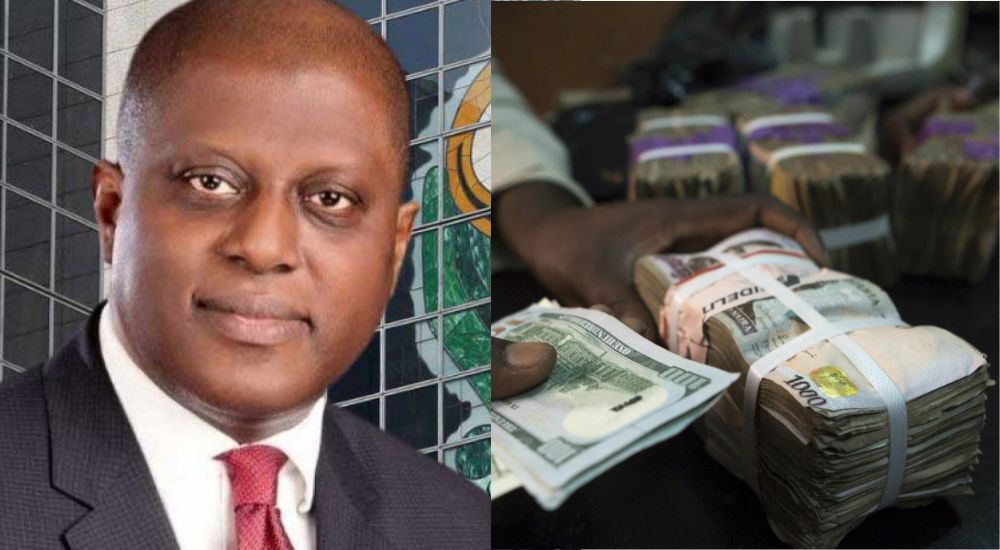

NNPCL’s Decision To Move Account To CBN Boosting Investors’ Confidence, Solving FX Crisis— Cardoso

The Governor of the Central Bank of Nigeria, Olayemi Cardoso, has said that the decision made by the Nigerian National Petroleum Company Ltd to move its accounts to the CBN is boosting the confidence of investors.

Cardoso said Foreign Portfolio Investors (FPI) are already indicating interest to return to the Nigerian economy.

Advertisement

The apex bank’s boss disclosed the development in an interview aired by Arise TV on Monday and monitored by THE WHISTLER.

Cardoso said, “I think the recent move to have NNPC and some of the other MDAs move their funding straight to the Central Bank also sends a very powerful signal to the confidence.

“Nigeria is going in the direction that many investors want to see it go. As the confidence comes back and their money starts coming in, which I see happening, volatility begins to reduce. The wide swings you have been seeing in the foreign exchange market begin to reduce, and I believe very strongly that the volatility will reduce and the foreign exchange market will stabilise.

“Today, I will say that we have a situation where a lot of foreign portfolio investors are very interested in coming back to the Nigerian market. It is incredible, and if there is any group that has taken an interest, very methodically may I say, it is the foreign portfolio Investors.”

Advertisement

The NNPCL offered to move its account to the apex bank to support the liquidity management objective of the CBN.

Sources had told THE WHISTLER that the NNPCL offered to move some of its accounts domiciled in commercial banks to the CBN.

The source said that since the implementation of the Petroleum Industry Act of 2021, the NNPCL in line with its limited liability company status, has its accounts with commercial banks.

The source said, “Some parts of the NNPC accounts were moved to the CBN. The movement was not an obligation, it was just a part of NNPC’S effort to boost liquidity in naira and dollar components. The meeting where this decision was taken was held at the Ministry of Finance between officials of CBN, NNPC, and Ministry of Finance.”

Cardoso also narrated how he inherited $7bn in FX obligations from previous governors.

Advertisement

But Cardoso said the worrisome part of the backlogs is that he uncovered that $2.4bn of the backlogs were illegitimate and fraudulent.

He said the approximately $7bn FX backlog had accumulated over a period of time, adding that it was important for the CBN to pay the debts in order to keep Nigeria’s integrity intact.

Cardoso said, “Now, approximately $7bn was what we were told that the applications were. We looked at these and commenced the process of starting to pay. Meagre resources as we had them, we were settling some which we believed were valid and due for payment and obviously this isn’t something we could just do in one shot or it had to be to take a bit of time.

“Now, as we went along, we now had reason to believe that we needed to take a harder look at these applications. So, we contracted Deloitte Management Consultants to do a forensic of all these obligations and to actually tell us what was valid and what was not.

“And of course, we were committed to ensuring that we would pay all valid transactions. The result that came out of this was startling. We discovered that of the $7bn, about $2.4 had issues which we believed had no business being there and the infractions on that range from so many things.”

He said some of the infractions identified in the audit ranged from not having valid import documents and in some cases “entities that did not exist”, to beneficiary’s account parties who had asked for foreign exchange got more than they asked for. He said that some didn’t ask for any Fx and received FX.

Advertisement

The CBN governor said they will not pay FX backlogs that are “illegitimate”.

“We are not paying. If you don’t qualify, they are not a validly constituted request. The valid constituted ones, we have settled about $2.3bn and that applies to the airlines and a whole load of different spread throughout our economy.”