Economic experts on Friday commended the Central Bank of Nigeria’s (CBN) new minimum capital requirements for banks, pegging the minimum capital base for commercial banks with international authorisation at N500bn.

THE WHISTLER earlier reported that the new minimum capital base for commercial banks with national authorisation was pegged at N200bn, with the regional authorization moved to N50bn.

Advertisement

This development comes two decades after the last review was announced on July 6th 2004, where the CBN uniformly recapitalised the banking sector from N2bn to N25bn with effect from 31st December 2005.

This drastic increase to N25bn as banks’ minimum capital base led to a remarkable reduction in the number of banks from 89 to 24 in 2005.

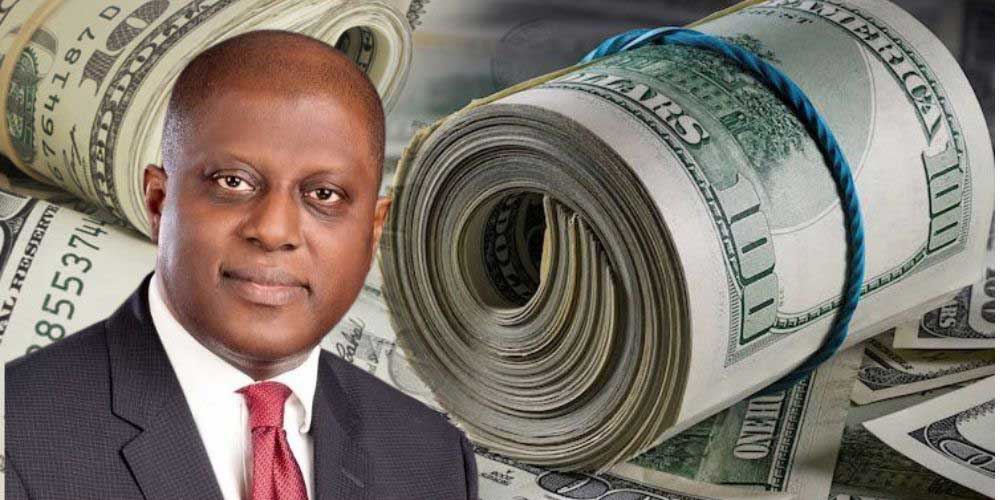

However, the CBN under the leadership of its Governor Olayemi Cardoso in November 2023, said the review was to enhance banks’ resilience, solvency, and capacity to continue supporting the growth of the Nigerian economy.

Weighing in on the review, the Special Adviser to the Chairman Senate Committee on Banking, Insurance and Other Financial Institutions, Prof Uche Uwaleke told THE WHISTLER that the move will help strengthen the country’s financial system and a potential boost to the stock market

Advertisement

Before the naira devaluation following the unification of exchange rates, the new calibrated minimum capital requirements according to Uwaleke seemed good unlike the uniform capital base of N25bn stipulated in 2005.

He said, “I believe the FUGAZ (FBN, UBA, GTB, Access and Zenith) banks with international authorization will have no difficulty meeting this requirement as the stock market (Option 1) presents the most feasible option as few will likely go the Mergers and Acquisitions (M&A) route.

“I also think the 2 years period allowed is sufficient to implement recapitalisation as several Banks including FBN, Access and Fidelity had already commenced the process of recapitalisation before now, with Access bank announcement of raising N365bn via right issue”.

However, he urged the apex bank to consider applying a differentiated CRR according to the bank’s license categories.

Uwaleke added, “Given the young age of Non-Interest Banks in Nigeria, they should be allowed a longer period, say, 3 years to meet the minimum capital requirements and based on the type of authorization (International, National or Regional).

Advertisement

“The CBN may consider applying a differentiated CRR according to the category of license instead of the 45 per cent current uniform rate for commercial banks.”

Speaking on the new commercial capital rates, the Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf also told THE WHISTLER that the economy needs a strong financial institution.

He noted that the degree of support a bank can render depends on the bank’s strength.

He asserted that the last N25bn raised in 2005 has been massively eroded by inflation.

In December 2005 the country’s inflation stood at 11.57 per cent and rose to 31.70 per cent in February 2024.

Yusuf said, “Between 2005 and now, the value of the N25bn capitalization has been massively eroded because of inflation. So, if you look at the equivalent of that value to what we have now, we are earning closer to what the CBN proposed.

Advertisement

“So I think the whole idea is to show that the country has a banking system that is strong and stable and can support the economy, also the good news is that the CBN has given sufficient time for the banks to be able to adjust and recapitalize,”.

He noted that the 2 years period given will enable banks to plan efficiently without being forced to merge unlike the 2005 CBN administration led by the current Governor of Anambra State, Chukwuma Soludo.

“Unlike Soludo’s era, banks went into mergers that were not convenient, which led to a financial loss on shareholders and an increase in employment in the banking sector.

“But this time, I think it’s going to be more orderly. The shocks on the system will be mild because there is enough time to make a decision.

“But if some banks have reasons to merge, there will be the possibility of job loss. However, there won’t be major risk, particularly because there is enough time, for proper planning”.

The CPPE boss further urged the CBN to review banks’ minimum capital periodically, rather than an extensive period in regards to the last 2005 review.