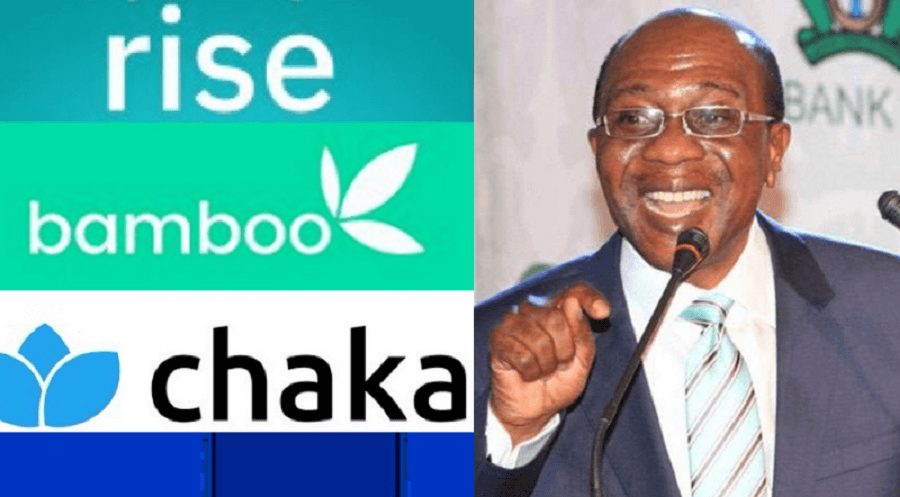

‘Don’t Make Fintech Firms Scapegoat,’- Reactions Trail Freezing Of Bamboo, Rise Vest Accounts By CBN

The fresh clampdown by the Central Bank of Nigerians on the accounts of Rise Vest, Bamboo and other fintech firms has gathered reaction from aggrieved Nigerians and fintech experts on microblogging site, Twitter.

On Tuesday, THE WHISTLER broke a report that the Federal High Court sitting in Abuja granted an ex parte motion which sought temporary freezing of bank accounts belonging to certain online investment and trading platforms.

Advertisement

The affected firms are Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Bamboo Systems Tech. Ltd OPNS, Chaka Technologies Limited, CTL/Business Expenses and Trove Technologies Limited.

The apex bank alleged that the six fintech firms were complicit in operating without license as asset management companies “and utilizing FX sourced from the Nigerian FX market for purchasing foreign bonds/shares in contravention of the CBN circular referenced TED/FEM/FPC/GEN/01/012, dated July 01, 2015.”

The CBN said the illicit foreign exchange trade has contributed to the devaluation of the naira.

Hence it was granted an interim order to freeze forthwith all the bank accounts of the Defendants/ Respondents for a period of 180 days pending the outcome of investigation and inquiry conducted by the regulator.

Advertisement

But Rise Vest and Bamboo assured their users of the safety of their funds pending when the issue will be settled.

Rise Vest said in an email, “With regard to the latest news about us and our FX dealings, you can be sure that your investments and funds are safely managed, that funding and withdrawals will continue to be processed as normal, and that all our US operations remain intact.

“We will work with regulators, as we always have to ensure that all issues raised are properly addressed. However, this does not affect our users or their investments, which are managed by regulated third parties in all jurisdictions in which we operate. Thank you for choosing Rise.”

Nigerians who reacted believed that fintech firms should not be made scapegoats for the failure of the naira which currently trades at N515 to the dollar on the parallel market.

Financial experts like Kalu Aja on Twitter decried the impact of the apex bank decision on Nigeria’s fintech space.

Advertisement

In a tweet via his Twitter handle @FinPlanKaluAja1, he said, “Here we go again. The CBN is again freezing operations of local FINTECH in a bid to ‘save the naira.’ It’s just tiring. The reputational damage done is unquantifiable. FINTECH are platforms, do not make them scapegoat for a falling Naira.”

Ayo Sogunro on his verified account @ayosogunro said, “This is peak Buharinomics madness. A combination of misuse of legal process (ex-parte orders should not last more than a week), ignorance of fintech, and fear of innovation outside their patronage political system. Buhari fails rule of law, fails economics, and fails governance.”

Wale Adetona via @iSlimfit said, “What is left that the government is yet to touch? Anything Fintech or sector that’s thriving, ban it or slam huge levy on them! Chased out Gokada, ban Crypto, ban Twitter, NITDA Amendment bill. Now coming for online Investment Platforms. Ease of doing business in the mud.”

@ijeuwaesika said, “NITDA is coming for your tech and fintech companies. They want to license them ( product, service provider and platform provider Licence)and also charge them a levy of 1% pre tax profit (100M+ revenue threshold).”