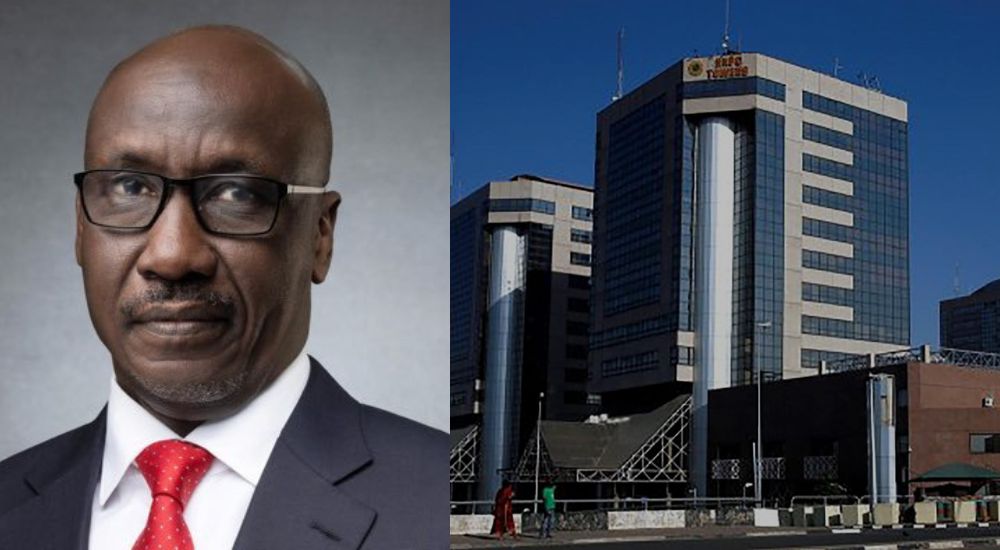

Oil Revenues: Kyari Demands Forensic Audit Of NNPC Ltd To End Incessant Corruption Allegations

…Net Dollar Inflows Into NNPC Ltd Coffers Spent On PMS Import, Ajiya Replies World Bank

The Group Chief Executive Officer of the Nigerian National Petroleum Company Limited, Mr Mele Kyari has called on President Bola Tinubu to order a forensic audit of the national oil company to put an end to all the corruption allegations against the company.

Advertisement

THE WHISTLER gathered that Kyari’s call for a forensic audit of the NNPC was made to the president following series of corruption claims against the NNPC Limited.

The NNPC Limited had in recent times come under attacks from various individuals and organization.

The most recent is the claim by the World Banks that the NNPC Limited is not transparent about the financial gains from fuel subsidy removal.

According to the World Bank, while revenue gains from the exchange rate reforms are visible, more clarity is needed on oil revenues, including the fiscal benefits from the PMS subsidy reforms.

The Bank said, “There is a lack of transparency regarding oil revenues, especially the financial gains of the Nigeria National Petroleum Corporation from the subsidy removal, the subsidy arrears that are still being deducted, and the impact of this on Federation revenues.”

Advertisement

But a Presidency source confided in THE WHISTLER that already, the GCEO had, before the comment by the World Bank, requested that the forensic audit be done on the NNPC Ltd.

The source said, “In recent times, there had been claims of corruption allegations against the NNPC and many of them are baseless. In view of these claims, the GCEO has actually requested the president to conduct a forensic audit of the company. He believes the audit will put to an end all the persistent corruption allegations against the NNPC Limited.”

This is just as the NNPCL’s Chief Financial Officer, Umar Ajiya, faulted claims by the World Bank that the country is not enjoying the gains of fuel subsidy removal in terms of revenue remittances.

Ajiya while defending the NNPC Limited at an event held by the World Bank in Abuja also said the national oil company had been using its revenue to import refined Premium Motor Spirit and service debt.

Since the removal of petrol subsidy and the liberalization of the foreign exchange market, the distortion had made oil marketers to argue that it was a disincentive to their participation in the fuel importation business.

Advertisement

The development had made the NNPC Limited, in playing its role in guaranteeing energy supply to continue to import petroleum products for the federation.

Speaking on the development, Ajiya said since the inflow of dollars into the country is tied to oil revenues, the country is facing the consequence of falling oil production, insecurity, and lack of investments in the sector.

He said, “Just to clarify and let the audience go with a well-balanced information. The inflows of dollars into the country are tied to oil revenues and the oil revenues are driven from oil production.

“The consequence of what we are facing today is a fall in oil production simply because of insecurity and lack of investments. The net dollar accruable from oil operations is what the NNPCL uses to import PMS.

“The PMS is sold in naira, you can’t sell it in dollars. Consequently, you would find out that the net dollar inflows into the NNPCL coffers are spent on the import of basically PMS and debt service.”

Ajiya stated that the surplus dollars inflow to the CBN and any other bank in the country can only happen when the country starts producing crude oil over its domestic requirement.

Advertisement

According to the CFO, adequate forex inflow can also happen if insecurity is addressed, and such development will attract partners to bring in fresh dollars in the form of investment to oil operations.

He added, “So until such a point where we have excess production over and above what we consume, then we will begin to see much dollar liquidity coming into this country.

“The whole consumption pattern of most Nigerians is foreign import-dependent and until we come to a position whereby, we begin to consume what we produce and also add value to our raw materials to bring further FX into the country.”