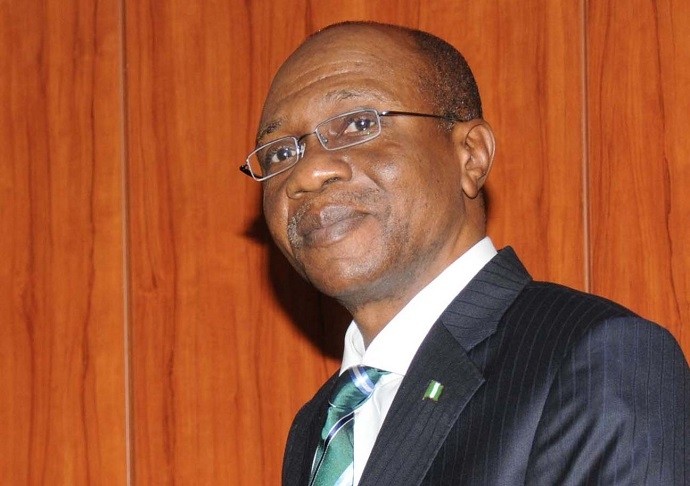

Godwin Emefiele[/caption]

Godwin Emefiele[/caption]

As the Central Bank of Nigeria (CBN) continues to resist calls to devalue the Naira in the face of plunging oil prices, economists and financial experts have warned of dire recession if the situation is not reversed.

CBN governor, Mr. Godwin Emefiele at the apex bank’s Monetary Policy Committee meeting on Tuesday in Abuja, resisted calls for devaluation as capital flight hits Africa’s largest economy.

“There is pressure but there is no way of exerting market discipline on the Nigerian central bank,” Ayodele Salami, who manages about $500 million of African equities as chief investment officer at Duet Asset Management in London, said by phone.

Advertisement

“We need to see a collapse in growth,” he said. “It’s not yet gone into territory where they have to panic. If growth was to be 1 percent or even go negative, I think that would definitely be the key thing that would persuade the central bank to move.”

The economy probably expanded 3 percent last year, the slowest pace since 1999, and is set to grow 4.1 percent in 2016, according to the International Monetary Fund.

Black Market

The central bank has effectively pegged the naira at 197 to 199 per dollar since March by restricting imports of products from glass to wheelbarrows, halting supply of foreign currency to exchange bureaus and all but shutting down the interbank market with trading limits.

While Emefiele on Tuesday acknowledged the need for improving liquidity, he said policy makers were also committed to stability in the naira.

Nigeria has resisted devaluation while oil-producing nations from Angola to Russia and Mexico have let their currencies weaken.

Advertisement

The naira was trading at about 306 per dollar on the black market on Tuesday. Naira forwards soared after Emefiele’s speech, suggesting traders have lowered their expectations of a devaluation. Naira three-month non-deliverable forwards rose to 229.25 per dollar at 6 a.m. on Wednesday in Lagos, the commercial capital, from 250.5 on Tuesday.

“Oil has gone lower than anyone thought it was going to and that didn’t change their mind,” John Ashbourne, an economist at Capital Economics Ltd. in London, said by phone.

A weaker economy “didn’t change their mind, and now you have a huge gap between the parallel market and the official market and that hasn’t changed their mind either,” he said. “I’m not sure what would be the sort of straw that breaks the camel’s back.”

The currency controls have knocked investor confidence, with foreign inflows dropping by 32 percent last year, the Nigerian Stock Exchange said in a report on it’s website on Dec. 19. The benchmark equity index is down 17 percent this year, the worst performer globally after gauges in Shanghai, Saudi Arabia and Hong Kong.

The central bank has favored lowering interest rates to help support growth in the hope that banks will boost lending. The MPC reduced the benchmark rate by 200 basis points to 11 percent in November and kept it unchanged on Tuesday.

Advertisement

The bank “wants to encourage credit and stimulate the economy,” Lanre Buluro, an analyst at Primera Africa Securities Ltd., said by phone from Lagos. “However, I don’t see the banks lending in the near term because of low economic activity.”