NSE Imposes Trading Fee On Fixed Income Securities

Advertisement

Nigerian Stock Exchange has imposed trading fees on fixed income securities traded on its platform.

The NSE made the disclosure in a statement on Friday.

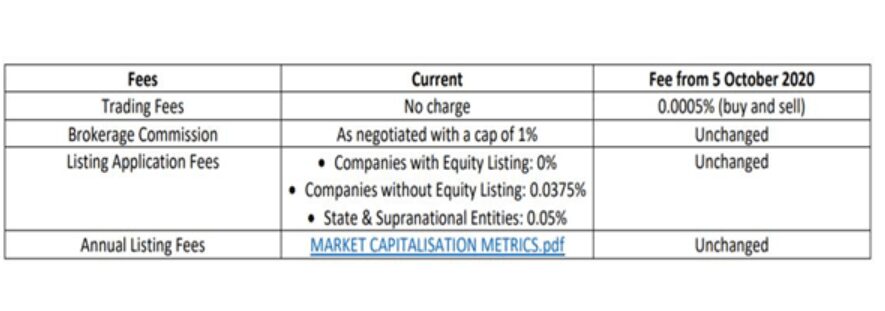

It said the revised fee structure would allow the bourse charge 0.0005 per cent which implies N5 per million on debt instruments traded on its platform.

Before now, the NSE charged no trading fee on the affected instruments.

Advertisement

Other fees remained unchanged following the development.

The reversal is part of NSE’s liquidity-enhancing efforts to introduce a trading fee moratorium as planned four years ago in August 2016.

The moratorium will stimulate activities and liquidity in the fixed income market, the exchange said.

Africa’s second largest stock exchange said the revised fees will become effective on October 5 this year.

Relevant Fees Effected By NSE

Advertisement

It said, “Following the end of the 4-year Fixed Income Securities Trading Fee moratorium, the Exchange has now received the regulatory approval of the Securities and Exchange Commission to revise its fee structure.”

The NSE said it offers a hybrid market for the execution of quote and order-driven transactions, while it provides dealers, institutional and retail investors access to increase liquidity in Fixed Income Securities.

The Exchange said, “By leveraging best-in-class market design and infrastructure, the NSE trading venue provides investors an integrated straight-through trading and post-trade process that supports efficient execution without any trade failures across all asset classes including Fixed Income Securities.

“Investors trading via the NSE platform can also enjoy access to diverse listed debt instruments including Federal Government, State Government, Corporates, Supranational, and Retail Savings Bonds.

“The Exchange continues to conduct various training, workshops, and conferences on Fixed Income Securities products to build domestic capacity and enhance financial literacy while encouraging inclusiveness.”

The NSE fixed income market allows debt markets participants to trade the listed debt instrument issued by the Federal Government, State Governments or Corporations.