The International Monetary Fund has projected that inflation will fall faster than expected but the institution warned against the premature reduction of Monetary Policy Rates as well as delaying rate cuts by Central Banks.

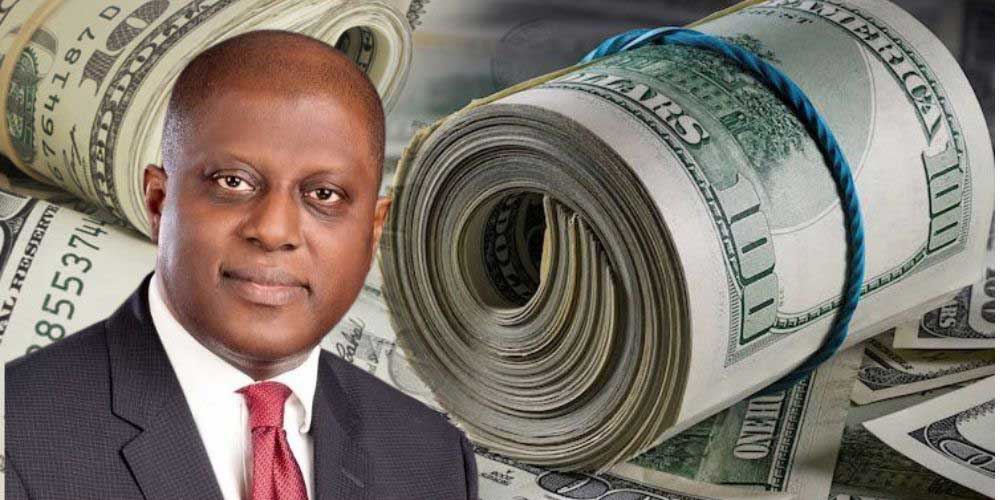

The IMF’s comment is coming ahead of the first Monetary Policy Meeting of the Central Bank of Nigeria under the new Central Bank Governor, Olayemi Cardoso.

Advertisement

The IMF projected in its World Economic Outlook, 2024, seen by THE WHISTLER that global headline inflation is expected to fall from an estimated 6.8 per cent in 2023 (annual average) to 5.8 per cent in 2024 and 4.4 per cent in 2025.

The IMF said advanced economies are expected to see inflation falling by 2.0 per cent in 2024 to 2.6 per cent while emerging market and developing economies will see a decline by just 0.3 per cent to 8.1 per cent.

It said, “As inflation declines toward target levels across regions, the near-term priority for central banks is to deliver a smooth landing, neither lowering rates prematurely nor delaying such lowering too much. With inflation drivers and dynamics differing across economies, policy needs for ensuring price stability are increasingly differentiated.

“At the same time, in many cases, amid rising debt and limited budgetary room to maneuver, and with inflation declining and economies better able to absorb effects of fiscal tightening, a renewed focus on fiscal consolidation is needed.”

Advertisement

Since Cardoso took over office, the apex bank boss has not conducted MPC meeting amidst the scourging monetary policy issues like rising inflation and depreciation of the naira.

Nigeria’s inflation in December last year was measured at 28.9 per cent by the National Bureau of Statistics, while the naira closed at the Nigerian Autonomous Foreign Exchange Market at N1,435.53 on February 2, 2024.

The CBN scheduled the first MPC meeting under the tenure of Cardoso for February 26 and 27.

The IMF added, “The faster-than-expected fall in inflation is allowing an increasing number of central banks to move from raising policy rates to adjusting to a less restrictive stance.

“In this context, ensuring that wage and price pressures are clearly dissipating and avoiding the appearance of prematurely ‘declaring victory’ will guard against later having to backpedal in the event of upside surprises to inflation.”