…To Review Land Use Act

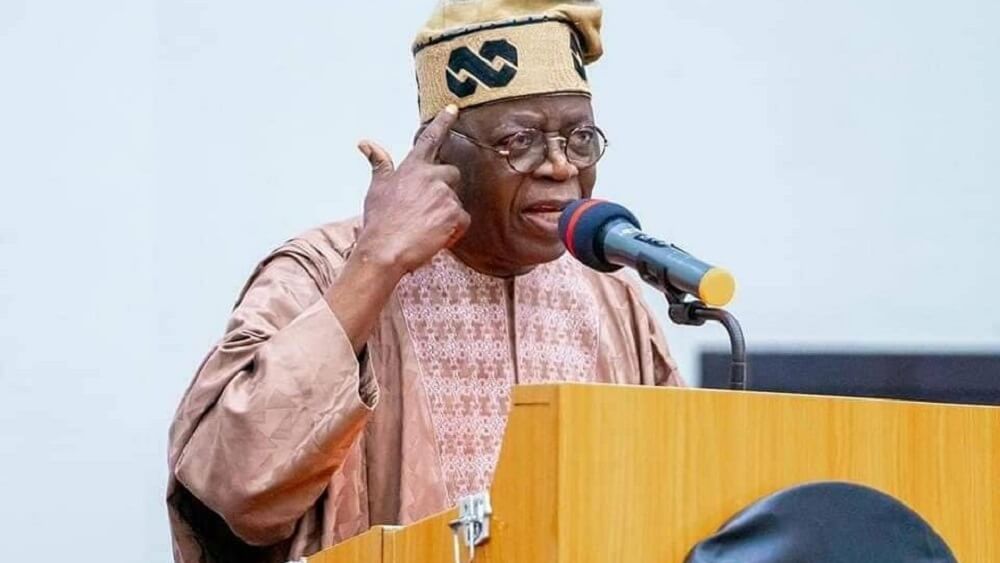

Barring any unforeseen contingencies, the president-elect, Bola Tinubu will be merging all federal government agencies saddled with the responsibility to promote home ownership when he fully takes over as President of Nigeria from May 29, this year.

Advertisement

Tinubu was declared Nigeria’s 16th President by the Independent National Electoral Commission after he won the February 25 Presidential election with a total of 8.79 million votes.

The federal government housing agencies, according to Tinubu, are too small and fragmented to effectively address the housing deficit in the country.

The Federal Government currently has three agencies saddled with the responsibility of promoting housing for Nigerians.

The agencies are the Federal Mortgage Bank of Nigeria, the Nigerian Mortgage Refinancing Company and the Family Homes Fund.

Advertisement

Nigeria currently has over 17 million housing deficit, according to data released by the Ministry of Housing.

Tinubu in his manifesto analyzed by THE WHISTLER stated that his government would ensure greater cohesion and efficiency by merging these agencies into a new, more competent body.

The document stated that the new entity will inherit the functions of existing housing authorities and would be adequately capitalized by the Federal Government.

The newly created agency, the document noted, will have a three-fold mandate to grant low interest rate mortgages directly; guarantee qualified mortgages issued by banks; and purchase mortgages from private banks.

The document reads, “The various federal agencies meant to promote home ownership are too small and fragmented.

Advertisement

“To address the housing deficit, we will ensure greater cohesion and efficiency by merging these agencies into a new, more competent body.

“This new entity will inherit the functions of existing housing authorities and shall be adequately capitalized by the Federal Government.

“The agency will have a three-fold mandate to grant low interest rate mortgages directly; guarantee qualified mortgages issued by banks; and purchase mortgages from private banks.

“The guaranteeing and purchasing of mortgages will incentivise banks towards mortgage lending and will deepen the secondary mortgage market.

“Banks will also be encouraged to engage much more in the provision of affordable consumer loans for automobiles and expensive domestic appliances. A certain portion of bank lending must be earmarked for the consumer.

“All non-compliant banks will pay a penalty to government. Compliant banks will be entitled to tax breaks and credits as well as favourable treatment by the CBN regarding inter-bank transactions and other monetary policy ratios.”

Advertisement

In conjunction with the National Assembly and state governments, Tinubu said in the document that his administration will review and revise the Land Use Act.

The Land Use Act of the 2004 Laws of the Federation of Nigeria vests all land in a state in hand of the the Governor of that State.

The Land Use Act has, over the years, generated controversy among housing experts and Nigerians who are owners of lands.

A key provision of the law is that ownership of land is vested in the states.

It therefore gives the government permission to seize a piece of land or property without any form of compensation if the claimer does not have a Certificate of Occupancy.

Although the Act has its own merits, many land and housing experts have called for a review or amendment of the Act.

But Tinubu in his manifesto said a review of the Act has become imperative to streamline and rationalise the land conveyance process.

“In this way, we lower costs and delays and promote more efficient use of land. This more efficient allocation will bolster the housing industry and lower costs for investors and consumers,” the document stated.

Working with state governments, he added that his administration will provide credits and incentives to developers of housing projects that set aside a significant portion of their projects to affordable housing.

“With the support of State and Local Governments we aim to establish and implement a new social housing policy whose objective shall be to provide pathways for the poorest Nigerians to climb onto the housing ladder.

“We will establish a coherent federal program to provide eligible and meritorious civil servants with federal payment guarantees for fixed-rate, long term mortgages for their homes,” it added.