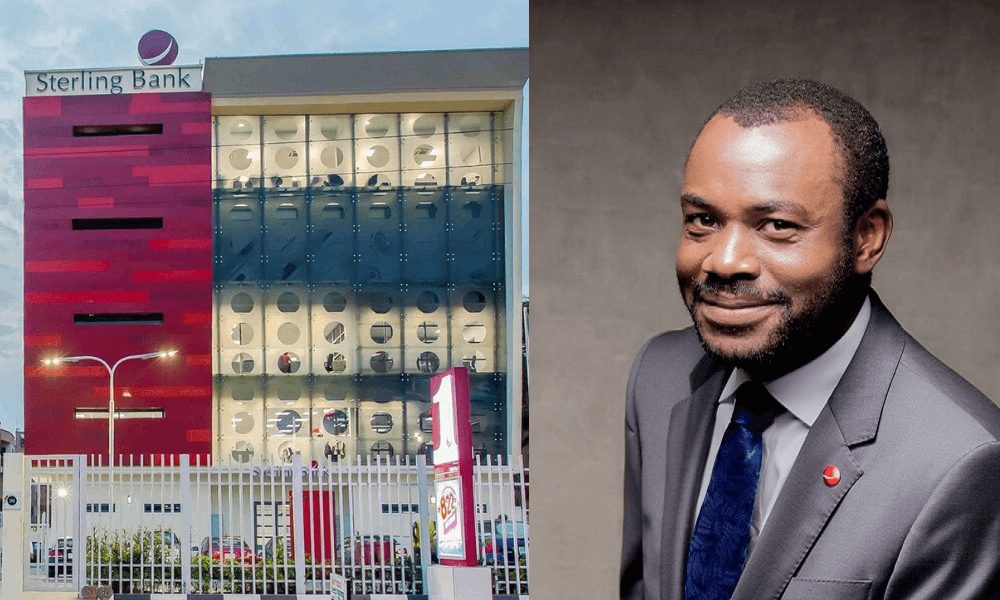

Sterling Bank Gets CBN Approval To Operate Islamic Banking Subsidiary

Sterling Bank Plc said that it has received the Central Bank of Nigeria‘s (CBN) Approval-in- Principle for a stand-alone license for its non-interest banking business that will run with the name ‘Alternative Bank Limited.’

Non-Interest banking or Islamic banking operates on defining principles including interest prohibition in debt and exchange contracts.

Advertisement

It also prohibits funding of unethical ventures such as, alcohol, tobacco, ammunition manufacturing and adult entertainment institutions and also prohibits any form of gambling.

The bank disclosed on the Nigerian Exchange Ltd that the new subsidiary was in line with the approval-in-principle granted to the Bank for the restructuring as a holding company (HoldCo).

The bank said, “Sterling Bank Plc has obtained the Central Bank of Nigeria‘s (CBN) Approval-in-Principle for a stand-alone license for its non-interest banking business – the proposed Alternative Bank Limited.

“The approval is sequel to the approval-in-principle granted to the Bank for the restructuring as a holding company (HoldCo) and subject to the fulfillment of conditions as stipulated by the CBN.”

Advertisement

Sterling bank revealed that the new subsidiary, Alternative Bank Ltd will focus on building partnerships that connect individuals and businesses leveraging technology to create business optimization while solving an individual’s daily financial needs.

The overall business will focus on social impact and corporate responsibility.

With the approval, Sterling Bank’s new subsidiary has joined Jaiz Bank, Taj Bank and Lotus Bank Ltd which are currently the non-interest banks in the country.

Like other Islamic Banks, Alternative Bank Ltd will ensure religious compliance in all its dealings, according to Sterling.