Contrary To Media Reports, NNPCL- Afrexim Bank $3bn Deal Still Intact

Contrary to media reports that the $3bn deal between the Nigerian National Petroleum Company Limited and the African Export -Import Bank has been stalled, both parties are currently progressing with the terms of the agreement, THE WHISTLER can authoritatively report.

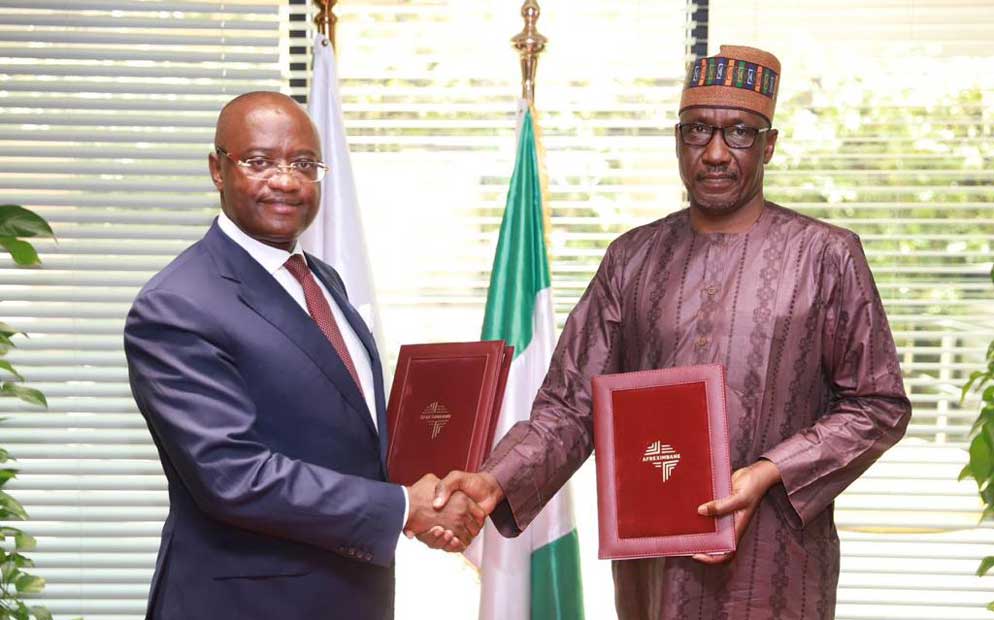

The NNPCL had on August 16, secured the $3bn facility with Afreximbank so as to enable the Federal Government to stabilize the foreign exchange market and boost the value of the naira against the dollar.

Advertisement

The $3bn emergency loan from the Bank was to ease pressure on the naira.

But some media platforms (NOT THE WHISTLER ) had reported that the deal has been stalled due to claims that investors who were supposed to make up the balance of the syndicated loan have developed cold feet.

The report had claimed further that African Export-Import (Afrexim) bank can not single-handedly provide all the $3bn needed for the deal.

But sources with knowledge of the transaction told THE WHISTLER on Thursday that there is no truth in the report as all parties involved in the deal are currently progressing with the terms of the agreement,

Advertisement

The deal, the source added would provide the federal government with dollars to aid liquidity to stabilise the naira via incremental releases based on the government’s needs.

On whether it was a risky transaction as claimed by the media platform, the source noted that it was not, stressing that the exposure for NNPC Limited was very limited, covering just a fraction of their entitlements, while there are no sovereign guarantees tied to the loan.

The funds for the loan will be released in stages or tranches based on the specific needs and requirements of the federal government.

A strengthened naira as a result of this initiative will lead to a reduction in fuel costs. This means that if the naira appreciates in value, the cost of fuel will drop and further increases will be halted.

A stronger naira will result in lower prices from the current level, making subsidies unnecessary. The deregulation policy remains unchanged.

Advertisement

The loan will be repaid against a fraction of proceeds from future crude oil production. It’s a strategic move that ensures a balance between our current economic needs and future production capabilities.

The source added that it is not a crude for refined products agreement where the government does not earn any proceeds from the swap.