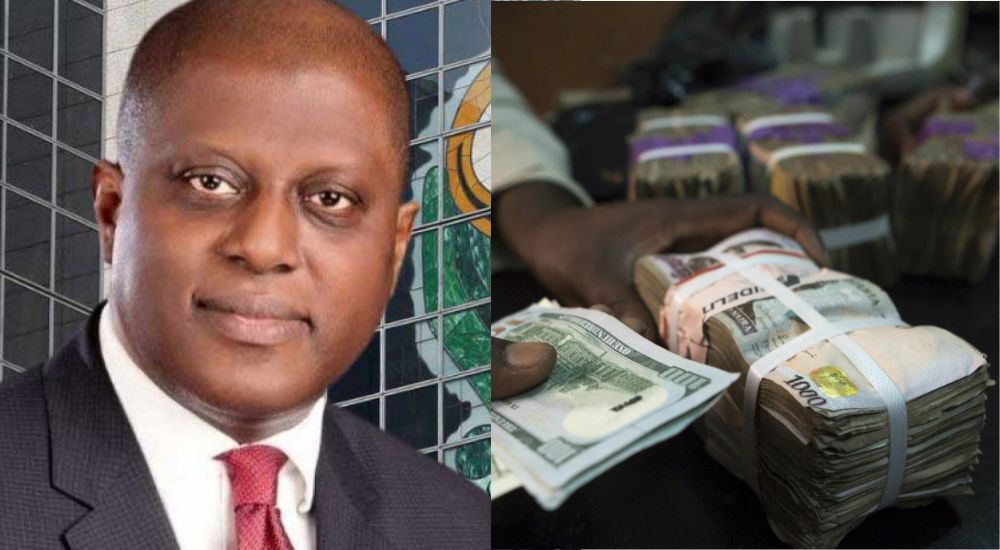

CBN Releases Circular To Check Excessive Forex Speculation, Hoarding By Banks

…Harmonises Reporting Requirements On Foreign Currency Exposures For Banks

In a bid to check suspected cases of excessive foreign currency speculation and hoarding from Nigerian banks, the Central Bank of Nigeria on Wednesday released a new circular.

Advertisement

The new circular introduces a set of guidelines aimed at reducing the risks associated with these practices.

The circular, titled “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks,” highlights the CBN’s concerns over the growing trend of banks holding large foreign currency positions.

In the circular seen by THE WHISTLER, the apex bank expressed concern with the growth in foreign currency exposures of banks through their Net Open Position (NOP).

The NOP measures the difference between a bank’s foreign currency assets (what it owns in foreign currencies) and its foreign currency liabilities (what it owes in foreign currencies).

Advertisement

A bank which holds net open positions (whether long or short) in foreign currencies is exposed to the risk that exchange rates may move against it. The open positions may be either trading positions or, simply, exposures caused by the bank’s overall assets and liabilities.

The apex bank said the growth in foreign currency exposures of banks through their Net Open Position has created an incentive for banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks.

In the circular, the apex bank mandated that the NOP must not exceed 20 per cent short (owning more than owning) or 0 per cent long (owning no more than the bank’s shareholder funds not reduced by losses) of the bank’s shareholders’ funds.

This calculation, it added, must be done using the Gross Aggregate Method, which provides a comprehensive view of the bank’s foreign currency exposure.

Furthermore, the CBN stated that banks with current NOPs exceeding these limits are required to adjust their positions to comply with the new regulations by February 1, 2024.

Advertisement

It added that banks must calculate their daily and monthly NOP and Foreign Currency Trading Position using specific templates provided by the CBN.

The circular reads, “The Central Bank of Nigeria (CBN) has noted with concern the growth in foreign currency exposures of banks through their Net Open Position (NOP).

“This has created an incentive for banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks. Therefore, to ensure that these risks are well managed and avoid losses that could pose material systemic challenges, the CBN issues the following prudential requirements.

“Banks are also required to have adequate stock of high-quality liquid foreign assets, i.e. cash and government securities in each significant currency to cover their maturing foreign currency obligations. In addition, banks should have in place a foreign exchange contingency funding arrangement with other financial institutions.”