Rising Inflation Eroding Purchasing Power Of Nigerians, Experts Lament

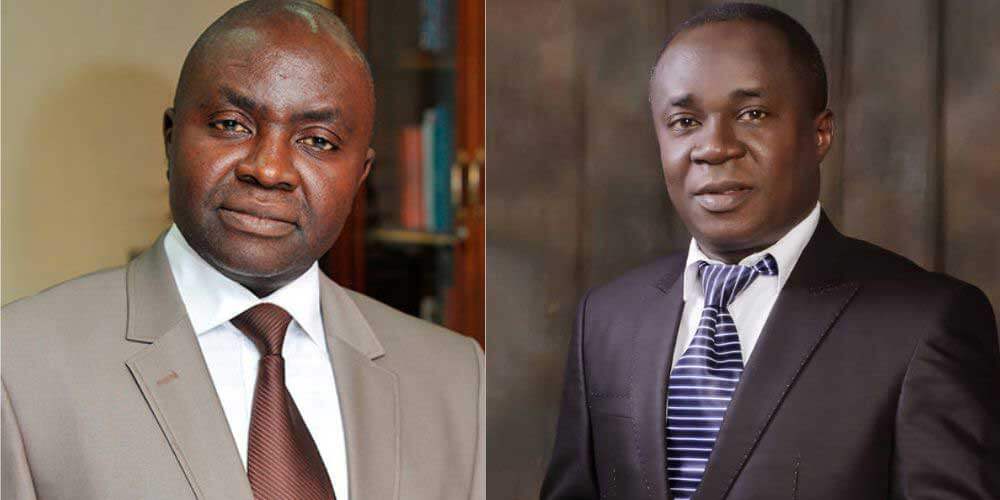

Inflation rose higher in November by 6.07 per cent on annual basis and the founder of the Centre for the Promotion of Private Enterprises, Muda Yusuf said the soaring rate is eroding the purchasing power of Nigerians.

The National Bureau of Statistics said on Thursday that Consumer Price Index for November 2022 stood at 24.47 compared to last year’s 15.40 per cent recorded recoded in November.

Advertisement

Food inflation is now at a record high of 24.13 per cent in November and is projected to jump in December due to the festive period.

The NBS data is leaning toward a narrative that more people will be pushed into multidimensional poverty if the rising figures persist.

The Bureau had last month released data which revealed that 133 million Nigerians or 63 per cent of the country’s population live in multidimensional poverty.

The projection exceeds World Bank’s estimate that by the end of 2022, 95.1 million Nigerians will live below the poverty line.

Advertisement

Reacting, Yusuf said the implication is the “Erosion of purchasing power of citizens as real incomes

collapse. Mounting poverty. Escalation of production costs which negatively impacts

profitability.

“Shrinking shareholder value in many businesses. The waning of investors’ confidence. Dwindling manufacturing capacity utilization.”

The Central Bank of Nigeria has made deliberate efforts to tame inflation by hiking Monetary Policy Rate to 16.5 per cent in November, but inflation has not abated.

But the CPPE CEO said the apex bank should resist the temptation of further monetary policy tightening.

He said, “The deployment of monetary tightening tools should be put on pause. The Nigerian economy is not a credit driven economy which is why the tightening outcomes has been inconsequential as a tool to tame inflation.”

Advertisement

But he believes the fiscal policy makers have to urgently intervene in fixing some legacy issues.

Yusuf said, “Taming inflation demands urgent government intervention to fix supply side constraints in the economy. Tackling production and productivity constraints, fixing the dysfunctional forex policy, and reducing liquidity injection through ways and means funding of fiscal deficit.”

Uche Uwaleke, a Professor of Capital Markets Studies also argued that the CBN monetary tightening and the new cash limit for withdrawals may reduce inflationary pressure.

According to him, inflationary pressure in Nigeria has consistently been driven chiefly by supply-side factors like scarcity of petroleum products, inadequate transport and power infrastructure as well as insecurity and flooding which negatively impact food output in particular.

Uwaleke said, “There’s equally the demand side caused by election spending and speculative demand for forex, especially in the parallel market resulting in naira depreciation and imported inflation.

“The supply-side factors can only be tackled by the fiscal authorities through decentralizing infrastructure provision and involving the private sector more in power and road transport infrastructure provision. It’s also the duty of the government to tackle insecurity which can be addressed in part through the establishment of State Police.

Advertisement

“Demand-side factors are within the purview of the CBN. This, the Bank can do via effective monetary policy which is geared towards controlling the money supply. To this end, the currency redesign and cash withdrawal limits might help.”