Nigeria’s Forex Reserves Lose $693.5m After CBN Resumption Of Dollars Sales To BDCs

Nigeria’s gross foreign exchange reserves have shed at least $693.5m since the Central Bank of Nigeria resumed the sale of dollars to approved Bureau de Change dealers, THE WHISTLER can report.

Data analysed by THE WHISTLER from the ‘movement in reserves’ published by the apex bank shows that gross reserves fell by 18.5 per cent from $34.2bn held on March 21, 2024, to $33.57bn on April 2, 2024.

Advertisement

As of March 21, when reserves were $34.2bn, the CBN was still making preparations to resume the sale of FX to BDCs.

The CBN announced in a circular referenced TED/DIR/CON/GOM/001/072 dated March 25, that it will resume the sale of $10,000 to qualified BDC operators at the rate of N1,251 per dollar,

The lender prohibited beneficiaries from selling the forex above 1.5 per cent spread above the purchase price.

“We write to inform you of the sale of $10,000 to each BDC at the rate of N1,251/$1. The BDCs are to sell to eligible end users at a spread of not more than 1.5 per cent above the purchase price,” the bank said.

Advertisement

Checks by THE WHISTLER shows that on March 26, which was a day after the announcement, forex reserves fell from $34.26bn held on March 21 to $33.57bn, representing a fall of $311.9m.

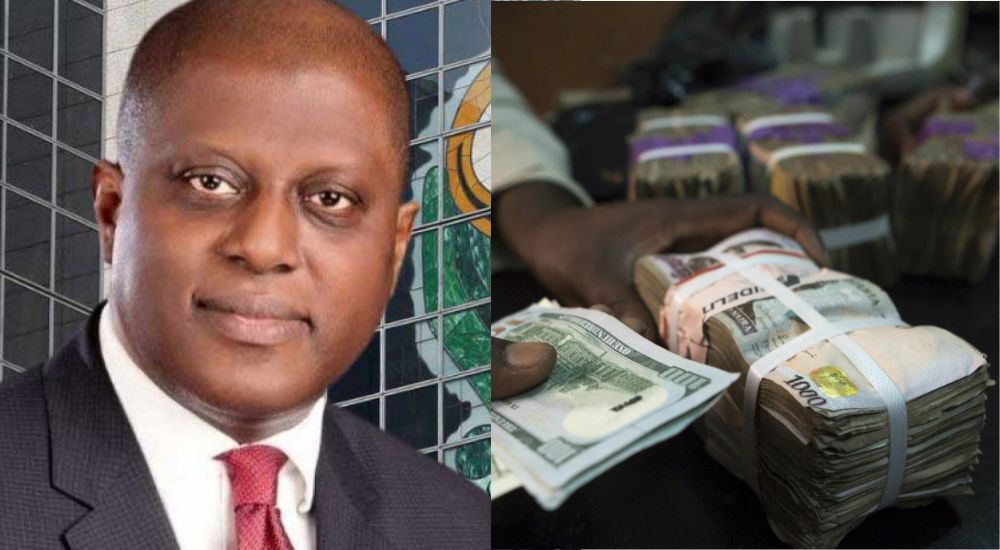

The Central Bank Governor, Olayemi Cardoso had vowed to crash the price of the dollar which had gained more than 100 per cent against the naira since President Bola Ahmed Tinubu took over office last year.

In February 2024, the naira exchanged at N1,900 against the dollar, which the apex bank governor said was an unfair valuation of the currency.

Cardoso had, on several occasions, accused BDC operators and speculators of fixing the currency at the BDC segment of the FX market.

Since the resumption of sales to BDCs, the naira has recovered by 15.5 per cent from N1,480 per dollar on March 25, 2024, to N1,250 as of the close of trade on April 4, 2024.