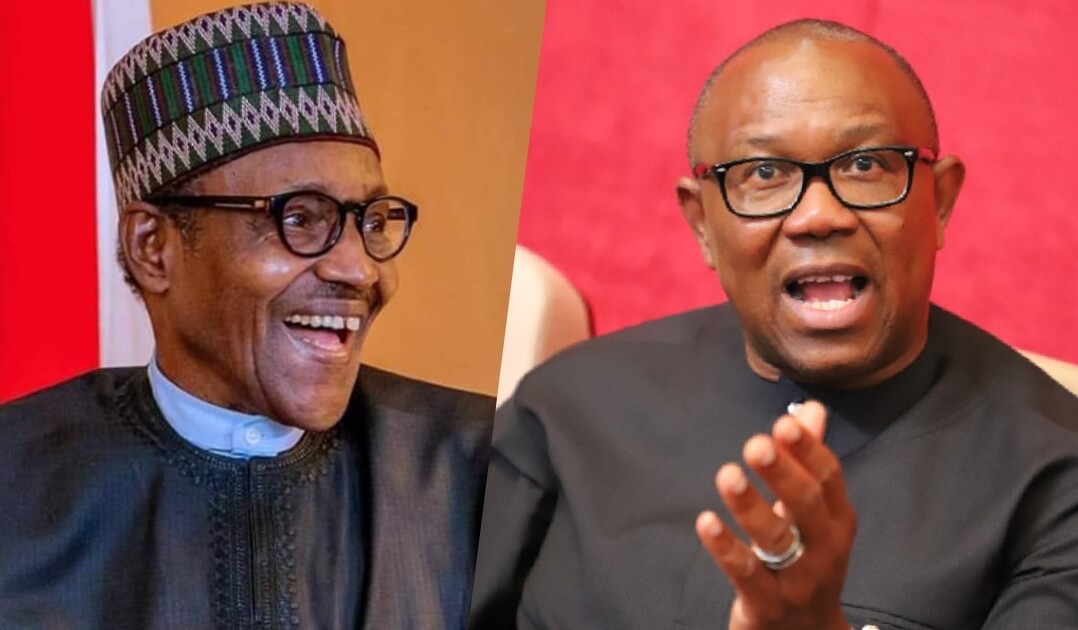

Buhari’s Forex Policy Deters Investment – Peter Obi Pledges Harmonized Exchange Rates

The Labour Party presidential candidate, Peter Obi, has condemned the forex policy of the President Muhammadu Buhari-led administration, saying the multiple exchange rate system has particularly worsened Nigeria’s economic situation.

The LP candidate who said this while speaking on the Prospects of Transformative Governance in Nigeria at Harvard University, USA on Thursday reeled out his economic plans for the country if elected.

Advertisement

Obi noted that the multiple exchange rate regime being operated by the Central Bank of Nigeria (CBN) encourages capital flight and deters investment.

The LP presidential hopeful promised to re-establish the independence of the Central Bank of Nigeria while removing forex restrictions, harmonising exchange rates and bringing inflation to single digits.

“We will explore ways of cushioning the forex demands by mainstreaming those components of Diaspora remittances that remain opaque and informal.

“We will enforce the legal framework protecting foreign investors and their indigenous partners. This is the only way to tamper with monopoly and capital flight.

Advertisement

“As part of our monetary policy, we will seek to re-establish the independence of the CBN; and commit to a credible and transparent plan to normalize the exchange rate and bring inflation to single digits.

“We will remove import and forex restrictions and insist on a single forex market. The current system penalizes exporters who bring in forex by forcing them to sell at a rate that they are unable to source for forex when they need to purchase forex.

“This multiple exchange rate regime encourages capital flight and deters investment, which has further worsened Nigeria’s forex situation,” the LP candidate added.

THE WHISTLER reports that since the announcement of forex restrictions and the introduction of multiple exchange rates by the CBN in 2016, Foreign Direct Investment in Nigeria fell from 3.45 billion dollars in 2016 to 2.39 billion dollars in 2021, according to data obtained from the World Bank.

The restrictions also prevented foreign businesses operating in Nigeria from repatriating their funds abroad. In August, Emirates Airlines threatened to cease operations in Nigeria over its inability to access forex and repatriate funds amounting to over eighty-five million dollars ($85m) to the United Arab Emirates where it is domiciled.