Agriculture Financing: Mozambique Learning From Nigeria

Nigeria’s success with the establishment of institutions to derisk agricultural financing has been noticed in the Continent, prompting interest from other African countries.

Nigeria’s record in this sector has also prompted Mozanbique to send a high-powered delegation to Nigeria to understudy ways to finance its own large and small-holder farmers to boost economic growth.

Advertisement

Mozambique is one of the fastest-growing economies in Africa as growth picked up momentum on the back of strong services production and the start of LNG production.

After its economy witnessed a modest recovery in 2021, growth gathered pace at 4.2 per cent in 2022 and is expected to surge to 6.0 per cent in 2023 as LNG production at the Coral South offshore facility picks up.

But the country seeks to harness its agricultural capabilities to solve food crises and a growing poverty rate estimated at 62 per cent of the population according to Statista.

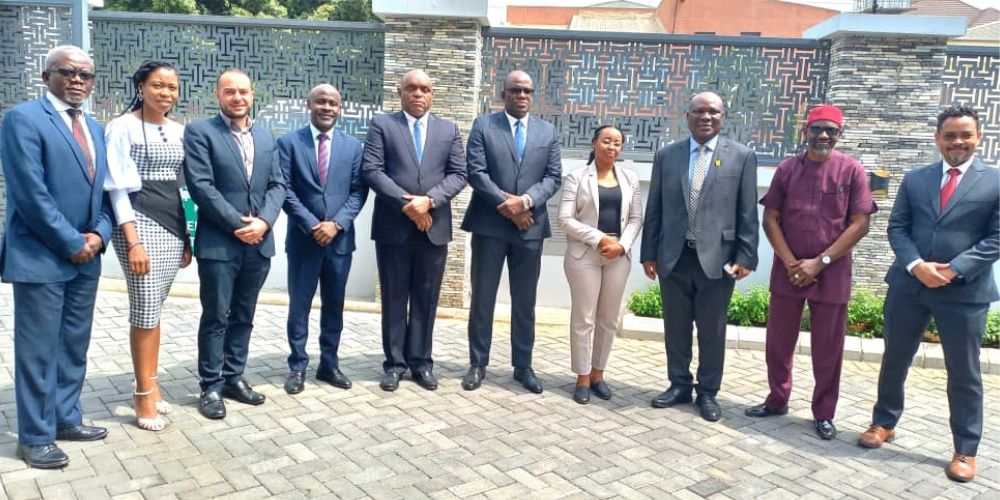

For one week, delegates from the South African country were in Nigeria to meet stakeholders of critical government institutions in the agric sector.

Advertisement

The delegation visited NIRSAL Microfinance Bank, Bank of Agriculture, The Ministry of Budget and Economic Planning, the Central Bank of Nigeria and the Bank of Industry and had useful engagements for one week that the visit lasted.

The delegation was led by the National Director for Promotion of Commercial Agriculture, Ministry of Agriculture, Mozambique, Jaime Robert Chissico.

Other members were the representative from the country’s Central Bank, Ministry of Finance, the Policy Officer, Food Agriculture Organisation (FAO), Regional Office for Africa, Mark Kofi Fynn and the Senior Private Sector Development Adviser, Private Sector and Property Lead, British High Commission, Maputo, Sergio Dista.

The team lead, Chissico said the country has adopted a programme, ‘Finance for Agriculture’ to find solution for Agric funding in Mozambique.

Chissico said, “When we go to the bank, the commercial bank will tell us that we have money to lend to agriculture but of course, there are some barriers and those barriers deal with the risk. But Nigeria has managed to overcome those risks.

Advertisement

“We came to Nigeria to learn how we as a country can find a way to finance agriculture. That is why we came with this team. It is a multidisciplinary team. We have the Ministry of Agriculture and Rural Development; the Ministry of Economy and Finance and the Association of Commercial Banks. They are the ones who deliver finance to people who want money for commercial agriculture and then our Central Bank.”

Chissico said the country wants to overcome the constraints which hinders financing for agricultural projects.

He continued, “We came under a programme from FAO. They are the ones that funded our journey to Nigeria because we as a government have a programme and our strategic plan looks at the way to find out how to finance agriculture. Without finance, you cannot even find a way to other things. We need to find ways for improvement.

“We are aiming to get some experience from Nigeria and also from West Africa. We chose Nigeria because we found out that it is ahead in terms of facilitating the derisking of agriculture. We heard about Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRASAL Plc) which is mostly risk shearing and we have a similar situation.

“We want to find out how NIRSAL works and how we can adapt in our local market. We are not here just to copy a model but we are coming to learn if it will fit our case or not then when we go back, we will discuss the experience. Agriculture is the future.”

The Senior Private Sector Development Adviser, Private Sector and Property Lead, British High Commission, Maputo, Sergio Dista hinted about setting up a vehicle that can mobilise capital for small holder farmers in the context of Mozambique.

Advertisement

According to the UK representative, it is imperative to learn from institutions like the NIRSAL, Bank of Agriculture and Bank of Industry so that the government of Mozambique can avoid the pitfalls encountered at the early stages of the Nigerian institutions.

“As a part of the UK government, we have bilateral relationship with the government of Mozambique in many areas and one of the areas is about prosperity and development.

“Particularly, we support the government of Mozambique in that kind of agenda to reduce poverty and increase trade prosperity between Mozambique and UK,” he said.

The consultant in charge of the delegation is the Chief Executive Officer of Successory Nigeria Limited, Dr Steve Ogidan, mni.

Dr Ogidan, a development expert with decades of industry experience in Agric financing, said the delegation was convinced by Nigeria’s competitive advantage and the government’s ability to derisk Agric-financing.

The CEO said Nigeria is part of the South-South Corporation and the largest country in the continent that have played the role of a ‘big brother.’

“It is a high-level policy delegation from Mozambique to understudy what we are doing in Nigeria. Before this, we carried out a study for the government of Mozambique sponsored by the FAO and we made some recommendations on how to improve agriculture in Mozambique and ensure food security and recommended some institutions to visit and see what they are doing.”

During the visit, the Minister of Budget and Economic Planning, Atiku Bagudu told the delegation that Nigeria has used technology and institutions like NIRSAL to reduce the risks associated with agricultural lending in Africa’s biggest economy.

The minister explained to the delegation how the various agric-lending schemes of the government like the Anchor Borrowers Programme (ABP) and the Agricultural Credit Guarantee Scheme Fund (ACGSF) helped the country exit recession.

Bagudu said “In 2016, the world oil prices moved against Nigeria. So, the Central Bank created an Anchor Borrowers Programme, the jury is mixed out there but I think it has done well even with the challenge we faced at that moment. We saw the formation of commodity associations, self-regulatory and providing support for off-take. At some point, the commodity association borrow directly and offtake the produce.

“We don’t encourage the displacement of smallholder farmers. We have seen a very successful evolution of our grower model where companies have set up processing facilities and they don’t have farmlands and they rely on farmers to grow for them.

“Last week, a US-funded FID company said their rate of recovery was 99 per cent and at the heart of this is the fundamental realisation that whether it is farming or fishing, the first element is how to help them increase production.”