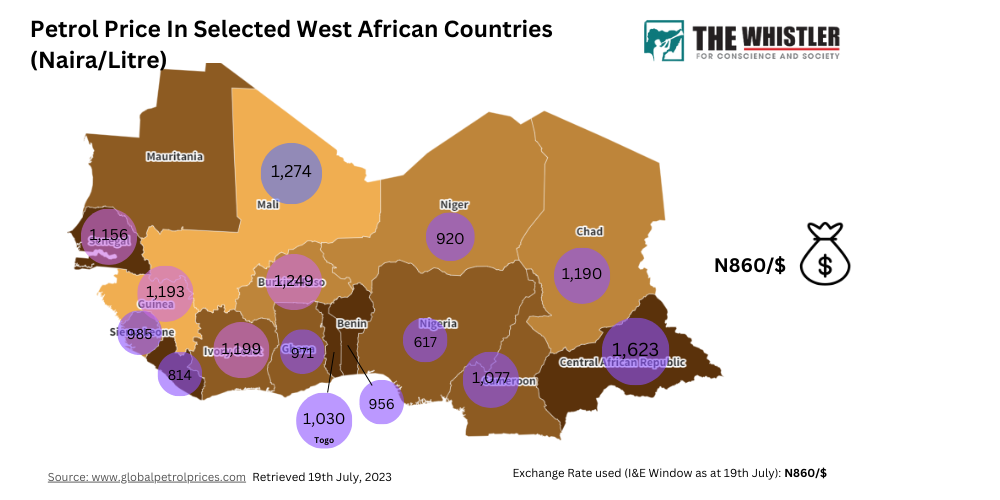

Despite Fuel Subsidy Removal, Nigeria’s N617 Per Litre Petrol Price Lowest In Africa

…CAR N1,623,Mali N1,274, Guinea 1,193, Ghana N971, Togo N1,030

Despite the removal of petrol subsidy by the Federal Government which had pushed petrol price from N195 per litre in May to N537 and now N617 per litre as of Tuesday, Nigeria still has the lowest price regime for Premium Motor Spirit, THE WHISTLER can report.

Advertisement

Within the last two months, energy prices have soared in the international oil market making petroleum products to sell for high prices in many countries.

When President Bola Tinubu removed the subsidy on Premium Motor Spirit on May 29 this year, the price of crude oil was about $74.75 per litre.

However, as of the end of trading on July 17, the price of crude oil had risen to $82.74 per litre. This implies that between May 29 and July 17, the price of crude oil in the international market had risen by $7.99 per litre or 10.68 per cent.

What this means is that since Nigeria still rely on imported petrol to meet local demand for the product and with the deregulation of the sector, the price of petrol will continue to reflect the international price of crude oil.

Advertisement

An analysis of petrol prices in some West African countries post deregulation showed that Nigeria has the lowest price of the product with the current price of N617 per litre.

Based on the analysis, Central African Republic with a petrol price of N1,623 per litre topped the chart of countries with the highest petrol price. This is followed by Mali with a petrol price per liter of N1,274

Burkina Faso had petrol price of N1,249 per litre while Còte d’ Ivoire with N1,199, Senegal with N1,156

Guinea with N1,193 followed respectively.

Other countries where the product sold higher than Nigeria are Niger N920, Ghana N971, Togo N1,030 Benin N956, Chad N1,190, Sierra Leone N985, Liberia N814 and

Cameroon N1,077.

The Group Chief Executive Officer of the Nigerian National Petroleum Company Limited, Mr. Mele Kyari had on Tuesday said the increase in petrol pump price from N540 to N617 and N620 per litre was caused by market forces,

Advertisement

He explained that the increase was not due to shortage in the supply of the product.

According to him, the current price reflected the market realities as the price of the product could either increase or decrease.

He said, “We have the marketing wing of our company. They adjust prices depending on the market realities. This is really what is happening; this is the meaning of making sure that market regulate itself so that prices will go up and sometimes they will come down also. This is what we have seen and in reality this is what the market works.

“There is no supply issue completely. When you go to the market, you buy the product; you come to the market you sell it the prevailing market prices. Nothing to do with supply. We don’t have supply issues. There is robust supply. We have over 32 days of supply in the country

“There is no supply issue completely. When you go to the market, you buy the product; you come to the market you sell it the prevailing market prices. Nothing to do with supply. We don’t have supply issues. There is robust supply. We have over 32 days of supply in the country

“What I know is that the market forces will regulate the market. Prices will go down sometimes; sometimes it will go up, but there will be stability of supply and I’m also assuring Nigerians that this is the best way to go forward so that we can adjust prices when market forces come to play.

Advertisement

“I don’t have the details this moment, but I know that our marketing wing acts just like every other company in this business. I know that a number of companies have imported petroleum products today. So, many of them are on line. I’m sure my colleague would confirm this.

“Market forces have started to play; people have started having confidence in the market. Private sector people are importing products, but there is no way they can recover their cost if they cannot take market reflective cost.”