The Federal Government spent a total of N7.61trn on domestic debt servicing between July 2015 and June 2020, statistics available from the Debt Management Office have shown.

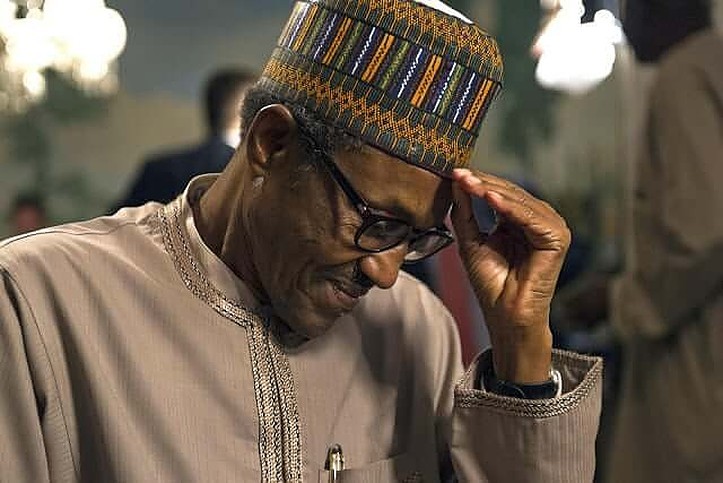

The period coincides with the period President Muhammadu Buhari has been at the helms of affairs in the country as well as a time when the nation’s external and domestic debts ballooned to unprecedented heights.

Advertisement

Debt service is the cash that is required to cover the repayment of interest and principal on a debt for a particular period.

According to the DMO, the domestic debt of the Federal Government rose from N8.4trn as of June 2015 to N15.46trn as of June 2020.

This shows an increase of N7.06trn or 84.05 per cent rise in the Federal Government’s domestic debt over a period of five years.

The increasing domestic debt portfolio reflects in the cost of debt servicing which has also been increasing over the period.

Advertisement

In the last six months of 2015, the Federal Government spent N489.59m on domestic debt servicing.

In the first full year presided over by Buhari, 2016, the Federal Government spent N1.23trn on domestic debt servicing.

The cost of debt servicing went up to N1.48trn in 2017 and got to a peak in 2018 when the Federal Government spent N1.8trn on domestic debt servicing.

In 2019, the weight of domestic debt servicing reduced slightly as the Federal Government spent N1.69trn, a little lower than what was spent in 2018 on the subject.

This may be a reflection of the policy of the government which declared intention to ramp up foreign loans and reduce local loans in order to reduce high cost of servicing domestic loans.

Advertisement

The downward trend witnessed in the 2019 cost of domestic debt servicing may not be sustained in 2020.

This is because figures obtained from the DMO showed that in the first half of the year, the Federal Government had already spent N921.95bn on domestic debt servicing.

A growing number of experts and international agencies have been raising the alarm on the sustainability of the nation’s debt portfolio.

Although the country’s debt to Gross Domestic Product is said to be low at about 20 per cent, experts maintain that the debt to revenue ratio is very high.

A recent report of the World Bank projected that debt servicing would gulp about 75 per cent of Federal Government’s revenue by 2024.

The World Bank report titled ‘State debt management in Nigeria: Challenges and lesson learned’ highlighted institutional and capacity challenges in Nigerian fiscal federalism system.

Advertisement

The report said in recent years, Nigeria’s public-debt-to-GDP ratio had increased significantly.

The report said, “A debt sustainability analysis conducted by the IMF as of end-2018 indicates that while Nigeria’s public debt-to-GDP ratio remains relatively low compared with other frontier market economies. The debt ratio is expected to rise under baseline mainly driven by the Federal Government fiscal deficit.

“It is projected that interest payment will rise to close to 75 per cent of Federal Government revenue by 2024 from 60 per cent in 2018. The debt sustainability is vulnerable to the slow growth and widening fiscal deficit.”

In 2018, for instance, the Federal Government’s revenue stood at N3.95tn.

However, in the same year, it spent $1.47bn and N1.8tn external and domestic debts servicing respectively.

The Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed had said the underperformance of government’s revenue is causing a significant strain in its ability to service debt.

She said this was why all the policies being implemented at the ministry of finance is concentrated on driving revenue to meet the obligations of the government.

She said, “The underperformance of our revenue is causing a significant strain in our ability to service debt and to service government day-to-day recurrent expenditure and that is why all the work we are doing at the ministry of finance is concentrating on driving the increase in revenue.”