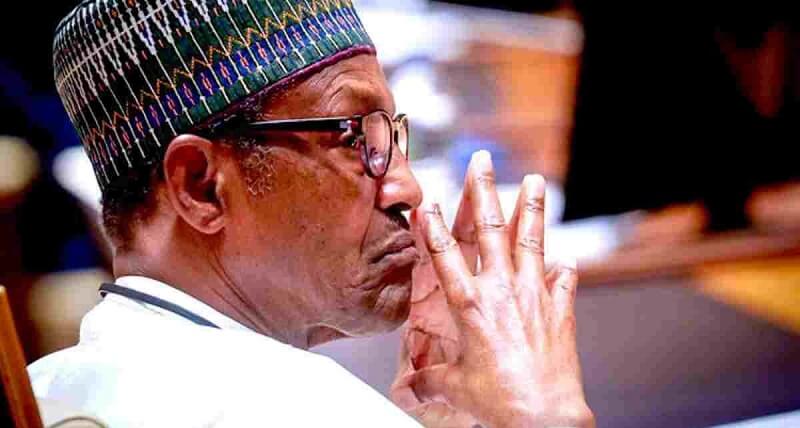

SERAP Gives Buhari 14 Days To Withdraw Plan To Borrow N895bn From Dormant Bank Accounts

The Socio-Economic Rights and Accountability Project has cautioned President Muhammadu Buhari on the plan by the Federal Government to borrow about N895bn from unclaimed dividends and funds in dormant accounts in Nigerian banks to finance 2021 budget.

It noted that borrowing these dividends and funds without due process of law, and the explicit consent of the owners is arbitrary, and as such, legally and morally unjustifiable, especially given the unwillingness or inability of the government to stop systemic corruption in Ministries, Departments and Agencies, cut waste, and stop all leakages in public expenditures.

Advertisement

In an open letter to Buhari on Sunday, SERAP urged him to use his good offices “to promptly drop the plan woven around “the patently unconstitutional and illegal Finance Act, 2020, and to ensure full respect for Nigerians’ right to property.”

The SERAP letter signed by its Deputy Director, Mr Kolawole Oluwadare, was also copied to Mr Abubakar Malami (SAN), the Attorney General of the Federation and Minister of Justice, and Mrs Zainab Ahmed, the Minister of Finance, Budget and National Planning.

It said, “The right to property is a sacred and fundamental right. Borrowing unclaimed dividends and funds in dormant accounts amounts to an illegal expropriation, and would hurt poor and vulnerable Nigerians who continue to suffer under reduced public services, and ultimately lead to unsustainable levels of public debt.

“The right to property extends to all forms of property, including unclaimed dividends and funds in dormant accounts. Borrowing these dividends and funds without due process of law, and the explicit consent of the owners is arbitrary, and as such, legally and morally unjustifiable.

Advertisement

“The borrowing is neither proportionate nor necessary, especially given the unwillingness or inability of the government to stop systemic corruption in MDAs, cut waste, and stop all leakages in public expenditures.

“The borrowing is also clearly not in pursuit of a public or social interest.”

SERAP further stressed that rather than pushing to borrow unclaimed dividends and funds in dormant accounts, the government ought to move swiftly to cut the cost of governance, ensure review of jumbo salaries and allowances of all high-ranking political office holders, and address the systemic corruption in MDAs, as well as improve transparency and accountability in public spending.

It added, “The borrowing also seems to be discriminatory, as it excludes government’s owned official bank accounts, and may exclude the bank accounts of high-ranking government officials and politicians, thereby violating constitutional and international prohibition of discrimination against vulnerable groups, to allow everyone to fully enjoy their right to property and associated rights on equal terms.

“SERAP is concerned that the government has also repeatedly failed and/or refused to ensure transparency and accountability in the spending of recovered stolen assets, and the loans so far obtained, which, according to the Debt Management Office, currently stands at $31.98bn.

Advertisement

“SERAP notes growing allegations of corruption and mismanagement in the spending of these loans and recovered stolen assets.

“We would be grateful if your government would drop the decision to borrow unclaimed dividends and funds in dormant accounts, and to indicate the measures being taken to send back the Finance Act to the National Assembly to repeal the legislation and remove its unconstitutional and unlawful provisions, including Sections 60 and 77, within 14 days of the receipt and/or publication of this letter.

“If we have not heard from you by then as to the steps being taken in this direction, the Registered Trustees of SERAP shall take all appropriate legal actions to compel your government to implement these recommendations in the public interest, and to promote transparency and accountability in public spending.”

According to SERAP, the government cannot lawfully enforce the provisions on Crisis Intervention Fund and Unclaimed Funds Trust Funds under the guise of a trust arrangement, as Section 44(2)[h] of the Nigerian Constitution 1999 [as amended] is inapplicable, and cannot justify the establishment of these funds.

SERAP also noted that while targeting the accounts of ordinary Nigerians, the Finance Act exempts official bank accounts owned by the federal government, state governments or local governments or any of their ministries, departments or agencies.