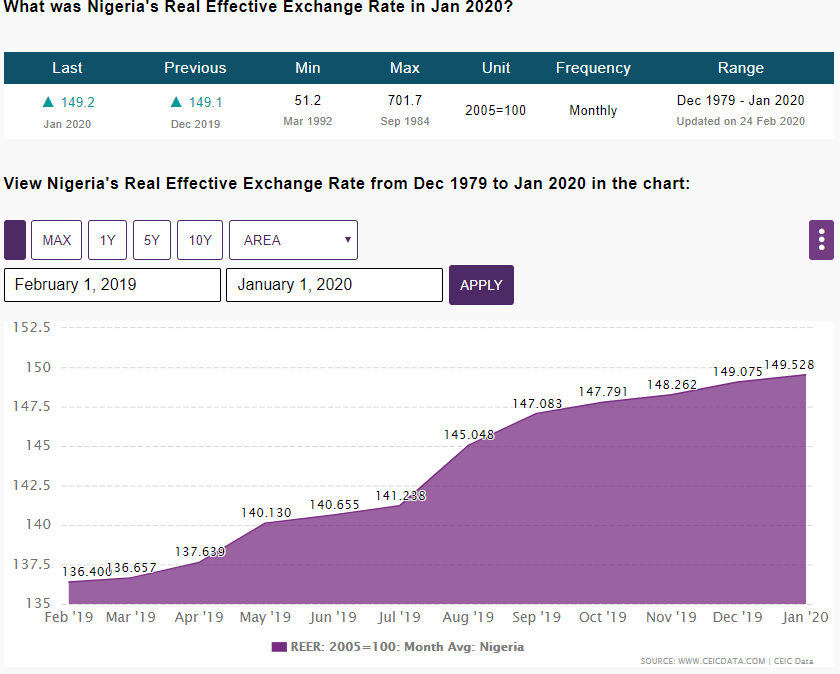

The Census and Economic Information Centre (CEIC), based in the United Kingdom has provided real effective exchange rate score (REER) data showing that the Naira is one of the ‘most overvalued’ currencies among oil exporting countries. The REER analysis was introduced by the International Monetary Fund(IMF), to show the weighted average of a country’s currency in relation to an index or basket of other major currencies.

Advertisement

A score in the REER chart above 100, is said to be overvalued, while on the chart the Naira is at 149.2.

The CBN officially values a dollar at N307, while the pressure is already telling on the parallel forex market, where it sells for N378 per dollar.

The Investors and Exporters (IE) FX Window shows that the Naira lost 0.02% to the dollar as it rose to N368.42 on Wednesday against N367.57 per dollar closing price on Tuesday.

The CBN last week said that “market fundamentals do not support a Naira devaluation at this time,” but the bank on on Monday cut interest rates on its intervention funds to 5% and announced a release of N50 billion to combat the impact of the pandemic on the economy.

Advertisement

The Senate, however on Tuesday showed its willingness to consider the removal of subsidy on petrol and devaluation of the Naira to help contain economic crises as a result of the negative effect coronavirus was having on oil price.

The fall in oil price had intensified as Brent crude sold Wednesday March 18 at $29.46 per barrel, WTI Crude fell to $25.88 per barrel and MARS US sold at $23.25, with experts predicting that oil price may fall further.

THE WHISTLER observed from Financial Market Dealers Quotations (FMDQ) data that foreign exchange daily turnover slumped by 51.51% on Tuesday to close at $143.33 million compared with $295.58 million recorded on Monday, further putting pressure on the Naira.

Meanwhile Nigeria’s foreign reserves as of March 16, 2020 had lost $6.51 billion in one year to $36.05 billion from $41.59 billion recorded in March 9, 2020. This represents one of the lowest reserves of oil producing countries.