We Will Provide Forex To Foreign Investors Seeking To Repatriate Investments–CBN

The Central Bank of Nigeria has said that it will give priority to foreign investors seeking to repatriate their profits and dividends.

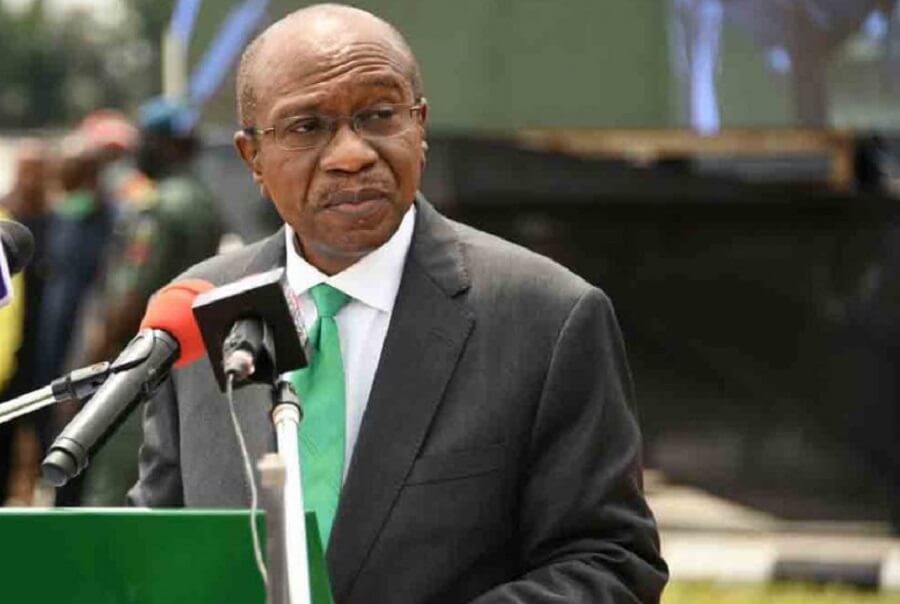

The CBN Governor, Godwin Emefiele, said this on Wednesday at the Nigerian International Partnership Forum in Paris.

Advertisement

The apex bank in a bid to boost foreign reserves has been rationing dollars to investors.

Nigeria was faced with dollar crunch during the period of the Covid-19 pandemic when oil prices went lower than production cost.

According to official records, over $2bn of Foreign Portfolio Investors (FPIs) funds seeking to be repatriated were locked in the economy due to the severe dollar scarcity.

But Emefiele told investors in Paris that with the rebound of crude oil prices and the reopening of the economy which is currently out of recession, the country has enough reserves that can fund the repatriation of funds belonging to investors.

Advertisement

Checks by THE WHISTLER showed that the Nigerian reserves as of November 8, 2021 was $41.6bn. It is higher than the about $30bn reserves held in March last year.

Emefiele said, “Reserves have gone up. As we speak to you today, reserves are over $41bn. We are also hoping that as we see further rebound in crude price, even though some of us are not (happy), yes we are happy that price is up, but we believe that we are not going to lay down our guards.

“We must continue to do what is needed to be done to ensure that we truly diversify the base of the Nigerian economy from relying on oil into the non-oil sectors of the economy.

“So, we will continue to do anything possible to boost the reserves to reserve the position for those of you in our foreign investor community who look at reserves, I would say the reserves today look good.

“For those of you who have businesses and are looking at the possibility of repatriating your profits through dividends, we started a programme where dividends are now being repatriated easily, as long as it is a properly documented foreign direct investment into the country.

Advertisement

“We are positive that you should be able to and we will give priority to you as you aim to repatriate your profits.”

He explained that the country’s inflation has moderated downwards to 16.6 per cent from 18.17 per cent and will moderate to 15.35 per cent by December 2021 and 14.91 per cent by February 2022.

The apex bank governor was also optimistic that the confidence in the Nigerian business space has increased.

Emefiele explained that the business confidence index, which is projected to grow to 37.7 index points in November 2021, will surge to 57.6 index points by June 2022.

The CBN boss also told the prospective investors in France that the Nigerian country is open and friendly for investment.

Emefiele also revealed that the apex bank will revert to the normal rate it charges on its interventions, adding that the government had directed banks to restructure loans of people who were affected during the pandemic.

Advertisement

He said that the interest rate on its intervention which was reduced from nine per cent to five per cent will be returned to the original nine per cent following the recovery of the economy.