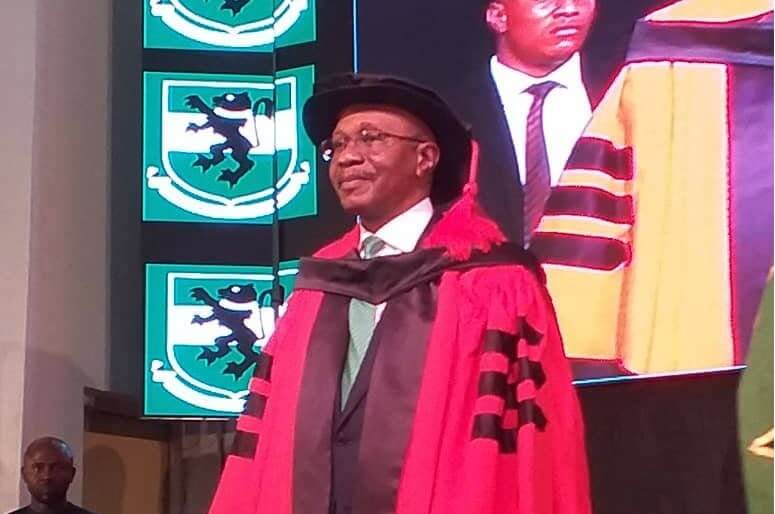

Emefiele Vows Hell For Economic Saboteurs As He Bags Honorary PhD

Nigeria’s Central Bank Governor, Mr Godwin Emefiele, on Friday, bagged an honorary doctorate degree in Business Administration from the University of Nigeria, Nsukka (UNN).

UNN conferred the honorary degree on the CBN Governor, alongside 50 other people, at a special convocation of the institution held today.

Advertisement

Emefiele, who delivered a lecture titled “From Recession to Growth: The Story of Nigeria’s Recovery from the 2016 Economic Recession” at the occasion, gave an insight into what Nigerians should expect from his second term as governor of the apex bank.

– Tough Times Await Economic Saboteurs

The CBN Governor, whose tenure was recently renewed by President Muhammadu Buhari and confirmed by the Nigerian Senate, vowed tough times for saboteurs of the country’s economy.

“If you don’t respect the economic policies of this country, and you fall short of our economic policies as an economic saboteur, you will be dealt with.

Advertisement

“Given this opportunity now, we will make it very difficult for people to circumvent economic policies. Policies that are meant to diversify our economy will be pursued very aggressively. We will also pursue policies that would help to create jobs for our children. So, we must learn to respect our policies,” said the CBN Governor.

Emefiele also shared insights into the factors that triggered the economic recession witnessed in the country between 2016 and 2017 and the measures implemented by both the monetary and fiscal authorities as well as measures that needed to be taken in order to “build an economy that will support improved wealth and job creation for a majority of Nigerians.”

He said, “On assumption of office as Governor of the Central Bank of Nigeria in June 2014, one of my cardinal objectives was to create a people focused Central Bank. A Central Bank that will promote macro-economic objectives such as low inflation and a stable exchange rate, along with a focus on promoting inclusive growth and reducing unemployment in the country. I believed that these objectives were necessary in Nigeria given the constraints faced by rural dwellers, as well as small and medium scale businesses in the country. The economic recession between 2016 – 2017 provided additional impetus on the need to promote a pro-growth strategy, that will reduce our reliance on earnings from the sale of crude oil, as well as our dependence on the importation of items that can be produced in Nigeria.”

– Why Nigeria Slipped Into Recession In 2016

The CBN Governor identified three factors that triggered the 2016 economic recession as:

Advertisement

- Widespread and rising geopolitical tensions along critical trading routes in the world – Beginning in March 2014 with the United States’-led sanctions on Russia for its annexation of Cremia and alleged role in precipitating the crisis/conflict in Ukraine. Other areas include Britain’s desire to pull out from the European Union, and rising trade tensions between the United States and China, with its attendant implications on global trade and capital flows.

- Crude Oil Prices – The 60 percent drop in oil prices between 2014 – 2016 exposed the structural vulnerabilities of oil dependent economies like ours. In July 2014, global crude oil prices began a sharp descent. The price of Bonny light, Nigeria’s crude, plunged from about US$115 per barrel in June 2014 to as low as US$31 per barrel by January 2016; and

- Normalization of Monetary Policy by the United States’ Federal Reserve System – This measure led to an acute capital flow reversal especially in emerging markets and increased financial fragilities in these countries. In October 2014 the US Federal Reserve commenced the tapering of its quantitative easing in preparation for a more conventional monetary tightening cycle. In an effort to contain rising inflation, the Fed fund rate was raised steadily to 2.25 percent in December 2018.

Emefiele, however, said Nigerians have every reason to rejoice today as the country’s economy has come out of recession and had been established on a growth trajectory. He added that the nation’s foreign exchange reserves has risen from $23bn in October 2016 to $45bn in April 2019.

“Nigeria’s current stock of external reserves is now able to finance 9 months of current import commitments. With improved availability of foreign exchange, the exchange rate at the I&E FX window has remained stable over the past 24 months at an average N360/$, and the parallel market exchange rate has appreciated from N525/$ in February 2017 to N360/$ today,” he said.

Emefiele further addressed concerns being expressed in some quarters that the “unconventional tools” being used by the CBN may not be effective.

He said, “Skeptics have pointed out that the pace of recovery has been slow, with GDP growth averaging only slightly higher than a 2 percent annual rate over the past few years and inflation remains above the CBN 6 – 9 percent threshold,” but noted that, “What the critics fail to note is that our economic recovery has faced powerful headwinds, as oil revenues constitute over 90% of our export earnings.”

The CBN Governor said due to the slow growth of the GDP, the apex bank would support domestic production of goods in the country so as to improve economic growth.

Advertisement

“Addressing the constraints of farmers, SMEs and manufacturers will be critical, to drive sustainable growth of the Nigerian economy and reduce our reliance on proceeds from the sale of crude oil.

“In addition, there is need to forge partnerships between universities, research institutions, the private sector and public sector institutions.

“This will aid in developing and implementing solutions that will support productivity in the agriculture and manufacturing sectors to build a sustainable productive base for the nation,” he said.