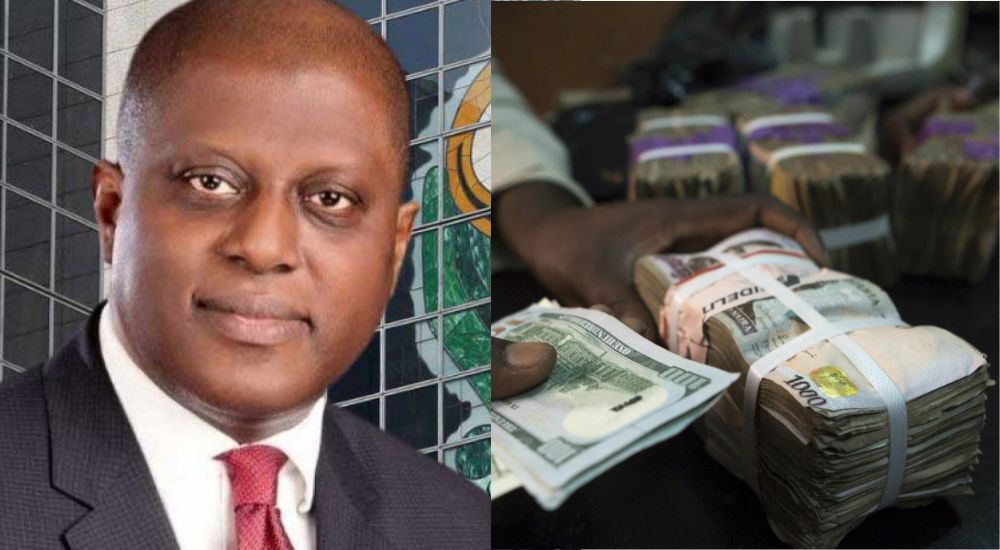

CBN To Introduce New Forex Guidelines For Banks, BDCs To Save Value Of Naira

… To Pay Forex Forwards Backlogs To Only Legitimate Transactions

The Central Bank of Nigeria (CBN) has said that it will introduce a new foreign exchange guideline for banks and Bureau de Change operators in the country in order to save the naira from speculators.

Advertisement

The CBN said it has also approved a new framework to tackle inflation, but awaits inputs from the fiscal authorities.

The apex bank governor, Olayemi Cardoso, announced the decision on Friday during his keynote address at the 58th Annual Chartered Institute of Bankers Dinner.

This is Cardoso’s first meeting with banking executives since he assumed office.

Cardoso admitted that with the recent developments in the domestic market, Nigeria is faced with severe issues that are driven by insecurity which has resulted in decreased national output of agricultural produce and infrastructural issues.

Advertisement

He said the decline in crude oil output driven by oil theft has weakened Nigeria’s economic diversification and has also constrained government revenues.

According to Cardoso, fiscal debt has also compounded the pressures on the country’s foreign exchange reserves. Cardoso said he understands that there are concerns about the way forward for the Nigerian economy.

According to him, fuel subsidy removal and the floating of the naira are expected to have a positive impact in the short run, particularly on the stabilisation of the naira.

He assured investors that the Nigerian economy will experience stability in the short to medium term.

Cardoso said, “The primary mandate of the CBN is to ensure price stability in addition to other objectives such as issues legal tender currencies and safeguarding our external reserves, promoting a sound financial system and providing financial advice to the government.

Advertisement

“In line with our strategy to refocus on our core mandate, the CBN will discontinue direct quasi-fiscal interventionist activities and instead utilise orthodox monetary policy tools for implementing monetary policy. As part of this refocus, the CBN has just approved the adoption of an explicit inflation targeting framework to enhance the effectiveness of our monetary policy.

“The details and requirement of this framework are currently being finalised alongside the fiscal authorities. Additionally, the CBN will provide forward guidance, enhance transparency and maintain effective communication with the public to build trust among stakeholders.”

He said his monetary policy will aim to achieve price stability, foster economic growth, stabilise the exchange rate of the naira and reduce interest rate to facilitate investment in the real sector.

“In order to ensure the proper functioning of domestic and foreign currency markets, clear, transparent and harmonised rules governing market operations are essential. New foreign exchange guidelines and legislation will be developed and extensive consultation will be conducted with banks and FX operators before implementing any new requirements.”

According to him, tranche payments have been made to 31 banks to clear the backlog forward obligations.

“We have been subjecting these payments to detailed verification to ensure only valid transactions are honoured.

Advertisement

“As the monetary authority, we are taking the right step to send the right signals to the market and achieve our mandate to ensure stability, curb speculation and restore confidence in the foreign exchange market we have initiated payments of unsettled forward foreign exchange obligations and these payments will continue until obligations are cleared.”

The CBN has not been able to control inflation using its monetary tools to reduce it to a single digit since 2015. The Consumer Price Index (CPI) which measures inflation has worsened to 27.33 per cent in October 2023.

The food component was measured at 31.52 per cent in October despite several MPR hikes.

In July, the Acting CBN Governor Folashodun Shonubi along said the committee hiked the monetary policy rate to 18.75 per cent to tame the country’s rising inflation.

Aside from inflation, the country is also battling with the devaluation of the naira after introducing a managed float foreign exchange on June 14, 2023.

The change in the operation of the forex market led to the depreciation of the naira at the official and parallel markets.

The currency fell as low as N900 to the dollar at the official window and over N1,300 at the parallel market. This worsened the country’s inflation numbers coupled with the fuel subsidy removal.