Floating Naira Worst Economic Decision Since 1999— Economists React As $1 Sells For Over N1,420

Some Nigerian economists have said that the foreign exchange policy of floating the naira which was introduced by the Central Bank of Nigeria last year is the worst economic decision since 1999.

The naira has been on a steady fall crashing to N1420 per dollar in the early hours of Friday while it reached a daily high of N1,399/$ at the Nigerian Autonomous Foreign Exchange Market spot rate on Thursday.

Advertisement

The naira woe began as a result of the demand pressure on foreign exchange which was limited in supply. But the currency was pegged by the CBN led by former Governor, Godwin Emefiele.

Emefiele’s regime pegged the naira around $461/$ at the official market while the black-market rate was around N740/$ in May 2023.

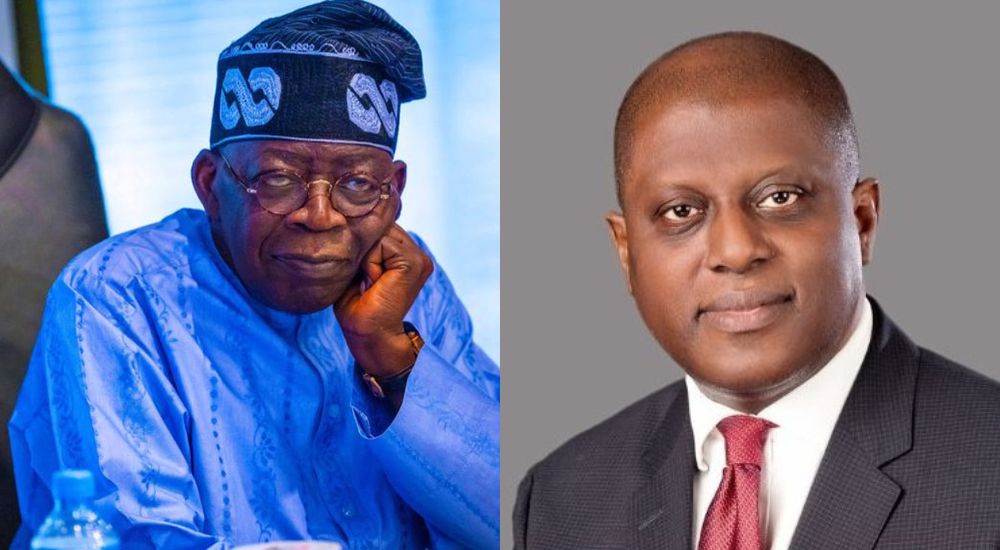

The Bola Ahmed Tinubu-led government appointed an acting Governor, Folashodun Shonubi to overhaul the apex bank and he introduced a ‘managed float’ as part of the mandate given to him by the president.

The Lead Faculty of Tekedia Institute, Professor Ndubuisi Ekekwe, said the CBN cannot float a currency without first ensuring that it can create parity on demand and supply.

Advertisement

Ekekwe said, “One of the worst economic policies in Nigeria since 1999 is the current floating of the Naira. That decision has a score of ‘F’ from me, because despite what any person could tell you, economics is ‘science’ played by the people. And science operates on principles.

“If demand continues to rise for US dollars in Nigeria and you have no means to improve the supply of US dollars, you have disarmed the naira, because market forces will weaken its positioning.”

Tinubu had in his inauguration speech in May 2023 said that the monetary policy needed “thorough housecleaning.”

Before the introduction of the ‘Willing Buyer, Willing Seller’ FX model, the CBN had been advised by the International Monetary Fund (IMF) and the World Bank to float the naira and discontinue its multiple foreign exchange window.

The Senior Economist and Partner at SPM Professionals, Paul Alaje, said that the depreciation of the naira is not good for the Nigerian economy as it may drive inflation higher and affect the real GDP.

Advertisement

He said, “The naira, like many other African countries, set a new low record of N1,400 to 1 USD. I have mentioned in an interview around September 2023 that if the care is not taken, this may get worse.”

Alaje said using a quick fix or interventionist approach by the CBN has not been sufficient to save the naira from crashing.

He suggested the “Convergence of policy by the monetary, fiscal, and trade authorities. Ensure confidence and faith in the currency and the economy of Nigeria.

“Change the dominant economic activity from service to manufacturing, agro-allied, and plantation and promote export (especially Export Promotion and Import Substitution). These should be the direction.”