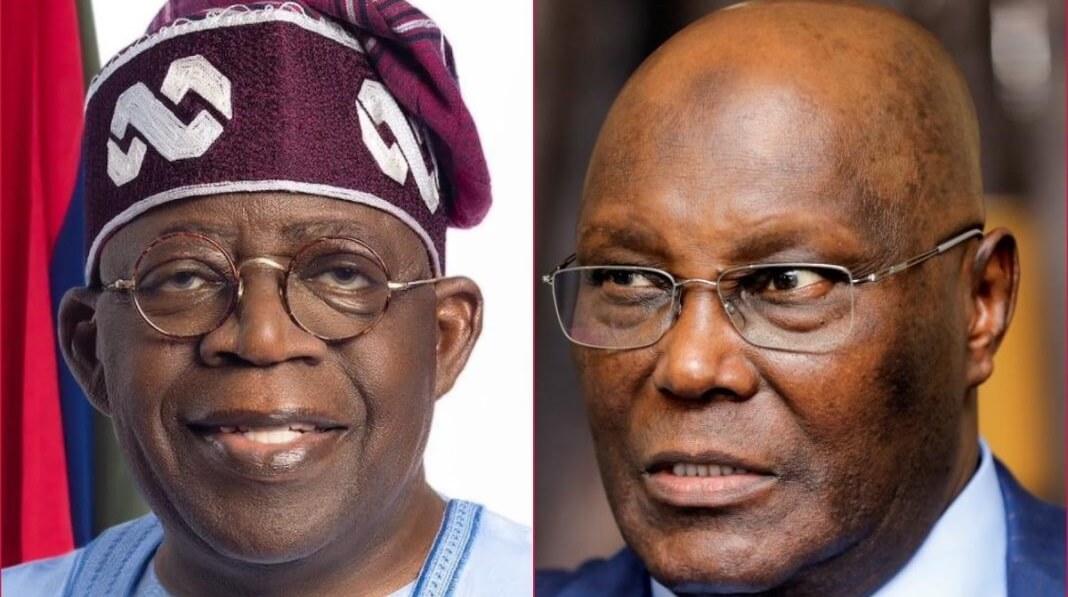

Atiku Blames Tinubu’s ‘Poverty Of Ideas’ For Naira’s Free Fall, Offers Solution

Former Vice President Atiku Abubakar has criticised President Bola Tinubu’s handling of Nigeria’s foreign exchange crisis, accusing him of lacking concrete policy solutions and offering his own recommendations.

At a meeting called by Tinubu on Thursday, Atiku said the president failed to present any tangible steps to curb currency fluctuations and alleviate poverty.

Advertisement

The president had summoned the meeting with governors of the 36 states to address the food crisis facing the nation.

According to Atiku, President Tinubu “demonstrated a poverty of ideas” at the meeting when he “failed, yet again, to showcase any concrete policy steps that his administration is taking to contain the crises of currency fluctuation and poverty that face the country.”

The former vice president added, “Rather, he told the country and experts who have been offering ideas on how to resolve the crisis that he and his team should not be distracted and allowed time to continue cooking their cocktail that has brought untold hardship to the people of Nigeria.”

Atiku, in a statement on Sunday, urged the president to abandon his “usual hubris” and embrace alternative solutions.

Advertisement

He claimed to have foreseen the current economic crisis and proposed solutions in his policy document, “My Covenant With Nigerians” released ahead of the 2023 presidential election in which he emerged second position

Atiku said the Tinubu administration had no business fixing an official exchange rate after it claimed to have floated the naira to eliminate the multiple exchange rate system and halt exploitation by opportunists and middlemen.

The former VP believes this approach is incompatible with Nigeria’s economy and limited foreign exchange reserves, adding that a fixed rate would require substantial reserves to defend the Naira, which Nigeria currently lacks.

“A fixed exchange rate system would be out of the question. First, it would not be in line with our philosophy of running an open, private sector friendly economy. Secondly, operating a successful fixed-exchange rate system would require sufficient FX reserves to defend the domestic currency at all times. But as is well known, Nigeria’s major challenge is the persistent FX illiquidity occasioned by limited foreign exchange inflows to the country. Without sufficient FX reserves, confidence in the Nigerian economy will remain low, and Naira will remain under pressure. The economy will have no firepower to support its currency. Besides, a fixed-exchange rate system is akin to running a subsidy regime!” he said.

Offering an alternative, Atiku said he’d rather adopt a managed-float system where the Central Bank of Nigeria (CBN) intervenes to control and stabilize the Naira’s value, primarily to curb speculative activities.

Advertisement

“On the other hand, given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill. We would have encouraged the Central Bank of Nigeria to adopt a gradualist approach to FX management. A managed-floating system would have been a preferred option. In simple terms, in such a system, the Naira may fluctuate daily, but the CBN will step in to control and stabilize its value. Such control will be exercised judiciously and responsibly, especially to curve speculative activities,” he added.

According to Atiku, Tinubu’s foreign exchange management policy was hastily formulated without proper consultation with stakeholders, thereby causing “untold pain and distress” to Nigerians.

He accused the administration of failing to anticipate the negative consequences of its actions.

“The Government did not allow the CBN the independence to design and implement a sound FX Management Policy that would have dealt with such issues as increasing liquidity, curtailing/regulating demand, dealing with FX backlogs and rate convergence.

“I firmly believe that if and when the Government is ready to open itself to sound counsels, as well as control internal bleedings occasioned by corruption and poorly negotiated foreign loans, the Nigerian economy would begin to find a footing again,” said the former presidential candidate.