FG Moves To Cut Borrowing, Backs NRS N40.7tn Revenue Target

The Federal Government has intensified efforts to reduce Nigeria’s dependence on borrowing, throwing its weight behind the Nigerian Revenue Service’s (NRS) plan to raise N40.7tn in revenue in 2026, following a strong improvement in collections last year.

The revenue target was unveiled at the NRS 2026 leadership retreat held in Abuja, where the agency reviewed its 2025 performance and outlined priorities for the coming fiscal year. The Service reported that it generated N28.3tn in 2025, a 30.3 per cent increase from the N21.7tn collected in 2024.

Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, who addressed the retreat, said Nigeria must gradually move away from heavy reliance on debt as global financing conditions become more restrictive for developing economies.

According to him, borrowing has become increasingly difficult and costly due to tightening global financial conditions, weakening multilateral support and rising interest rates.

“We need to reduce our dependence on debt, and revenue mobilisation within this context is a developmental imperative,” Edun said. “The primary anchor of our fiscal sustainability is our own fiscal effort, our ability to generate revenue and savings that can be channelled into productive investment.”

Advertisement

He warned that many developing countries now spend more servicing debt than they receive in foreign aid or investments.

Citing recent figures, Edun said developing nations collectively paid about $163bn in debt service in 2024, compared with $42bn in overseas development assistance and $97bn in foreign direct investment.

“These numbers show clearly why Nigeria must focus on strengthening domestic revenue rather than relying excessively on external borrowing,” he said.

Despite the government’s push to cut borrowing, Edun acknowledged that Nigeria’s revenue challenges remain significant, particularly given shocks such as the COVID-19 pandemic, geopolitical tensions and trade disruptions, which have increased borrowing needs while shrinking fiscal space.

He stressed that building sustainable revenue streams would allow government to invest more meaningfully in infrastructure, education, healthcare and social protection for vulnerable citizens.

Advertisement

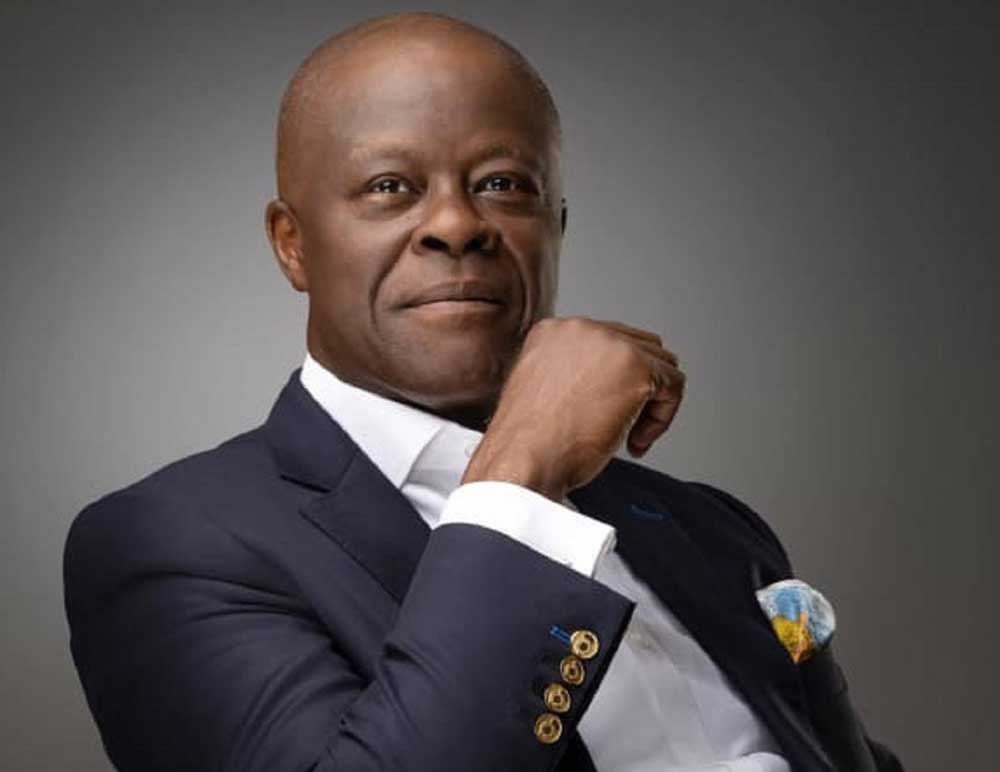

Chairman of the NRS, Mr. Zacch Adedeji, said the agency was entering a new phase that would require a departure from old methods and rigid bureaucratic culture in order to meet its ambitious 2026 target.

“This transition will not be secured by the weight of our positions or the familiarity of our structures,” Adedeji told participants. “What brought us here will not be sufficient for where we are going.”

He noted that reform efforts often fail due to outdated mindsets, adding that adaptability, collaboration and innovation must take priority over rigid control systems.

Adedeji said the retreat was designed to encourage leadership self-examination, stressing that sustainable revenue growth would depend on empowering staff, improving coordination and embracing new ways of working.

Details of the agency’s 2025 performance were provided by the Executive Director in charge of Government and Large Taxpayers, Mrs. Amina Kurawa.

She disclosed that revenue collections exceeded projections in three of the four quarters of the year, with only the final quarter falling short.

Advertisement

According to her, the NRS achieved 96.9 per cent of its target in the first quarter, 129.7 per cent in the second quarter and 131.9 per cent in the third quarter, before slipping to 90.4 per cent in the fourth quarter.

“Despite the dip in the fourth quarter, the year ended with a strong performance driven by improved compliance and voluntary filings,” Kurawa said.

She said non-oil taxes accounted for the largest share of revenue growth, rising by 35 per cent year-on-year to N21.5tn from N15.9tn in 2024. Value-added tax, company income tax and capital gains tax recorded combined growth of 19 per cent. Oil-related taxes also increased by 19 per cent to N6.8tn.

Kurawa attributed the improved performance to internal restructuring, tighter enforcement, clearer reporting lines, elimination of overlapping duties and expanded use of digital tools.