $4.4 billion to BDCs while it sold $43.65 billion to banks through the Retail Dutch Auction. This reveals that out of the $48.09 billion sold by the CBN, less than 10 per cent was sold to BDCs.”

Speaking on the decision of the CBN to stop dollar sales to BDCs, Gwadabe who said it has grave implications for the economy, added, “First, is the spike in the parallel market exchange rate from N270 to over N290 per dollar within three days of its pronouncement. Over time this would lead to increased scarcity of dollars even for legitimate activities and further depreciation of the naira.”