Naira Appreciation Impact Of NNPCL’s N3bn Deal Excites Tinubu, Presidency Officials

The $3bn loan facility which the Nigerian National Petroleum Company Limited secured from Afreximbank is causing excitement among Presidency officials and the President, THE WHISTLER has learnt

It was learnt that the President is excited that the $3 billion is gradually injecting the much needed liquidity into the foreign exchange market in Nigeria.

Advertisement

THE WHISTLER reported that the NNPCL secured the $3bn emergency loan from the African Export-Import Bank to ease pressure on the naira.

The loan would enable NNPCL defray taxes and royalties in advance and provide the Government dollar liquidity to stabilize the Naira.

The disbursement of the loan will be in tranches based on Government requirements.

This will assist in the appreciation in value of the Naira which will translate to lower cost of fuel and further stem increase in the cost of petrol.

Advertisement

The implication of this, is that a stronger Naira will mean lower prices against current level and won’t require any subsidy.

Sources at the villa said the President felt a sigh of relief that the deal is beginning to reduce the pressure on the Naira in the foreign exchange market as the currency has recorded some appreciable level of increase since the deal was announced last Wednesday.

Bureau de change operators in Nigeria became jittery after the deal was sealed a development that made the naira to gain about N90 to a dollar in the last five days.

The source said the President and his team of economic advisers are hopeful that the NNPCL deal will further crash the value of the dollar.

The Presidency source added that the “quick and proactive steps taken by the NNPC Limited show that this government has the capacity to turn around Nigeria’s economy positively in a short time. What the government needs right now is for forthright thinking appointees of the president to come up with novel ideas like this to better the economy.

Advertisement

“Nigerians are impatience with government and as such Tinubu’s government doesn’t need laybacks or people with nothing to offer in the saddles of key leadership positions in government. People are impatience for the government to perform, and as such there are no rooms for trial-and-error ministers and heads of agencies.”

This is the fourth transaction being consummated between NNPCL and AFREXIM Bank over the last 3 three years and goes to further consolidate the mutual relationship between the two entities.

Both Nigeria and NNPCL are shareholders in AFREXIM Bank, with sole purpose of enhancing investments and growing prosperity in Africa.

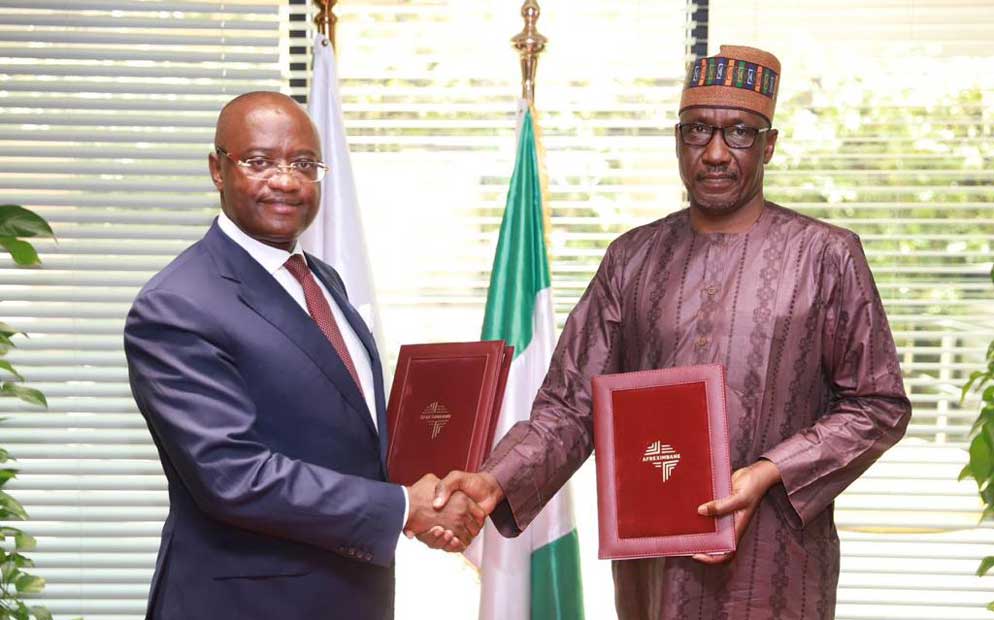

The agreement for the loan which was sealed on Wednesday in Cairo, saw the Group Chief Executive Officer of NNPC Ltd, Mallam signing for the National Oil Company while Dr George Elimbi, Executive Vice President Afreximbank signed for the bank.