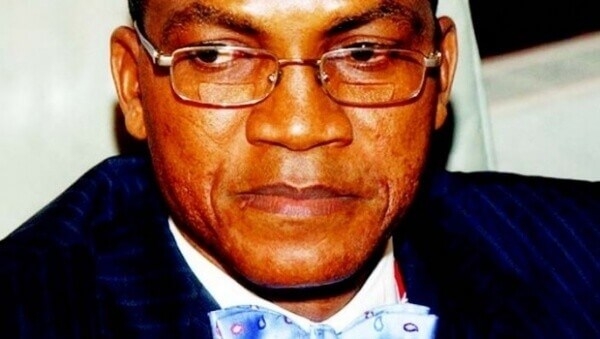

Dr. Abraham Nwankwo, DMO DG[/caption]

Dr. Abraham Nwankwo, DMO DG[/caption]

The Federal Government on Monday appointed Goldman Sachs and Stanbic IBTC as financial advisers for the $300 million Diaspora Bond which will now be floated before the second half of the year as against the initial March 2017 scheduled date.

The Director General of the Debt Management Office, DMO, Dr. Abraham Nwankwo, who disclosed this, added that Olaniwun Ajayi LP and Arnold & Porter, were also appointed as Legal Advisers for the same course.

Founded in 1869, the Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm that provides wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals.

Advertisement

Stanbic IBTC, a member of the Standard Bank Group, is a financial service holding company in Nigeria with subsidiaries in banking, stock brokerage, investment advisory, pension and trustee businesses. Standard Bank is Africa’s largest banking group ranked by assets and earnings operations in 20 African countries and 13 countries outside Africa.

Recall that the National Assembly through the Minister of Finance Kemi Adeosun on 10th January approved $300 million diaspora bond to be rolled out in March.

“We are hoping to roll out by March, the diaspora bond where Nigerian in the diaspora who wants to invest in the country can key into,” Adeosun said on the approval.

“Beyond that of course, the investment opportunities in Nigeria are very huge, a lot of diaspora who are interested in investing at home are encouraged to do so.

Advertisement

“Government is putting in place a lot of incentives such as infrastructures and also creates conducive environment for them to thrive. We are encouraging them to come back home and join the trend.”