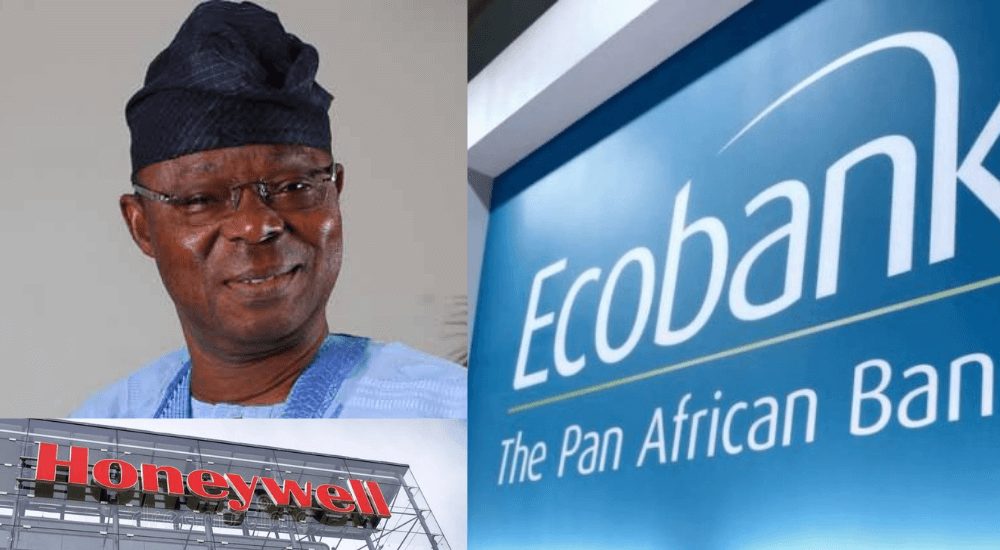

Ecobank Nigeria Plc has warned against the acquisition of the shares of Honeywell Flour Mills Plc about 24 hours after the company was acquired by Flour Mills Nigeria Plc.

Flour Mills had on Monday announced that it had acquired Honeywell from Honeywell Group Ltd and First Bank Holdings Group.

Advertisement

The two companies owned a combined 76.75 per cent of the shares held by Honeywell.

Honeywell Group Ltd owned 71.69 per cent shares, while First Bank Holding controlled 5.06 per cent shares in Honeywell.

Flour Mills said it acquired the shares for N80bn.

But Ecobank through its legal team Kunle Ogunba & Associates warned buyers to beware of accumulating the Honeywell shares.

Advertisement

The statement was titled, ‘Purchase of Honeywell Group Limited’s 71.69 per cent stake in Honeywell Flour Mills Limited- Caveat Emptor’.

Ecobank alleged that it had failed to liquidate a N4.1bn loan the founder and the Chairman of Honeywell Group, Dr Oba Otudeko, took from the bank.

THE WHISTLER understands that Ecobank was constrained to commence winding up proceedings against Honeywell Group Limited at the Federal High Court, Lagos in suit no: FHC/L/CP/1571/2015.

Ecobank said it filed an appeal (with appeal No: CA/L/1041/2016) at the Court of Appeal, Lagos Division adding that upon a review of Ecobank’s case, the Appellate Court found merit in the appeal.

The Court held that the winding up proceedings against Honeywell Group Limited was properly done and that the Federal High Court had jurisdiction to hear the said petition.

Advertisement

Ecobank adviced Flour Mills to cease and desist from consummating the subject transaction which aims to divest the assets of a company being wound-up (Honeywell Group Limited).

Ecobank said, “Please be further informed about the assets of both Honeywell Group Limited and Honeywell Flour Mills Plc are the subject of the winding-up action and thus based on the doctrine of “lis-pendens” (in addition to the provisions of CAMA supplied above) you are advised to refrain from dealing with the subject asset which forms part of the subject matter of litigation.

“Moreover, we are constrained not only to demand an urgent reversal of the alleged ‘divestment processes’ as epitomised by a counter publication, notification or caveat in that regard.”