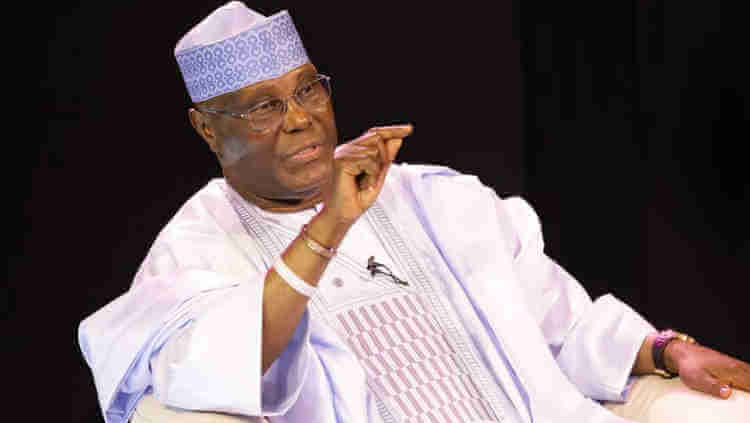

The former Vice President of Nigeria Atiku Abubakar has said it is time for Nigeria to protect her economy by building a strategic crude oil reserve, with a massive storage capacity that can hold at least a month’s worth of its production capacity.

Abubakar said this in a statement on Tuesday after the US oil experienced a drop to the negative territory.

Advertisement

The global oil market has continued to suffer from the impact of the coronavirus as prices continue to crash due to the sudden, massive and unexpected drop in worldwide demand for crude oil.

According to him. when such an infrastructure is built. the country will not have to sell its crude at a loss.

“We will be in a position to stockpile the product in our reserve until such a time as prices improve.”

Referring to other countries who have taken measures to protect their economy, Abubakar warned that Nigeria could not be left behind. “We must be in business for the best interest of our economy,” he added.

Atiku stated, “North American and European nations have such internal controls to protect almost every sector of their economy – from agriculture, automobile, and even intellectual property.

“I would also strongly recommend that we discuss with our partners in the Organisation of Petroleum Exporting Countries, and obtain a concession, whereby we can defer our daily quota, such that when we undersell, due to a crash in the price of crude oil, we can oversell when the prices stabilize, subject to the condition that we balance out our quota.”

He further said that Nigeria’s oil industry remained more susceptible to outside influences, than to internal control advising that the measure could change the narrative and make the oil industry more stable, even when there is global instability.

Advertisement

“This will translate to greater economic independence on our part,” Atiku added.

On his part, an Industry expert, Prince Ifeanyichukwu, who works with an Abu Dhabi based oil service company, Baker Hughes, said a drop in WTI did not bode well for Nigeria’s economy, post COVID-19.

“ We can only hope for a tremendous demand for crude by all sectors around the globe and also that the OPEC+ agreement to cut production by over 9 million barrels in May and June, with further cuts in the following months, resultantly drives price in an upward direction.”

For the meantime, he said Nigeria would have to borrow to fund its projects, pay salaries and keep some aspects of the economy running.

Ifeanyichukwu said Nigeria already had a glut that amounted to its oil price falling to $12 or thereabout a few days back “as we were scamping for buyers of our Crude.”

Advertisement

He stated “Thank goodness it is currently in its mid 20’s which is not nearly good enough because measuring this against the cost of production per barrel amounts to almost nothing for us..

“For a country that is heavily dependent on oil and had modeled its budget based on ~$50/bbl, we are doomed..

“This is not going to change any time soon because the real oil players (OPEC+) are OK with the current price so long as it asphyxiates the US Shale oil cum its investors.

“Nigeria will do what they do best- Borrow to fund their projects, pay salaries and keep the aspects of the economy they can, running..

“More so, at times like this, it’s the big players and operators of the ‘green fields’ in Nigeria that are most hit.. Because the cost of running such organizations is way too high and unsustainable with these dwarfed prices for crude.

“The ‘brown and marginal field’ players may still be able to cling to a lifeline as a more gentle operating cost greets them.

Advertisement

“In general, this doesn’t bode well for Nigeria’s economy, Post COVID-19.

“We can only hope for a tremendous demand for crude by all sectors around the globe and also that the OPEC+ agreement to cut production by 9 million barrels in May and June, with further cuts in the following months, resultantly drives price in an upward direction.”