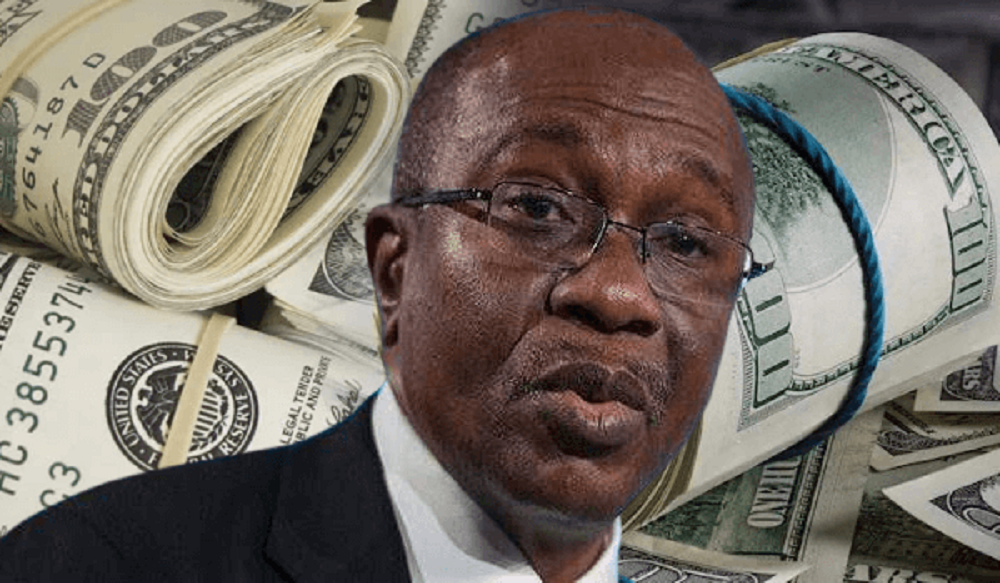

CBN Moves To Avert Aviation Sector Crisis, Releases $265m To Airlines

In a bid to check a brewing crisis in the country’s aviation sector, the Central Bank of Nigeria on Friday, released the sum of $265m to airlines operating in the country, to settle outstanding ticket sales.

A breakdown of the figure indicates that the sum of $230m was released as special forex intervention while another sum of $35m was released through Retail SMIS auction.

Advertisement

Confirming the release, the Director, Corporate Communications Department at the CBN, Mr. Osita Nwanisobi said the Governor, Godwin Emefiele and his team were concerned about the development and what it portends for the sector and travelers as well as the country in the comity of nations.

Nwanisobi retiterated that the Bank was not against any company repatriating its funds from the country, adding that what the Bank stood for was an orderly exit for those that might be interested in doing so.

With Friday’s release, it is expected that operators and travelers as well will heave huge sighs of relief, as some airlines had threatened to withdraw their services in the face of unremitted funds for outstanding sale of tickets.

The release of the amount is coming few days after Turkish Airlines and British Airways threatened that they will no longer issue tickets to passengers in naira following the foreign exchange challenges facing Nigeria.

Advertisement

There had been fears that other foreign airlines whose funds are trapped in the Nigerian economy may follow soon.

The airlines said in a message last week that Nigerian passengers can only pay for tickets in US dollars.

Before the threat, Emirates Airlines had announced suspension of flights to and from Nigeria beginning September 1.

The International Air Transport Association (AITA) had estimated the amount at $450m of funds belonging to foreign airlines trapped in Nigeria.

Emirates said in July that the company is owed $85m of unrepatriated funds by CBN, which they had reported to the Minister of Aviation, Hadi Sirika.