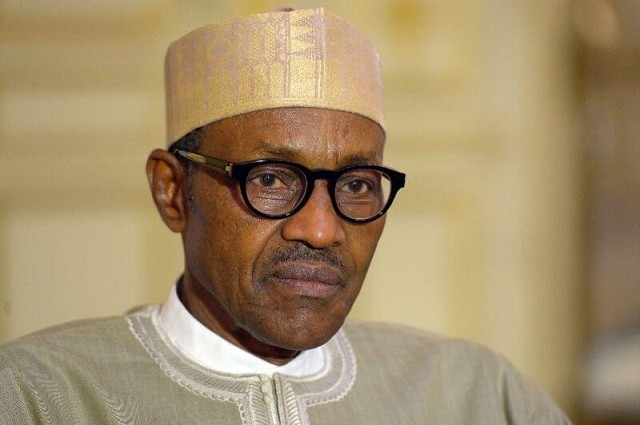

President Muhammadu Buhari[/caption]

President Muhammadu Buhari[/caption]

Influential financial and economic media giant, Bloomberg, has raised the red flag that President Muhammadu Buhari of Nigeria is taking the country to 1983 – 1985, the period he served as a military dictator characterised by long queues, scarcity of economic policies, lack of basic commodities and an excruciating forex.

In its recent report on Nigeria, Bloomberg notes: “History is repeating itself in Nigeria, where the more President Muhammadu Buhari is urged to devalue Nigeria’s naira, the more he is digging in his heels. Investors are beginning to surmise that politics — rather than economics — will determine the currency’s immediate future.

“Even as growth slows, inflation rises and foreign investors flee, analysts in a Bloomberg survey are backing away from estimates a devaluation will take place before the third quarter.”

Advertisement

Several analysts the media outfit spoke to expressed unanimity of opinions.

“Changing his position would make him seem like a spineless leader,” said Manji Cheto, an analyst at Teneo, a global advisory firm, who predicts there won’t be a change of currency policy until at least the second half of this year. “Buhari is seen as the man who will stand up to foreigners. He ran a campaign as a strongman, someone who would put Nigerian interests ahead of foreign ones.”

Foreign-exchange trading restrictions and import curbs have led to shortages of goods from gasoline to milk and sent the naira plunging to 320 on the black market.

Buhari and Emefiele, who meet at least weekly, say that the naira is fairly valued on the official market and that letting it drop would only harm poor Nigerians by pushing up prices. That’s already happening, with inflation accelerating to an almost four-year high of 12.8 percent in March as manufacturers struggled to pay for imports.

Advertisement

Growth slumped to 2.8 percent last year, the slowest pace in 17 years. It will slow further to 2.3 percent in 2016, according to the IMF, which called for a “speedy unwinding” of the currency controls to help revive growth.

It’s not the first time Buhari has resisted the IMF. When he last ruled Nigeria from 1983 to 1985, a time when, like today, oil prices had just crashed, he ignored advice to depreciate the naira and refused financial assistance from the Washington-based lender.

After Buhari was ousted in a coup amid a worsening financial crisis, his successor Ibrahim Babangida started an IMF-led structural adjustment program, which included a devaluation.

It was the first of many that saw the currency’s value drop from roughly parity with the dollar to today’s rate of near 200. Politicians still say the IMF program failed the country.

For investors, such thinking makes little economic sense. Most businesses are already trading at the black-market rate since the central bank’s policies are choking off dollars in the official market, according to Exotix Partners LLP, a London-based investment bank focusing on frontier markets. PZ Cussons Plc, the Manchester, U.K.-based soap maker, said last week its Nigerian unit is forced to pay a 50-70 percent premium on the official rate to source foreign-exchange.

Advertisement

With foreign investors avoiding the country until there’s a devaluation, Nigeria’s local bonds are the only ones to have made losses this year among 31 emerging markets tracked by Bloomberg. Nigerian average yields have risen 161 basis points to 12.31 percent since the end of 2015, whereas Russia’s have fallen 26 basis points to 9.29 percent and Colombia’s 28 basis points to 7.77 percent.

Buhari “just doesn’t get it,” Kato Mukuru, the London-based head of equity research at Exotix Partners LLP, said in an interview. “When he was last in power in the ’80s he was also told to devalue the currency. He refused until he was sent out in a coup. Clearly he didn’t do the same economics as I did. There comes a point where you need to understand that the whole country has already devalued.”