Insensitive Banking: How Nigerian Banks Embarrass Persons With Disabilities

Abubakar Jibril is an Ilorin-based visually impaired writer and businessman. Like every businessman, he has several banking needs like paying for goods, sending money to people and buying items for personal use.

Just like many other business people, he fancied the idea of operating several bank accounts. But after encountering series of dehumanizing experiences in all the commercial banks he visited, he decided to stick to only one bank and save himself the trauma.

Advertisement

He had visited Jaiz Bank at the University of Ilorin in February this year to open a current account, but was turned back. He was asked to go and swear an affidavit in court before he could open an account. He did not get any explanation. But when he complained that he was visually impaired and had no one to take him to the court, he was ignored by the bank official who quickly moved to another customer.

He decided to try another bank and went to the United Bank for Africa. At the UBA branch at Challenge area of Ilorin, he made similar request and got the same answer.

The bank official who attended to him bluntly told him that it was “none of his business” if he couldn’t bring a court affidavit.

Advertisement

Embarrassed and frustrated, he stood on the same spot contemplating his options when another bank official told him that the bank would not want to be liable in case of any loss of funds or if he was scammed!

Today, he operates only one bank account at Access Bank because his close friend works there and usually assists with his transactions.

The Chairman of the National Association of Persons with Physical Disabilities (NAPWPD), Chris Agbo, also dreads going to the banks and is grateful for the operation of POS agents who make banking easier for people like him. Agbo is also the publisher of The Qualitative Magazine.

Agbo, who uses a wheelchair, went to his bank to withdraw a huge amount of money but was refused access. He was told he needed a thumbprint but his wheelchair could not enter the banking hall. He had to write a check for someone to withdraw the money for him.

Advertisement

Agbo who is based in Abuja, was given the same treatment by another bank in Wuse which he refused to name. He wanted to enter the banking hall with his crutches but was prevented. They told him it was the policy of the bank that no one in crutches must be allowed into the bank.

Shocked by the discriminatory policy, he insisted on going inside the bank and blocked the entrance so that no one else would go in. He caused a scene which attracted the attention of the bank manager. The manager said the bank made the policy for security reasons, saying the bank had experienced a man faking disability with POP on his leg and crutches who entered the bank and brought out guns, and opened the doors for his robber colleagues.

“I then asked him, are you denying me and other people using wheelchairs and crutches because of others’ crime?” Agbo told THE WHISTLER while narrating his experience with commercial banks.

“I asked him why they did not stop people with two legs from entering the bank when most robbers do not fake disability. So, people with genuine disabilities will have to suffer?”

Banks are Suffering People With Disability

Nigeria is a signatory to the United Nations Convention on the Rights of People with Disabilities (CRPD) which mandates members to promote and ensure the equal enjoyment of all human rights and fundamental freedoms by all persons with disabilities, and to promote respect for their dignity.

Advertisement

The Discrimination Against Persons with Disabilities (Prohibition) Bill waspassed by the House of Representatives and the Senate joint committee in November 2016. Former President Muhammadu Buhari later signed it on January 17, 2019.

The law established the National Commission for Persons with Disabilities (NCPWD) and empowered it to promote, protect and prioritize the rights of persons with disabilities, and to further enhance their productivity through education, health and other socio-economic activities of the state.

But the laws and the NCPWD have done little to stopped the continued discrimination against the physically challenged. Many suffering disabilities have shared similar banking experiences where they faced direct and indirect discrimination.

NCPWD data indicates that there are approximately 26.16 million people with disabilities in the country, who have unique financial needs that banks are not prepared to meet.

The CBN approved 24 Deposit Money Banks (Commercial Banks) with 4,437 branches across the country, according to data from Techpoint Africa. The mission statements of these banks suggest they would provide banking services for all categories of Nigerians, something that has not been the case.

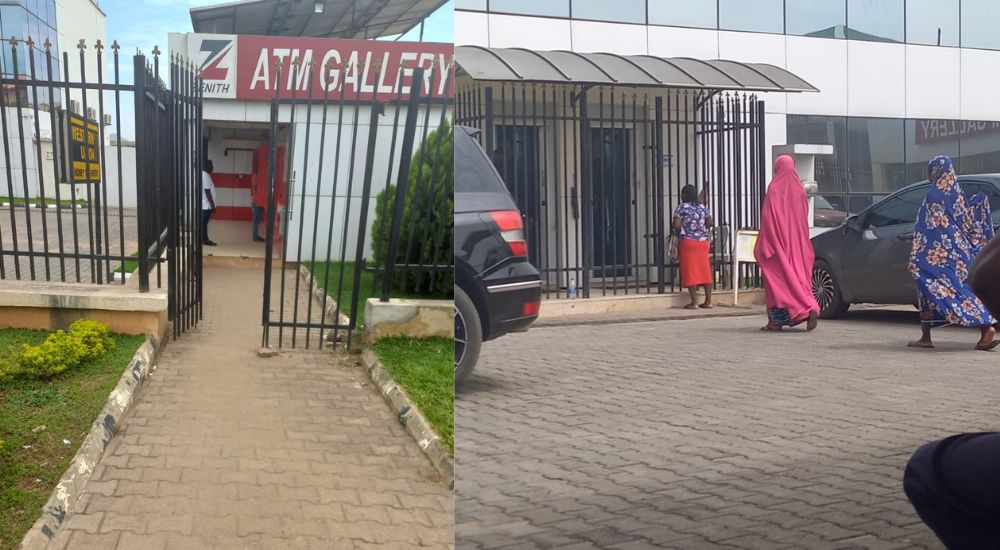

THE WHISTLER visited some branches of the leading banks such as Access Bank, United Bank for Africa, Guaranty Trust Holding (GTCo), Zenith Bank Plc, Ecobank Plc, and Fidelity Bank, among others, in Abuja to verify claims of discrimination.

Our investigation revealed that there’s no serious commitment to integrate PWDs into the plans to promote financial inclusion. While some of the banks have built ramps for PWDs, the ramps do not have side rails and the tiles used for them are slippery in most cases.

In some cases when the PWDs are able to use the ramps, accessing the entrance doors to the banking halls becomes impossible for a PWD sitting on a wheelchair. The average size of the banks’ revolving security door is about 2 feet while the average wheelchair size is 2 feet three inches or more.

Also, those using crutches find it difficult to also use the doors because their crutches are made of steel or aluminium which usually results in embarrassment as the doors will not allow them passage unless the security features are disabled. Even when they manage to get access, some banking halls visited require customers to climb to the first or second floors for certain services like bulk deposits and customer care services.

For instance, GTCO in Third Avenue Gwarimpa, Abuja has a ramp that gives access to both the ATM machine and the revolving security door. However, a revolving door is just about 2 feet in size and even when the person on a wheelchair or crutches manages to enter, they have to climb the first or second floor to either deposit, withdraw or carry out other transactions.

The case is similar at the UBA branch located on Third Avenue. The bank has a ramp built in the entrance but when a PWD enters, they have to go to the first floor if they need customer service issues and there is no facility available to take them to the floor.

There are several other bank branches that do not have ramps to assist the PWD in accessing banking halls. In the entire First Avenue, all the banks visited from Access Bank to Zenith Bank, Jaiz Bank and FCMB have no ramps, except Fidelity.

At Fourth Avenue, the Ecobank branch visited by THE WHISTLER is not accessible to PWDs who are in wheelchairs because there’s neither ramp nor alternative entrance for them. Just in front of the bank entrance, a physically challenged has to climb three steps which are about 1.8 feet high.

The ATMs of the banks are not accessible to a person in a wheelchair because most of them require the user to climb some steps. The visually impaired also do not have access to these facilities because the ATMs do not have Tactile and Braille signs to assist them.

The National President of the Nigeria Association of the Blind (NAB), Stanley Onyebuchi, and his members are serial victims of harassment and discrimination by banks and the CBN that is supposed to call the banks to order.

NAB went to the extent of securing a grant from the United States of America based Disability Rights Fund, to create awareness on inclusive banking for persons with disabilities. But the banks resisted the efforts.

“We sent invitation letters, we paid over N250,000 for a hall, we invited different disabilities groups in Lagos and we invited all the banks for a round table discussion which the grant was meant for. Believe me, it was only Access Bank and two other microfinance banks that attended in Lagos,” claimed Onyebuchi.

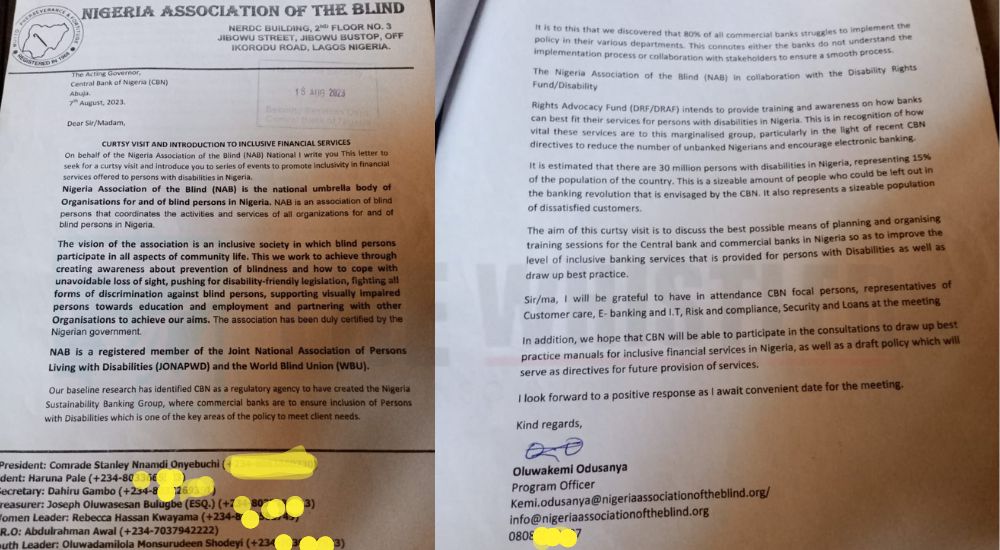

After failed attempts to dialogue with the banks, the association wrote severally to the CBN for a courtesy visit so that they could use the medium to make an appeal but the apex bank paid deaf ears to their request.

The last letter they wrote was to the Acting CBN Governor, Folashodun Shonubi, on August 7, 2023, titled, “Courtesy Visit and Introduction to Inclusive Financial Services.” But the apex bank allegedly snubbed the association.

The owners of the fund had to call for refund since the association did not achieve the purpose of the fund.

“We are returning $11,554 to that organization because we are unable to carry out this advocacy to the banks because of the attitude of the banks and CBN. This is the one in dollars. The little we changed in naira for the event, we are also going to refund them. We have up to the end of November to refund them so that we can get another grant next year for another project,” Onyebuchi said with regret.

Banks Defend Their Actions

Banks believe that it is highly capital-intensive to set up special desk for the deaf and dumb, visually impaired persons and as well replace or purchase ATM machines with tactile, braille signs and talking ATMs.

The Head of Corporate Communications of Jaiz Bank, Hadiza Olaosebikan , responding to the embarrassment faced by a visually impaired customer, Jubril, at the Uni Ilorin branch said she would investigate the branch and take the right actions. She said the bank frowns on staff who snub customers, particularly the visually impaired.

“In all of what we do in terms of our brand development, we also take into consideration people with disability. We may not be perfect in everything, but we are trying as much as we can to make them very inclusive in our banking,” she said.

Olaosebikan said Jaiz Bank provides a parking space for the PWD, and provides ramps for people on wheelchairs. Also, when a PWD enters the premises, the bank has made it a policy that they will be attended to first before any other customer.

However, she admitted that it’s the bank’s policy for a visually impaired person to get a court affidavit to open an account.

She said the provision of ramps depends on the size of a bank and the ownership of the building. For banking buildings that are not owned by the bank ,oftentimes the bank does not have the right to alter the building structure.

The Head of Corporate Communications Ecobank Plc, Austen Osokpor, also said the bank considers the needs and of PWDs in its customer engagement policy.

He also admitted that the bank does not have ramps in all its branches, adding that the bank hopes to incorporate more ramps in its building design.

“We encourage them to come along with their guide who is usually a relative. Conversation is done in the language they understand and, in some cases, we encourage them to agree to add their trusted relatives as joint signatories who can do transactions on their behalf. We see most of them incorporating their children in this case,” he said.

Efforts to speak to more banks and the CBN did not yield fruits. THE WHISTLER made several calls to the Head of Corporate Communications of the United Bank for Africa, Ramon Olarenwaju Nasir, but he did not pick. He also ignored WhatsApp messages sent to him.

Isa Abdulmumin, the Director of Communications of the CBN was also contacted but neither returned his calls not replied SMS messages sent to him as at the time of this report.

NCPWD Reacts

The National Commission for Persons with Disabilities (NCPWD), which was set up to promote the rights, privileges and aspirations of PWDs, said the issue of discrimination in banks would be investigated.

Although the head of media and publicity of NCPWD, Mbanefo John-Michael, could not be reached for comments when THE WHISTLER visited the agency, a senior staff said the commission would take drastic action by first investigating the allegations.

He revealed that the agency has a database and everyone on the database was given an identity card which they can use in the bank without being asked to produce an affidavit.

He urged PWDs who are discriminated against to report to the NCPWD Desk Offices in the state they reside. “If any of those people have issues, let them report to the disability desk in the state and we will take it up from there. We have an app on our website that monitors those things on a daily basis,” he said.

He also noted that the commission has had series of engagements with commercial banks and the CBN on inclusive banking, adding that it also got the commitment of the Nigerian Deposit Insurance Company to “make sure that PWD whose cash is trapped in liquidated banks or banks with issues are prioritised and get their money first.”

Banks Should Face Sanctions- Lawyers

Lawyers who spoke to THE WHISTLER on the issue said it is irresponsible for banks to discriminate against persons with disabilities, and called for sanction against any bank that contravenes provision of the Discrimination Against Persons with Disabilities (Prohibition) Act, 2018.

Barrister Uma Ntima, an Abuja-based lawyer, said, “There are penalties that are prescribed by the Act ranging from fines to imprisonment. If anybody is alleging discrimination by a bank or corporate person or organisation, the victim should seek redress and they have the banking of the Discrimination Against Persons with Disabilities (Prohibition) Act, 2018.

“If the person or organisation is found liable, they will be sanctioned based on the Act. For those PWDs that do not have the capacity to seek redress in court, they can approach agencies like the National Commission for Persons with Disabilities, and the Legal Aide Council, there are human rights lawyers that also render pro bono services for PWDs who they can approach.”

While supporting the view of Ntima, another legal practitioner, Tunde Folola, said discrimination of any form is forbidden under the Nigerian constitution. He said it is a cause for worry if banks discriminate against PWDs when rendering services to them.

He urged PWDs who face such discrimination to report to SERVICOM. He said If any person suffers discrimination in banks or public institutions, they should lodge a proper complaint at SERVICOM.