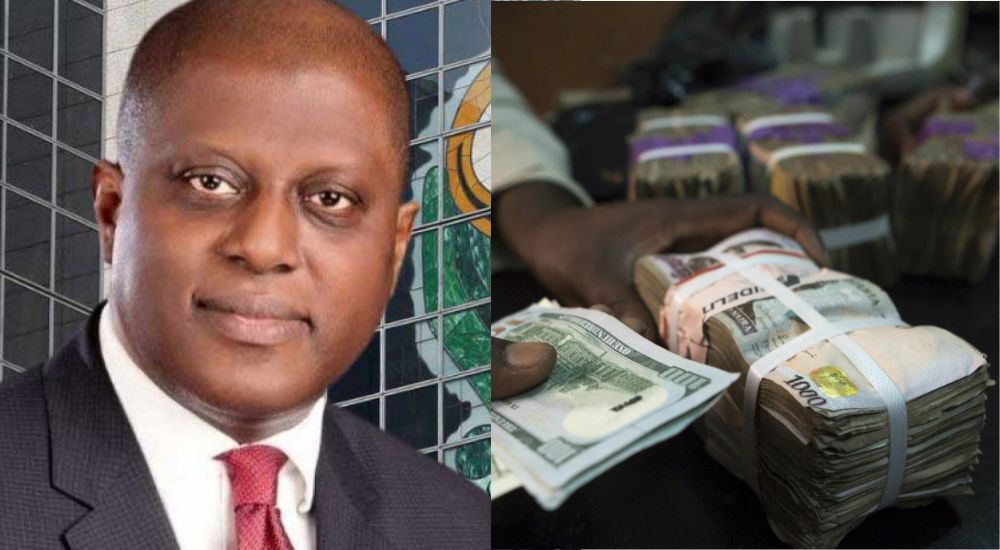

The Central Bank of Nigeria does not have the liquidity to defend the naira, which nearly depreciated to N1900 per dollar in February 2024.

Economist Intelligence Unit (EIU), the research and analysis division of the Economist Group, made the claim in its latest Country Report on Nigeria.

Advertisement

The EIU asserted the claim that at least $20bn of the $33bn reserves of the CBN are trapped in various derivative deals.

It said, “For most of this year, the naira will be highly volatile, leading to regulatory erraticism that can affect businesses, especially those holding foreign currency.

“The CBN lacks the liquidity to support the naira itself; out of $33bn in foreign reserves, a large share (estimated at nearly $20bn) is committed to various derivative deals.”

According to the EIU, Nigeria needs to secure loans to rebuild its reserves.

Advertisement

The report said, “Our view is that it will take foreign borrowing to rebuild the CBN’s buffers, fully clear a backlog of unmet foreign exchange orders and restore confidence.

“This is probably only achievable towards the end of 2024.”

The report predicted that the naira will fall by the end of 2024 to N1,770 per dollar and N1,817 per dollar by the end of 2025.

It further projected a depreciation of the naira to N2,381 per dollar by 2028 ending.