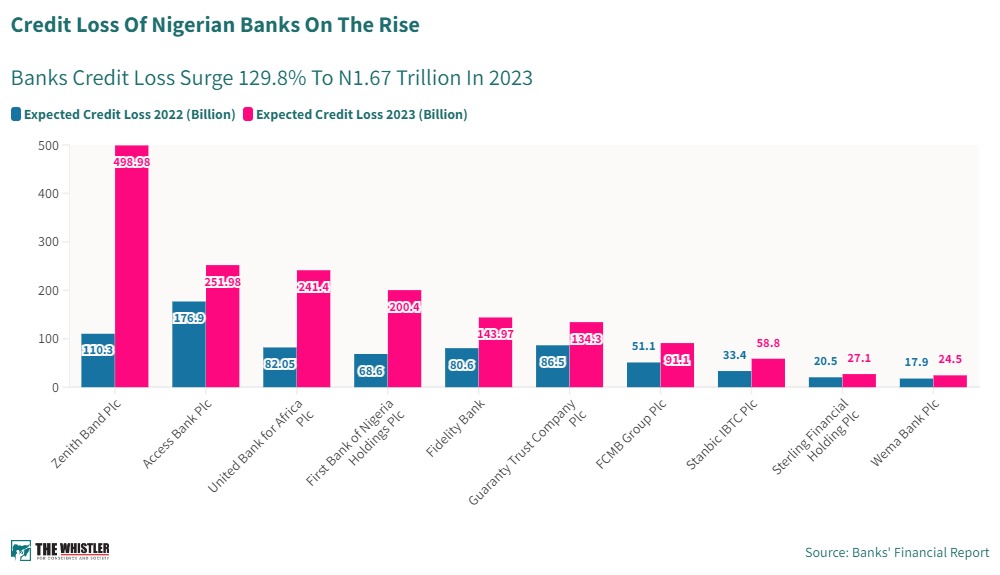

UBA, Fidelity, FBNH, Seven Other Banks May Lose N1.67tn As Auditors Raise Concern Over Credit Quality

The credit risk exposure of Nigerian banks is on the surge as their loan loss provisions accelerated by 129.8 per cent at the end of December 2023 over rising interest rates and harsh economic conditions.

The banks’ ECL positions reviewed by THE WHISTLER are, Zenith Bank Plc, Access Bank Plc, First Bank of Nigeria Holding, United Bank for Africa Plc, Fidelity Bank Plc, Guarantee Trust Company Plc, FCMB Group Plc, Stanbic IBTC Plc, Sterling Financial Holding Plc and Wema Bank Plc.

Advertisement

The ten leading deposit money banks in Nigeria recorded N1.67tn Expected Credit Loss (ECL) for loans and advances to customers, a surge from the N 727.84bn loss they accumulated in 2022, findings by THE WHISTLER reveals.

The sharp deterioration has become a major audit matter raised by different auditors like Ernst and Young, and Deloitte among others hired by the lenders.

“Expected Credit Loss (ECL) assessment on loans and advances to customers is considered a key audit matter in the consolidated and separate financial statements given the significance of the amounts,” one of the external auditors, Ernst and Young Nigeria said.

ECLs are the expected credit losses that result from all possible default events over the expected life of the financial instrument.

Advertisement

The Central Bank of Nigeria had in a circular issued in 2019 said it expects banks to put in place systems, governance arrangements and controls to identify instances where their exposures have suffered a significant increase in credit risk.

Last year, the balances of gross loans and advances issued by the ten banks to their customers rose by 57.9 per cent to a record N39.18tn in 2023, up from the N24.8tn which it was in 2022.

Across the wider Nigerian banks, the CBN compelled lenders to issue 65 per cent of deposits as loans. However, the CBN reduced the ratio to 50 per cent in March 2024 as it pursues a hawkish monetary policy regime.

But monetary policy rates remain elevated at 24.75 per cent as of March this year, resulting in the higher interest rate on bank loans.

Advertisement

Zenith Bank Plc is the worst hit by credit losses. The group made an ECL allowance on loans and advances to customers of N498.977bn in December 2023, an amount which rose by a shocking 352.5 per cent against the N110.261bn loss recorded in 2022.

Findings showed that Zenith Bank issued gross loans of N7.05tn to individuals and corporate customers by the end of December 2023 up from N4.12tn issued in the previous year.

Access Bank Plc increased loan issuance to customers from N5.6tn in 2022 to N8.9tn in 2023. However, the lender’s exposure to credit risk is on the surge after making an ECL provision of N251.98bn by the end of 2023, representing 42.4 per cent increase against the N176.9bn loan losses recorded in 2022.

United Bank for Africa is another lender whose credit risk exposure is on the rise. UBA’s group loans and advances to customers rose from N3.4tn in 2022 to N5.47tn in 2023 but the lender’s credit loss allowance rose by 194.2 percent from N82.04bn in 2022 to N241.4bn by 2023 end.

First Bank’s loan issuance to individuals, corporate customers and banks rose in 2023 to N6.4tn from N3.8tn in 2022. The bank has however, recorded higher provision on loan loss of N200.4bn which represents an alarming 192.12 percent surge from the N68.6bn in 2022.

Deloitte, the auditor of Fidelity Bank Plc considered it an audit matter and said the group made a credit loss provision of N143.97bn rising by 78.7 per cent from N80.55bn loss recorded in 2022. The lender’s gross loans to customers in 2023 was N3.24tn against N2.29tn which it was in 2022.

Advertisement

“Total loan impairment for the Group is N143.970bn (2022:N80.548bn), resulting in a net loan balance of N3.092tn (2022: N2.116tn) for the Group,” Deloitte said.

GTCO increased its lending as gross loans and advances to customers rose to N2.48tn from N1.9tn in 2022. However, the lender credit loss provision rose from N86.5bn in 2022 to N134.28bn in 2023, representing a 55.2 per cent increase in loss.

“The determination of ECL on loans and advances to customers is considered a key audit matter given the significant balances of the accounts,” EY said on GTCO’s loan loss.

The balance of FCMB Group Plc’s gross loans and advances to customers rose marginally to N1.93tn in 2023 against N1.25tn issued in 2022. But the impairment loos allowance on the loans and advances rose by 78.3 per cent to N91.13bn in 2023, a surge from N51.1bn recorded in the previous year.

“The Group wrote off a loan or an investment debt security, either partially or in full, and any related allowance for impairment losses, when Group determined that there was no realistic prospect of recovery,” FCBM said.

Another lender, Stanbic IBTC saw its ECL rose by 76 per cent to N58.8bn in 2023 from N33.4bn after increasing gross loans to customers to N2tn in 2023 from N1.2tn released in the previous year.

Like other banks, Sterling Financial Holding Plc increased its gross loan issuance to customers from N737.74bn in 2022 to N901.9bn in 2023. Sterling saw its credit loss provision rising by 32.8 per cent from N20.4bn in 2022 to N27.1bn by December 2023.

With an increase in gross loan balance of N825.6bn in 2023 compared to 2022, Wema Bank Plc made a credit loss allowance on loans and advances to customers at NN24.5bn, rising by 36.5 per cent against the N17.94bn loss of N2022.