By Omoh Gabriel –

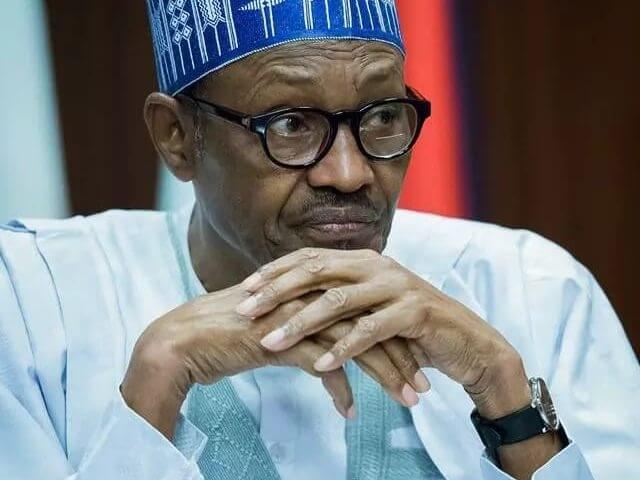

When President Muhammadu Buhari swept his way to power with the change mantra, many Nigerians were hopeful that things will get better. Buhari talked tough and many felt he meant well. In-fact his stand on the economy, which is to look inwards, was well received.

Many supported his position of not yielding to the devaluation of the naira. Yes, the economy was taking some bashing; Nigerians were going to have it rough and tough initially. Nothing good comes easy was the understanding of many.

The government planned to jump start production by injecting funds into the economy. To bring workers back to work, empower Nigerians to have enhanced purchasing power to oil the wheel of economic growth and progress. But thus far the economy is sinking and there is no recovery plan that is adequate to tackle the economy down turn.

Advertisement

There was a debate on the value of the naira and pressure came on the Central Bank of Nigeria to devalue the currency. Proponents of devaluation had argued that it will bring in a lot of dollars from foreign investors. CBN submitted to pressure by floating the naira.

The result was a steady decline of the national currency. The foreign exchange that was being hoped for has not come, with foreign investors waiting in the wings and watching to see the currency go further down the line. Nigerian policy makers seem not to learn from the past.

This economy can only grow through the genuine efforts of Nigerians. Foreign investors can only be additional benefit not the core of growth and development of the Nigerian economy. Four drivers of the economy Managers of the economy are well aware that consumption, investment, government spending and exports drive any economy. As it is the four drivers of the economy are looking downwards. They may not look up any time soon if appropriate policy measures are not applied.

The economy as admitted by both the minister of finance and the Central Bank governor is sinking and there is no recovery plan that is adequate to tackle the economy down turn. Nigeria needs massive investment, the purchasing power of the consumers need to be enhanced, government need to spend wisely on infrastructure and the private sector have to produce for both local and international markets.

Advertisement

The nation is not earning enough from crude oil export, so there is shortage of foreign exchange in the country. Nigeria policy makers seem not to learn from the past. This economy can only grow through the genuine efforts of Nigerians. Foreign investors can only be additional benefit not the core of growth and development of the Nigerian economy.

In the days of import license, the argument was that once the economy was liberalised, the nation can go to sleep and things will fall in place. Nigeria undertook the Structural Adjustment pills. Policies and programmes were put in place. One of such was the introduction of the foreign exchange market.

At that time, there were three separate markets for foreign exchange. There was the first tier, the second their and the autonomous market. In each of these markets different rates were applied for the same commodity. Along the line, foreign and local investors started agitating that the true value of the naira was reflected in the shadow market called parallel market.

The IMF, World Bank and other self styled experts kept asking the nation to adjust the naira value against the dollar. From about N1 to the dollar in 1986, the adjustment has taken the nation currency down the drain to N395 to the dollar as at today. So long as the parallel market exist side by side the inter-bank market, and Nigeria not earning enough foreign exchange, the naira will continue to weaken with its attendant inflationary pressure on the economy.

The fundamental issues in the economy are not being addressed in each of these adjustment experiments. No nation allows its economy to become a guinea pig for testing the suitability of a theory in the market place. The primary problem in Nigeria economy is its weak production base. Nigerians must realise that the economy as well as the currency can only get better if every Nigerian makes up his mind to be productive and be discipline. It is shameful that Nigeria imports virtually everything under the sun.

Advertisement

This simply is unsustainable. There is a general need for a reorientation of the minds of Nigerians, an orientation borne out of the fact that there is dignity in labour. Nigeria can come out of the current recession if all hands are on deck in a very short time by looking inward and producing locally most of the items it is importing now. Nigeria imports at least 70 percent of its refined fuel, despite pumping 1.6 million barrels of crude a day in June according to the International Energy Agency, and faced fuel shortages as retailers struggled to get foreign currency to buy product. The currency’s official exchange rate weakened to more than N280 per dollar, compared with the fixed rate of N197-199, and the naira trades at around 360 on the black market, increasing prices for consumers. Strong production base The lack of a strong production base has resulted in imported inflation. As the value of the naira nose dive, prices of goods and services rise as more naira are needed to import the same quantity of goods in the past.

National Bureau of Statistics in a statement recently said “In June, the Consumer Price Index (CPI) which measures inflation continued to record relatively strong increases for the fifth consecutive month. The Headline index increased by 16.5 per cent (year-on-year), 0.9 per cent higher from rates recorded in May (15.6%). While most COICOP divisions which contribute to the Headline index increased at a faster pace, the increase was however weighed upon by a slower increase in three divisions; Recreation & Culture, Restaurant & Hotels, and Miscellaneous Goods & Services “Year on year, energy prices, imported items and related products continue to be persistent drivers of the Core sub-index. The Core index increased by 16.2% in June, up by approximately 1.2% points from rates recorded in May (15.1%). During the month, the highest increases were seen in the electricity, liquid fuel (kerosene), furniture and furnishings, passenger transport by road, and fuels and lubricants for personal transport equipment. “While imported foods continue to increase at a faster pace, the Food sub index on the aggregate increased, albeit at a slower pace in June relative to May. The index increased by 15.3 per cent (year on year) in June up by 0.4 per cent from rates recorded in May. The index was weighted upon by a slower increase in the vegetables and “sugar, jam, honey, chocolate and confectionery” groups. Nigerians must produce what the nation feeds on. Nigeria cannot continue to import rice, beans, petrol and what not. Imagine if there is a Dangote in agriculture, another in auto manufacturing, another in petrol sector replicating the cement miracle, this economy will certainly grow faster and less dependent on import.

The argument that the business environment is harsh is begging the question. If Dangote can succeed in the Nigerian environment, others with the same mind- set can succeed. It is very obvious that devaluation can not benefit an import dependent country. Nigeria produces and exports oil. Nigeria does not determine the price of oil nor the volume it produces.

The second issue in the country today that should be addressed is the question of sanctity of contract. Foreign investors are not responding to Nigeria economic overtune because they are not sure that Nigeria government will keep its promised. Many are not convinced of the sincerity of those in power. There are too many conflicting signals coming from the principal officers of the current government.

It is a matter of concern that after the CBN introduced the floating exchange rate, the President in the open said he does not see the benefit of the policy to Nigerians. Such statement in the eyes of foreign investors connotes lack of policy cohesion and does not give hope for consistency. The question is if this administration believes strongly in looking inward, it should come up with policies and strategies to implement its diversification policy.

As it is this government is on an economic roller coaster that is leading no where. As of today the purchasing power of the citizenry is very low. Liquidity in the hands of individuals is paltry with several months of unpaid salaries in both public and private sectors. It is the ability of the citizenry to buy goods and services that gives signals to producers to produce more. It is the stimulation of production that generates employment, leads to industries expanding their facilities to cope with rising demand.

Advertisement

This process when triggered brings about moderation in the prices of goods and services. In the warehouses of the few manufacturing companies are inventories of finished goods they are not able to sell. From the annual reports of existing companies, a good number are declaring loses and can not invest in new projects. Nigeria is at the moment suffering from lack of economic growth and at the same time high level inflation. The economy is in what is known as stagflation. It is unfortunate that instead of releasing money into the economy the government is locking up funds that should have been used to foster production in the CBN vault in the name of fighting corruption.

It has also failed to release the money it promised it will release into the economy as soon as the budget is passed. Timely release of funds enables any economy to move to the next level. A breakdown of the total expenditure of government in the first three months of 2016 showed that the recurrent component accounted for 72.8 per cent, while capital and statutory transfers accounted for 18.0 and 9.2 per cent, respectively.

A further breakdown of the recurrent expenditure showed that the non-debt component accounted for 72.7 per cent, while debt service payments accounted for the balance of 27.3per cent. Thus, the fiscal operations of the Federal Government resulted in an estimated deficit of N725.18 billion, which indicated an increase of 178.6 per cent above the 2015 provisional quarterly budget deficit of N260.25billion”.

There is no way the Nigeria economy can grow fast with this kind of government expenditure pattern. Enough attention needs to be paid to the development of infrastructure in the country if Nigeria intends to attract the right type of foreign investment. Nigerians and Nigerians are the problem of the nation. We must wake up from our sleep; roll up our sleeves and work, work and work to bail out our country Nigeria.