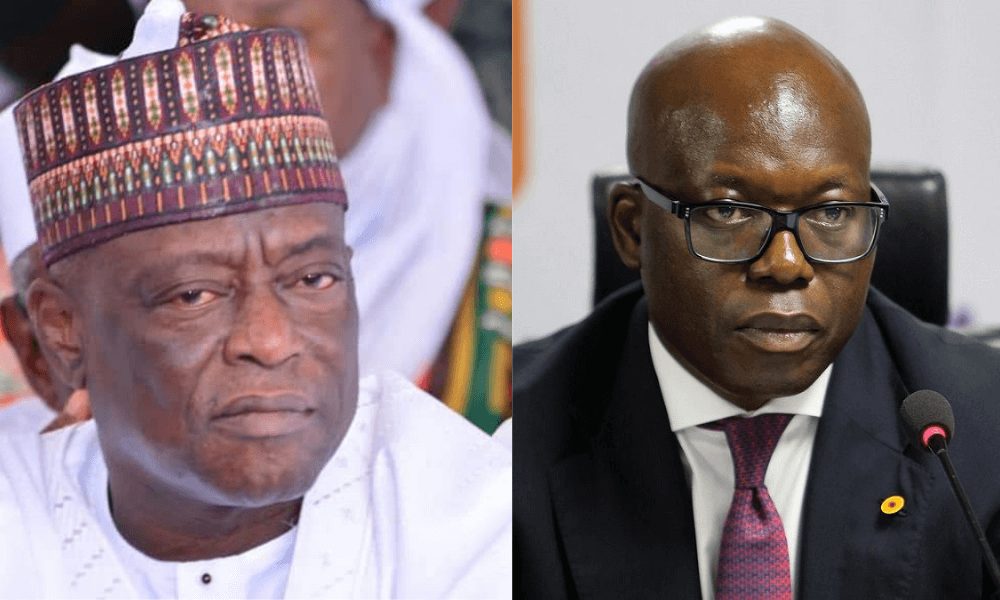

After Ownership Tussle With Tinubu, Dahiru Mangal Sells Entire 1.97 Billion Oando Shares

Billionaire businessman, Dahiru Mangal, has sold his shares in Oando Plc four years after his ownership battle with Adewale Tinubu led management.

Mangal is the Chairman and Chief Executive Officer of AFDIN Group of companies Nigeria Limited comprising Max Air Limited, Katsina Dyeing, Printing Textiles Limited, AFDIN Football Club, AFDIN Construction Company Nigeria Ltd, Manasawa Oil, Mangal Oil and Manasawa Enterprises, a clearing and forwarding firm.

Advertisement

Oando announced the development on Monday saying that Mangal has sold his 1,968,452,614 share in Oando Plc to Leaf Investment & Realtors Limited.

Although the details of the deal was not revealed, the deal may have worth around N10.4bn as the company’s shares trades at N5.4.

Oando said “Based on the above, Leaf Investment & Realtors Limited now holds 15.83 per cent of Oando PLC.”

The development is coming four years after ownership tussle with the Oando management led by Oando PLC’s Group Chief Executive, Tinubu.

Advertisement

Adewale Tinubu is the nephew of Chief Bola Tinubu, a former governor of Lagos State and the national leader of the All Progressives Congress.

The rift led to the suspension of the oil company from trading on both the Nigerian Stock Exchange and Johannesburg Stock Exchange.

Mangal and Ansbury Inc. on Wednesday, October 20, 2017 filed a petition on allegations of infractions and mismanagement against Oando management.

Ansbury Incorporated, owned by Gabriele Volpi, an Italian born Nigerian businessman petitioned the Securities and Exchange Commission.

The shares of Oando was suspended by the NSE and the Johannesburg Stock Exchange.

Advertisement

Volpi had claimed that he owned 61.9 per cent equity in the company which makes both him and Mangal owners of nearly 70 per cent of Oando shares.

The dou claimed that the shares was sufficient to make them owners of Oando.

In December 15, 2017, Oando accused Mangal of acquiring his shareholding interest by contravening market rules.

“The SEC ignored the wrong doing and illegal conduct of Alhaji Dahiru Mangal in not disclosing his full shareholding interest in the Company, a proportion of which was acquired as a result of market manipulation and Insider Trading activities,” the company said.

In 2018, Oando said a ‘peace deal’ had been reached with Mangal following the intervention of the Emir of Kano, Muhammadu Sanusi.

Oando confirmed that Mangal was a substantial shareholder, adding that all the issues raised in his petition to the SEC have been addressed and clarified by the Company.

Advertisement

Mangal had said: “Following the clarification I have received from Oando’s management team, I have withdrawn my petition to the SEC. I invested in Oando because I could see its potential. It is therefore with excitement that I concur to this Peace Accord signifying the renewal of our relationship; one that gives me more insight into the Company’s operations and aspirations and involves more dialogue.

“I am confident in the Company’s leadership team and trust that with the right support it will continue to grow from strength to strength, returning real value to all its shareholders including my good self.’’