BREAKING: FG To Stop Hoarding Of Dollar In Cash By Digitalizing Nigeria’s FX Regime

As part of efforts to address Nigeria’s foreign exchange crisis, President Bola Tinubu’s administration is set to digitalize Nigeria’s foreign exchange regime to curb ‘speculative demands and hoarding’ of foreign exchange in cash.

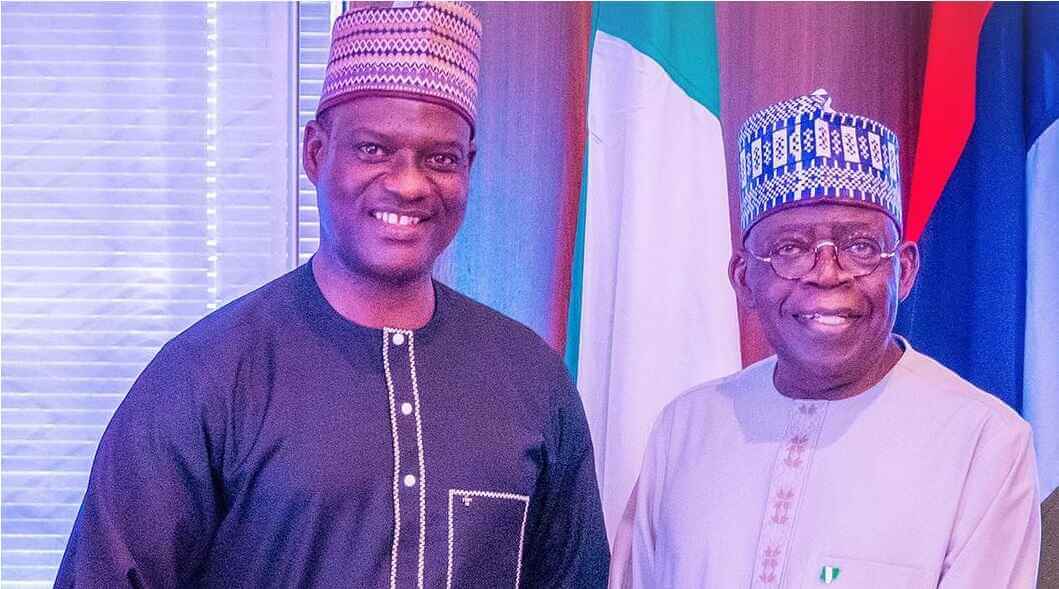

This was one of the key recommendations outlined in the ‘Quick Wins Report’ presented to President Bola Tinubu by the Presidential Fiscal Policy and Tax Reforms Committee on Tuesday.

Advertisement

The committee believes that digitizing the foreign exchange regime will make it more transparent and efficient, and will also make it more difficult for people to hoard foreign exchange in cash.

Chaired by Mr. Taiwo Oyedele, the committee’s report unveiled a roadmap for fiscal governance, revenue transformation, and economic growth facilitation.

The committee’s terms of reference was structured into three phases: “Quick Wins” to be implemented within 30 days, critical reforms to be enacted within 6 months, and full implementation within 1 year.

The ‘quick wins’ seeks to address different economic challenges facing Nigeria in the short term, including exchange rate crisis, fuel subsidy removal, inflation, and the facilitation of economic growth.

Advertisement

The recommendations include measures to streamline public service functions, enhance public financial management, and optimize government assets and natural resources.

The key recommendations include:

- Measures to address duplication of functions in public service, ensure prudent public financial management and optimize value from government assets and natural resources

- Policy signalling and collaboration by MDAs, economic management, and policy execution team

- Use of technology “Data4Tax” to expand the tax net

- Increase personal income tax exempt threshold and personal relief allowance

- Tax break for private sector in respect of wage increases to low-income earners, transport subsidy and net increase in employment

- Permit the payment of taxes on foreign currency denominated transactions in Naira for Nigerian businesses.

- Remove impediments to global employment opportunities for Nigerians based in Nigeria

- Suspension of VAT on diesel and tax waivers on CNG, CNG conversion, and renewable energy items

- Comprehensive review of tariffs on the 43 items unbanned from accessing forex in the official market and fiscal policy review of other items prohibited for imports

- Reforms of Withholding Tax Regulations to ensure simplicity and ease the pressure on working capital of businesses

- Facilitate the use of mobile phones for conditional cash transfers and introduce a spending framework for subsidy removal and forex reform windfall, including a national portal to track spending by FG, states and local governments

- Suspension of multiple taxes which place burdens on the poor and small businesses and compensate with windfalls revenue of certain agencies

- Expand the official foreign exchange market to incorporate BDCs, forex apps and retail fx dealers, and outlaw transactions in the black market

- Digitalise Nigeria’s fx regime and discourage speculative demands and hoarding of fx in cash

- Imposition of excise tax on foreign exchange transactions outside the official market

- Implement forward contracts for the importation of PMS as a short-term measure pending improvement in key economic indices

- Discontinue with the fx verification portal and requirement for Certificate of Capital Importation and export proceeds restriction

- Address impediments to export promotion and bottlenecks regarding Exports Expansion Grants, and remove restriction on repatriation and use of export proceeds by exporters

- Modify Tax ProMax to allow taxpayers to make part payments of outstanding tax liabilities

- Grant waiver of penalty and interests on the condition of full payment of outstanding tax liabilities on or before 31 December 2023.

Earlier, President Tinubu’s media adviser, Ajuri Ngelale, quoted his principal as commending the committee after receiving the report.

“I have listened attentively to your report. Charting the critical path forward for Nigeria’s economic recovery is crucial to all of us. I want to say thank you to your delegation,” President Tinubu stated.

Advertisement

Ajuri said the President also granted the request of the Committee to address a meeting of the Federal Executive Council (FEC) and apprise cabinet members of their work and expected outcomes to facilitate economic growth.

He said Tinubu directed Ms. Hadiza Bala Usman, the Special Adviser on Policy Coordination, to coordinate with the relevant government officials for the session.

In his remarks, the Acting Chairman of the Federal Inland Revenue Service (FIRS), Mr. Zacch Adedeji, pledged to ensure the implementation of the recommendations of the Committee, as they may apply, pending the approval of the President.

Adedeji declared that beyond supporting the fiscal and tax reforms, the FIRS will explore opportunities to diversify the nation’s revenue sources, as the historical overreliance on oil has made the economy vulnerable.

”Nigeria’s fiscal policy serves as the foundation of economic stability. It dictates how the government collects, manages and allocates resources for the betterment of our people. A well-developed fiscal policy is crucial for provision of infrastructure, healthcare, education and social services to our growing population. Tax reforms are an integral part of a robust fiscal policy.

”While our current tax system has contributed significantly to our revenue, there remains room for further enhancement; enhancement that can be driven with digital technology. To achieve this, we are collaborating with the Presidential Committee to streamline our tax laws, improve voluntary compliance, and expand the tax base to ensure equity and fairness,” the Acting FIRS Chairman said.

Advertisement

Meanwhile, Oyedele was said to have urged President Tinubu to push for an emergency economic intervention bill (Executive Bill) and the issuance of Presidential Executive Orders to address the duplication of functions across the public service, and to ensure prudent public financial management in a bid to optimize value from government assets and natural resources.