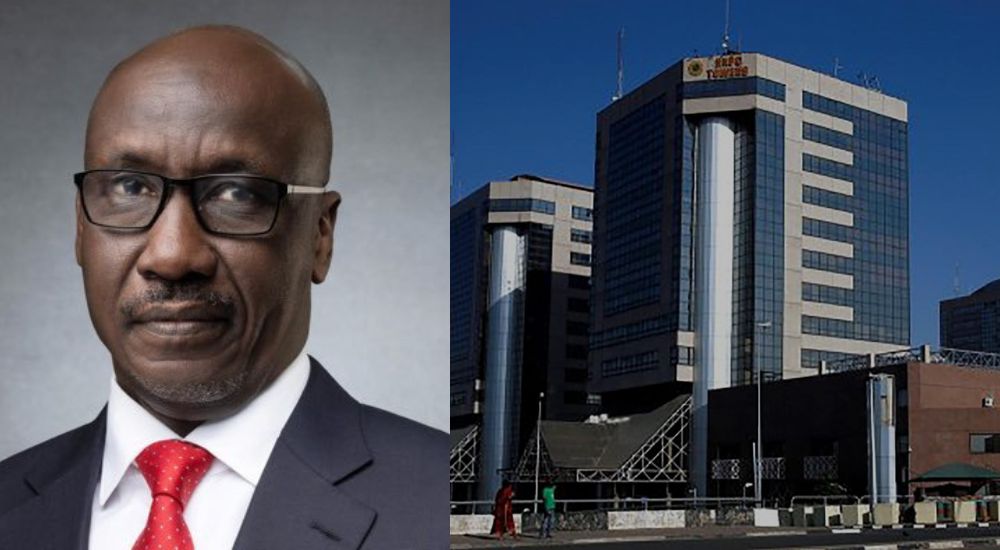

Mele Kyari’s NNPC Strategies: A Potential Saviour For The Naira?

On January 25 this year during the uveiling of the Nigerian Economic Summit Group (NESG) 2024 Macroeconomic Outlook Report, the Governor of the Central Bank of Nigeria, Olayemi Cardoso made an assertion that the “naira is undervalued.”

This statement was one of the motivation that pushed the Nigerian government into looking for both short-term and long-term solutions to save the naira, and the Nigerian National Petroleum Company Ltd (NNPCL) may be the magic wand in the short-term.

Advertisement

In January this year, PricewaterhouseCoopers (PwC), a global business advisory services firm said the naira depreciated to around N914 per dollar after the apex bank decided to float the naira on June 14, last year.

Between January 2024 and February 23, the currency traded at N1,506 per dollar based on the CBN weighted average. The government had the intention to allow market forces to determine the value of the currency so that it would become attractive to foreign investors.

But because foreign exchange earnings are low, demand pressure for foreign exchange had pushed the currency to plunge far beyond the expectations of the CBN.

There are multifaceted pressures on the foreign exchange markets, and the country’s foreign exchange reserves are low to absorb all the shocks. At $33bn of gross foreign exchange reserves, the increased import bill, which grew by 33 per cent from N6.34tn in the third quarter of 2022 to N8.46tn in Q3, 2023 is also mounting pressure on the naira.

Advertisement

Ultimately, the pressure on the naira is impacting on prices of goods and services, and the ripple effect is hardship on the over 200 million Nigerian population. Inflation has already reached 29.8 per cent as of January 2024, according to data from the National Bureau of Statistics.

The NNPCL is the goose that lays the golden egg for the continent’s biggest economy and all eyes are on the company that earns over 80 per cent of foreign exchange proceeds for the government to stem the tide.

The Group Chief Executive Officer of NNPCL, Mallam Mele Kyari has already laid a strategic foundation for both short-term and long-term remedies for the ailing naira before the country fully diversifies its economy away from over-reliance on crude oil proceeds.

As a quick measure, the Kyari-led NNPCL is already helping the government to earn dollars from the $3.3bn deal signed with the African Import and Export Bank (Afreximbank) in September last year.

On January 24, Afreximbank announced an initial disbursement of $2.25bn under the syndicated $3.3bn crude oil prepayment facility sponsored by the NNPCL.

Advertisement

The disbursed amount played a vital role in the CBN settling the $2.3bn foreign exchange forwards backlog inherited by President Bola Tinubu’s administration, leaving a balance of $2.2bn.

Even the CBN Governor, Cardoso, and experts like Muda Yusuf, the Chief Executive Officer of the Centre for the Promotion of Private Enterprises attested to the role the swap deal will play in reducing pressure on the naira and boosting the confidence of foreign investors whose funds were trapped for years.

A second tranche of $1.05bn is expected to be disbursed by the Afreximbank as part of the $3.3bn. An injection of the $1.3bn would go a long way in helping the CBN to intervene in the bank when necessary.

At the heart of the fight is a recent strategy announced by Kyari to move some of NNPCL’s accounts with commercial banks to the CBN. This move delighted the CBN because they are sure of more foreign exchange to defend the currency.

A review of the decision of the NNPCL to domicile a significant portion of its revenues and other banking services with the CBN shows as crude oil earnings improve, the CBN will have more forex to shore up its reserves.

In fact, the CBN now has more capacity to intervene in the official segment of the foreign exchange market and the Bureau de Change Segment of the Foreign Exchange Market. Already, the increased capacity has given the apex bank the morale to begin intervention in the BDC segment with a weekly disbursement of $20,000 to qualified operators.

Advertisement

Although the NNPC Limited was not under any obligation to domicile its accounts with the Central Bank, Kyari believes that the strategy will boost foreign exchange liquidity for the CBN to perform its of maintaining foreign exchange stability.

Nigeria is one of the emerging economies that spend the export proceeds from crude oil to import refined petroleum products and this is a major contributor to naira volatility.

In 2021, Nigeria imported $11.3bn in refined petroleum products, mainly from the Netherlands ($3.62bn), Belgium ($1.78bn), Norway ($1.2bn), India ($992m), and the United Kingdom ($760m).

In an attempt to wean the country off its heavy reliance on the importation of refined products, NNPCL began a radical move to revamp the Port Harcourt Refinery, Warri Refinery and the Kaduna Refinery.

For two years, work has been ongoing at the Old Port Harcourt Refinery (Area 5) and NNPC Ltd. had pledged to complete Phase One of the project (mechanical completion and flare start-up).

The refinery will begin by processing 60,000 barrels per day (bpd), and NNPCL expects to operate at the full capacity of 210,000 bpd later this year thereby reducing the pressure to import refined products with the scarce foreign exchange.

As an oil and gas-rich emerging economy, Kyari has also laid the foundation for Nigeria to tap into the international gas market with the signing of a Memorandum of Understanding (MoU) for the $25bn Nigeria-Morrocco Gas Pipeline.

Kyari is leading the push to fast-track the process of achieving the Final Investment Decision (FID) on the Nigeria-Morocco Gas Pipeline in line with the series of MoU signed in 2022. The initiative is expected to serve Africa and deliver gas to Europe.

The international natural gas market size was over $1.029tn in 2023 and it would grow to $1.127tn in 2024. With a huge reserve of 200 trillion cubic feet, Kyari has set a pathway for Nigeria to earn huge foreign exchange from the mega gas market. Revenues from the numerous gas projects of the Kyari-led NNPCL will be one of the long-term remedies for the foreign exchange pressure on the naira.