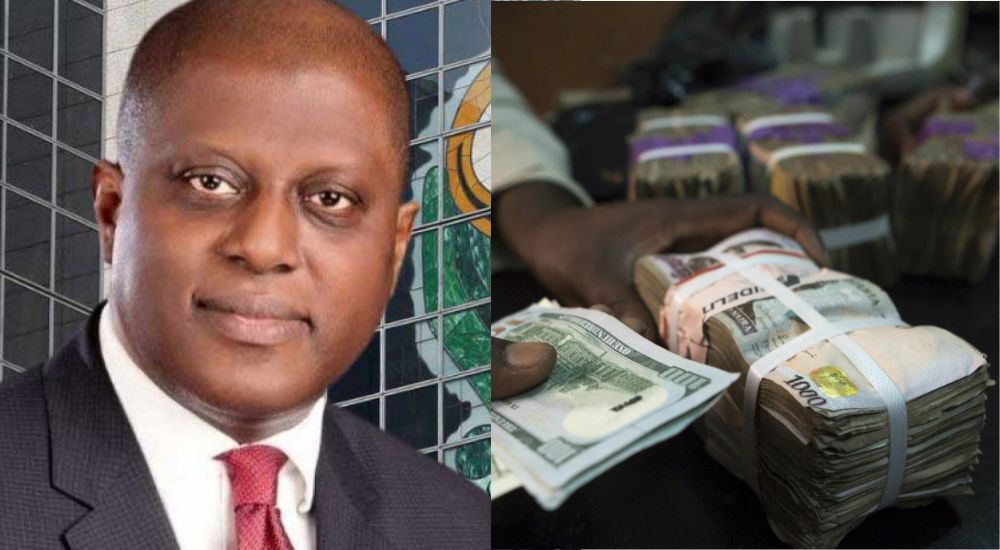

The naira has continued its losing streak and has reached a record low against the US dollar despite a boast by the Central Bank of Nigeria Governor, Olayemi Cardoso, that he is in control of the situation.

The naira has lost 10.4 per cent of its value from N1430 per dollar traded at the close of trade on February 1 to N1,580 on February 14.

Advertisement

The highest daily rate traded on the official spot market hit N1,550 on the Nigerian Autonomous Foreign Exchange Market on Tuesday, signalling defiance of the efforts of the CBN Governor who said the naira is undervalued.

The Central Bank Governor, Olayemi Cardoso, has threatened BDC operators accusing them of speculative activities, which led them to shut down operations across Nigeria on February 1, 2024 and reopen on February 2.

At least five circulars have been issued by the CBN to curtail the fall of the naira as banks and International Money Transfer Operators were not spared.

On Jan 29, the CBN issued a circular to authorised dealers titled, Financial Markets Price Transparency.’

Advertisement

The CBN accused authorised dealers and their customers of reporting inaccurate and misleading information on transactions. The circular threatened to sanction erring dealers.

Another policy was introduced in a circular dated January 31, 2024 on ‘Removal of Allowable Limit of Exchange Rate Quoted by the International Money Transfer Operator.’

The circular which reversed previous CBN circular dated September 13, 2023 stated that International Money Transfer Operators are required to quote rates within an allowable limit of -2.5 per cent to +2.5 per cent around the previous day’s closing rate of the Nigerian Foreign Exchange Market.

In its bid to resuscitate the naira and the economy, the apex bank issued another circular on the 31st of January, boosting diaspora remittances via official channels to Nigeria.

The CBN issued another circular on January 31, titled, ‘Reviewed Guidelines of International Money Transfer Services in Nigeria.’

Advertisement

The apex bank prohibited all banks from operating International Money Transfer services but can act as agents.

Also, Financial Technology Companies are not allowed to obtain approval for IMTO.

The CBN further released a circular on February 8 on the Removal of the spread on Foreign Exchange Transactions. The circular removed the spread on foreign exchange transactions in the interbank market.